India Auto Inc stuck in a deep rut, urgently needs GST cut, scrappage policy

With demand for passenger vehicles at a 12-year low and CVs dropping 85% in Q1 FY2021, the auto sector is staring at a deep and long slowdown. Whither the much-awaited vehicle scrappage policy or the GST rate cut?

The Indian automotive industry, which began witnessing sales turbulence right from the festive season of 2018 due to price hikes following reforms in safety norms and insurance, and further aggravated by a liquidity crunch, has now been pummelled into a corner, from which it looks difficult to fight back. The government clearly has to lend a helping hand, be it the long-awaited vehicle scrappage policy or the long-demanded GST rate cut.

The Society of Indian Automobile Manufacturers (SIAM) today announced the industry’s performance results for the first quarter of FY2021 (April-June 2020) and as expected the picture is rather grim and chances of a quick recovery quite bleak.

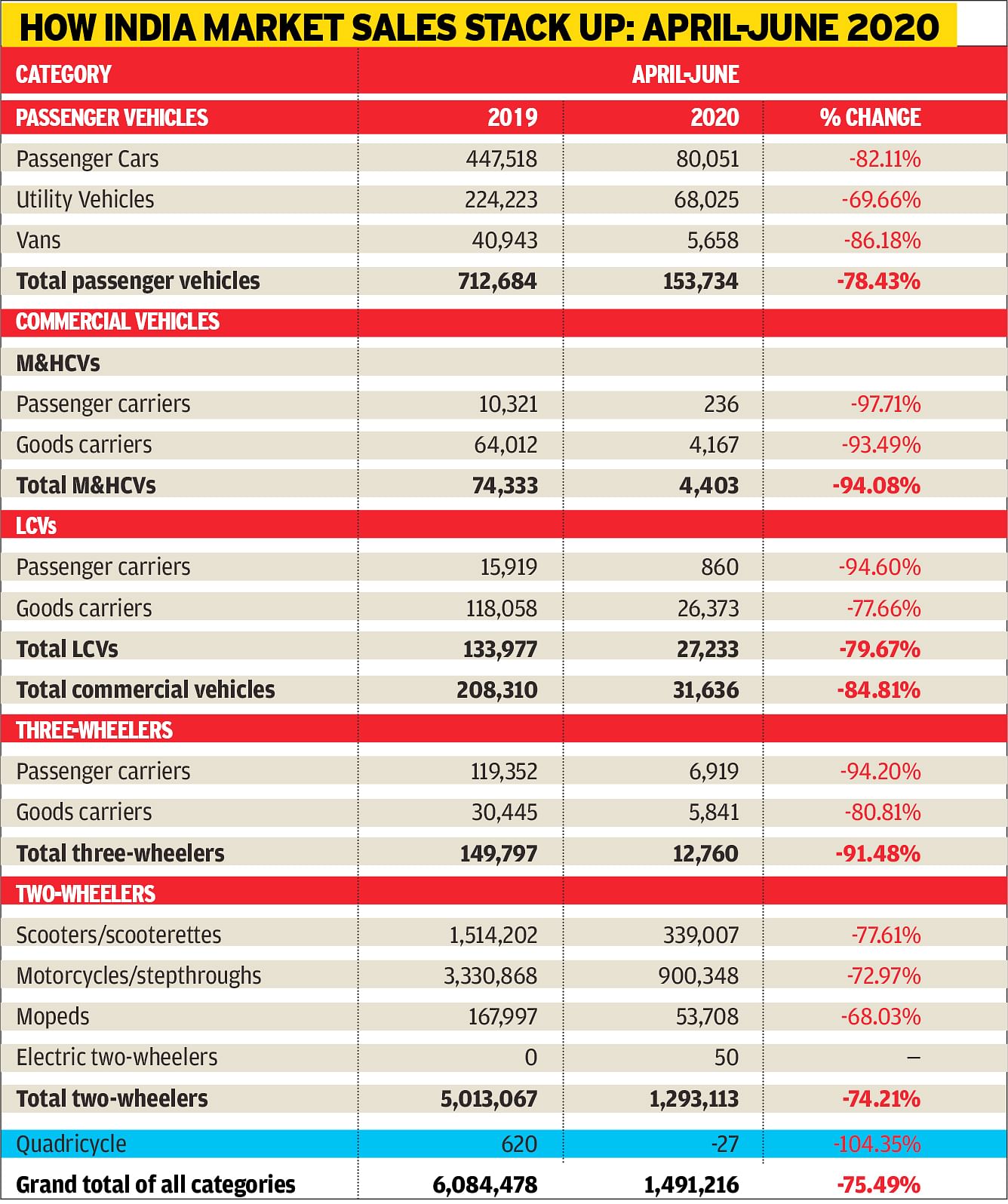

Look at the sales data table at the bottom of this report and the acres of red ink indicate just how bad the market situation is for OEMs in India. All 13 vehicle sub-segments are in the red and the YoY sales declines are all between 68-95 percent.

The industry has doled out its worst-ever performance in over two decades with the impact of coronavirus endangering growth and pulling it down by a dramatic 75 percent in Q1 FY2021. Furthermore, there is an added caution on the profitability of companies, which had heavily invested into the transition to the BS VI emission norms that came into effect earlier this year in April, and are now looking at extremely delayed returns.

SIAM president Rajan Wadhera: "An incentive-based scrappage policy is key to India Auto Inc revival. OEMs have limited profitability (3-9%) while government taxation is 28-60%.OEMs are hit by huge BS VI investment, low capacity utilisation & falling profitability. It is up to the government now."

Passenger Vehicles: 153,734 units (-78%)

With the pandemic triggering a significant amount of job losses across different business sectors around the country, discretionary spending is at an all-time low. As a result, the passenger vehicle segment has registered its longest and deepest slowdown in the past 20 years, registering 78 percent de-growth in Q1 FY2021 at 153,734 units (Q1 FY2020: 712,684), which has been continuing for nine consecutive quarters now.

Contrary to this, as per SIAM data, the last major recession in 2008-09 saw the PV segment decline 15 percent but lasted just one quarter with the government coming into action to announce fiscal benefits between December 2008 to 2009. In 2013-14 as well, the 15 percent drop spanned relatively lesser, lasting five quarters before an uptick.

Within the PV segment, passenger cars registered an 82 percent drop at 80,051 units while vans 86 percent. Only UVs which fared relatively better sold 68,025 units but still registering a de-growth of 69 percent compared to 224,223 units sold in Q1 last year.

Commercial Vehicles: 31,636 units (-84.81%)

Within the CV segment, sales of goods carriers dropped 83 percent while the passenger-carrying segment registered de-growth of 96 percent. Total M&HCV sales at 4,403 units (74,333) were 94 percent down while LCVs recorded an 80 percent decline with sales of 27,233 units (133,977).The commercial vehicle industry, seen as the barometer of the economy, is reflecting the poor state of the Indian economy. Like the PV segment, CVs recorded its second-longest slowdown in the last 15 years with overall sales dropping 85 percent in Q1 to 31,636 units, spanning five quarters compared to the eight-quarter-long slowdown seen during 2013-14.

However, according to SIAM, the lower segment of CVs – the small CVs – are showing better performance but trucks over 16-tonne payload capacity have shown a significant sales declines, which flags off high levels of concern for the economic revival per se.

However, according to SIAM, the lower segment of CVs – the small CVs – are showing better performance but trucks over 16-tonne payload capacity have shown a significant sales declines, which flags off high levels of concern for the economic revival per se.

Three-wheelers: 12,760 units (-91.48%)

While three-wheelers had seen some uptick over many months before the outbreak of Covid-19, owing to the rising demand for last-mile connectivity and small-goods transportation for hyperlocal businesses, the crisis has made even the three-wheeler segment register a drastic 91 percent de-growth in Q1 FY2021 with total sales plummeting to 12,760 units (149,797).

While passenger carriers declined 94 percent at 6,919 units (119,352) due to new norms of social distancing and people preferring personal transportation over shared mobility, goods carriers dropped 81 percent to 5,841 units (30,445).

Two-wheelers: 1,293,113 units (-74.21%)

Despite being the largest two-wheeler market in the world, India has registered its longest slowdown in the segment in the last 15 years, with the sales decline spanning for over six consecutive quarters and Q1 decline in the ongoing fiscal standing at 74 percent with sales of 1,293,113 units (5,013,067).

While scooters registered a 78 percent decline selling 339,007 units (1,514,202), motorcycles were slightly ‘better’ at a 73 percent de-growth with sales culminating in 900,348 units (3,330,868), owing to the better demand from the rural markets.

According to Rajan Wadhera, president, SIAM, “It is very clear that we have been suffering hugely on the demand front the whole of last year, as a result of which there is a de-growth in all segments. Now, the coronavirus has exacerbated that and we know that the impact of the de-growth is going to be very harsh on the auto industry, as is going to be its impact on the GDP.”

“It is the CV industry that shadows the GDP and the economy. The drop in personal vehicles is purely a reflection of consumer sentiments.”

“We are forecasting a de-growth of 26-45 percent for FY2021, that itself is a very large de-growth and will not warrant any fresh investments. We don’t see sales reaching pre-2018 levels before the next three- to- four years. Survival is going to be very difficult,” he added.

Rural vs urban demand, delayed imports from China

If there is some hope on the horizon, then it will come from demand from rural India. Wadhera said: “There is very good demand in the rural parts of the country that is largely linked to the agricultural segment because of good crop harvest and a good monsoon forecast.”

“All these things are also leading to entrepreneurship in rural India not just for agricultural but for non-agricultural products as well, which is eventually spurring demand for two-wheelers, passenger vehicles as well as CVs. We are very happy that rural demand is going up.”

According to an ICRA report, India will not replicate the ‘V’-shaped recovery pattern followed by China after the lifting of lock-down, rather will see demand take a gradual and slow recovery.

The report also mentions that recovery in rural income and improvement in overall economic activity remain crucial to have meaningful improvement in retail demand off-take.

As regards some port congestion and imports from China getting flagged by India after the border tensions in Ladakh, Wadhera provided an update: “While there was, for a period of 7-8 days, flagging off of every consignment at the customs with the Indo-China geopolitical issue sparking off, but that has been resolved and it is behind us now,” he said.

Capacity utilisation only 30%, investments on hold

Giving a status update, Wadhera explained that the lackadaisical demand in the market and the supply chain issues has forced companies to operate at only around 20-30 percent of the production capacity. “We continue to face a lot of supply chain issues; production is not smooth and it is happening in start-stop manner. The links in the supply chain are broken, leading to a huge challenge on the supply side, which is restricting the wholesale,” he said.

“The wholesales that happened in May were largely the inventory of March, which was eventually despatched after the easing of the lock-down. We would see production increasing over the next two to three months, but it wouldn’t go beyond 60 percent,” he added.

As regards new investments, Wadhera mentioned, “Practically, I don’t see any investments in the near future coming towards capacity expansion, but whatever new models are already in development and need a little more capital to eventually be rolled out, those will see cash flowing in, otherwise, companies cannot indefinitely go on borrowing money after having recently invested into BS VI regulations which has also hit the profitability.”

“There will be a need of support and collaborations between industry and academia and funding for common development of projects, otherwise there will be no viability at the business level to invest into EVs as of now. I do not see any case for investment in the near future, when PV volumes are lowest in 12 years,” he said.

Industry in dire need for direct stimulus

With the industry in doldrums to the extent mentioned above, consumer sentiment is also at its lowest. While there have been signs of an uptick initially, but industry leaders believe it could be the pent-up demand in the pipeline. Overall, the current new vehicle demand at the retail level is of the order of 40-50 percent of the previous year, as per SIAM.

The situation, however, can be significantly improved by the intervention of the government and giving direct consumer benefits on new vehicle purchase.

According to Wadhera, “There is a very strong need for demand stimulus. There was a fiscal stimulus that came our way in 2008-09 and another one in between February and December 2014.”

“We are in discussions with the government for almost a year and are trying to press upon the importance of direct demand measures. Our recommendations for bringing a 10-percentage points GST reduction across the board and scrappage policy continue. The GST ranges between 28 to 60 percent and automotive is one of the highest-taxed industries.”

“As of now, we are staring at a very deep slowdown led by the Covid-19 crisis. The world over, we have seen governments – the US, Spain, Italy, France, Thailand or Malaysia – supporting the industry by offering direct stimulus to the consumer. We haven’t given up and continue to talk to the government and while they are listening to us, but we still await action,” he said.

“We are seeing green shoots in personal mobility coming back as people who have been traveling by public transport and shared mobility are moving to two-wheelers,” he added.

India Auto Inc’s mission self-reliance

With the entire coronavirus crisis sparking off a huge debate on the increasing need to become self-reliant, Wadhera said, “When the industry is depending upon an intertwined global supply chain, it will be extremely difficult in the next 2-3 years to have 100 percent localisation because there are many products and technologies for which we do not have suppliers in the country.”

“We need scale to localise and if we were on the track for the automotive mission plan (AMP 2026), we would have gotten the scale and perhaps invited the technology providers into the country to localise.”

“That is where we are requesting the government to give us a concrete, long-term roadmap to achieve the goal of self-reliance. A well-built roadmap without any undue knee-jerk reactions which also incentivises manufacturing of EV parts which will become critical for the future, is very critical to be set. Then, we are very confident that we can achieve the goal of self-reliance and not just make in India, but make in India for the entire world,” he said.

“The Indian auto industry has developed a huge talent pool over the last decades. The design and development of vehicles in India has created a knowledge bank that we can use to build small cars and leverage our export potential,” concluded Wadhera.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

14 Jul 2020

14 Jul 2020

14011 Views

14011 Views

Autocar Professional Bureau

Autocar Professional Bureau