Increase in axle load norms to impact CV fleet utilisation and sales, says CRISIL

With the government expected to announce an increase in maximum axle load by 20-25 percent, the landscape for commercial vehicles in India will be altered but will bring the country's permissible truck axle load limits to levels prevalent in developed nations.

After over three decades, the government is working on a proposal to announce new norms on increasing the axle load on commercial vehicles by 20-25 percent. It is a move which will impact the overall CV segment, currently recording over 50 percent growth in India. While it should lead to substantial gains for the M&HCV segment, it is likely the LCV segment, or more specifically the small CV sub-segment, will be impacted by a demand shift to heavier machinery.

A CRISIL research report says the recent strict ban on overloading has led to an increase in the cost per tonne of sand, stones and other construction material, which is hindering implementation of projects the government is keen to fast-track, as it goes into the election year. Contractors who had bid for various tenders – especially in affordable housing and road construction – keeping certain rates for these commodities in mind, are finding it difficult to execute the projects. In view of these concerns, the government is believed to be contemplating new axle norms.

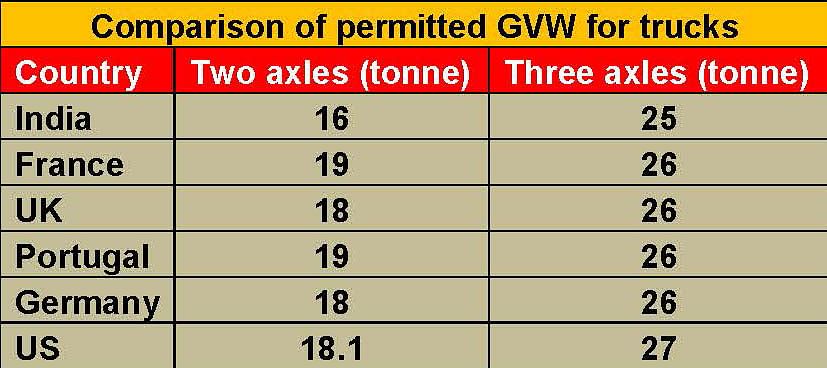

The maximum allowable axle load and gross vehicle weight (GVW) of commercial vehicles were notified in 1983, based on the recommendations of a committee set up for the purpose, and then reconfirmed in 1996. As per media reports, the maximum axle load could be increased by as much as 20-25 percent. This would bring India’s permissible truck axle load limits to levels prevalent in developed nations.

Rated load for higher-tonnage trucks based on axle combinations and vehicle lengths, but are higher than current rated loads in India.

Positive impact on inter-state freight movement

CRISIL believes there are two ways the change in norms can be implemented – an increase in axle load limits for all trucks, or only on new sales. "If the revised norms increase the freight capacity of the entire population of trucks currently operational in India by 20-25 percent, it will have a visible impact in interstate movement, which accounts for the bulk of primary freight and where overloading is limited. A good year sees a growth of billion tonne kilometres, or BTKM, growth of 7-8 percent. Hence, a 20-25 percent increase in freight-carrying capacity would be equivalent to three years of incremental freight demand," says global analytics company CRISIL.

Spot freight rates would soften as large fleet operators, who are transporting dense bulk commodities, would be able to carry more freight, improving their margins. Contractual freight rates would remain resilient until the contracts are renegotiated. The logistics costs of most companies will also reduce. Overall, this would be a big positive for infrastructure projects as moving construction material to project sites would turn cheaper.

Shift in demand to impact small CVs?

While the proposed move to hike axle loads will benefit heavy-duty trucks, it is likely the competitiveness of small fleet operators would gradually erode. Small fleet operators would be impacted as efficiency gains from being able to carry more rated load per trip would be passed on through lower spot rates. Besides, the increase in the freight capacity would be less meaningful for intra-state movement where overloading is prevalent – much more than in inter-state movement.

Speaking to Autocar Professional, Rajesh Kaul, Product Line Head, M&HCV, Tata Motors, said: “We welcome the move by the government, which will help improve the profitability of our transporter partners. An axle load increase will enable higher gross vehicle weights on vehicles and hence loading capability will also increase which will, in turn, enhance truckload efficiencies with regard to industrial output and demand. Truck demand as regards billion tonne kilometres movement will be impacted as a lesser number of trucks would be required now for transporting a certain tonnage over a given distance. Weighbridges may have to be reinforced in case of truck density (numbers per square kilometre) going up. Competitiveness with the rail sector would improve as the cost per tonne kilometre for road transporters will come down. More business may shift to the road for cost competitiveness.”

While Ashok Leyland is yet to reply to a query from Autocar Professional, Daimler India Commercial Vehicles, which manufactures the BharatBenz range of M&HCVs, declined to comment on the proposed initiative saying there are not many details available on the specific timeline of implementation.

Shift to higher-tonnage trucks already underway

With an increase in the supply capacity due to the new norms on key trunk routes, there would likely be a reduction in fleet utilisation for large fleet operators, as they would need fewer trucks to carry the same amount of load.

Given this, such fleet operators would reduce or halt expanding their fleets until utilisation reaches an optimal level. Sales of haulage trucks could fall, though tippers, which generally ply intra-state and tend to be overloaded, would be less impacted. Therefore, the tonnage segments on which the norm would be applicable would be a key parameter to be monitored.

The recent trend of the M&HCV buyer shift to higher-tonnage vehicles as a result of the strict implementation of the overloading ban had led to a shift to higher-tonnage segments such as 37T trucks and 49T T-trailer from 25T and 31T rigid trucks and 40T trailers. With the change in norms, this shift will subside. Also, considering the current 37T rigid vehicle will have 20 percent more carrying capacity (taking its GVW to around 44 tonnes), it remains to be seen how the market requirement shapes up for the yet-to-be-launched 41/43T rigid trucks, which would have even higher GVW capacity given the new axle norms.

According to CRISIL, if axle load limit is increased only for new trucks, and if only trucks sold after the implementation of the norm are eligible for the higher rated load, transporters could halt purchases of new trucks until the new norms become applicable and then replace as many of their existing fleet with new trucks with revised rated loads. This would lead to a surge in CV sales in the year of implementation of the norm.

With a large number of trucks being replaced, transporters will fetch lower resale value for the trucks that they would be selling, hampering their income. Besides, execution of this option would be difficult, given that it would be challenging to monitor overloading keeping an additional parameter of manufactured date as a criterion.

“Considering the pros and cons of both these options, we believe the norms would be applicable to the population park. This is because, many old vehicles are being used for government projects, and with no material change in the axle on new trucks, limiting older vehicles with similar axles to a lower-rated load might not be acceptable to transporters,” says CRISIL.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

16 Jul 2018

16 Jul 2018

25662 Views

25662 Views

Autocar Professional Bureau

Autocar Professional Bureau