Highly taxed diesel, petrol at all-time highs in India

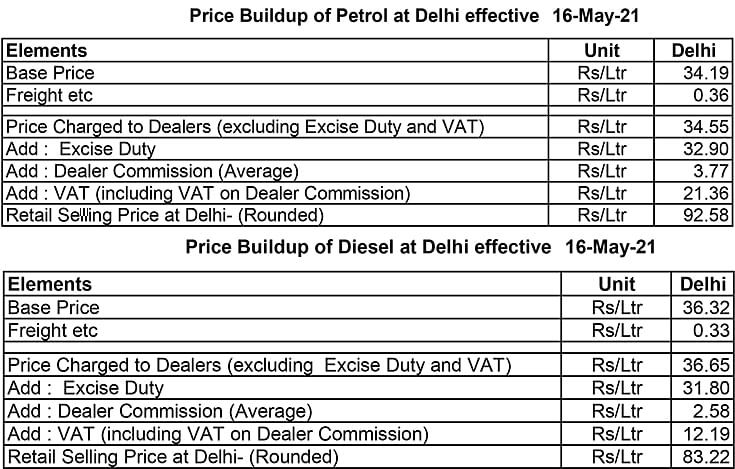

A litre of petrol, which costs Rs 92.58 in Delhi includes 59% Central and State taxes; diesel at Rs 83.22 bears 53% taxation.

It’s the start of a new week and mercifully there is no hike in the price of petrol or diesel. May 16 was the last price increase – making petrol costlier by 24 paise a litre (Rs 98.88) and diesel by 27 paise (Rs 90.40) – in Mumbai.

In Delhi, tanking up on petrol costs Rs 92.58 a litre ad fuelling diesel means you fork out 88.02 a litre. One of the key reasons for the sustained rise in fuel prices is the high level of taxation. Look at the data sheet below which reveals the extent to which the two fuels are taxed, with Delhi as the benchmark.

Of the Rs 92.58 price of a petrol litre, Rs 32.90 or 35.53% is charged as the Central government’s ‘Excise Duty’ and Rs 21.36 or 23% is what the state levies. Put together, taxes account for Rs 54.26 or 58.60% of the price of petrol in the capital city.

It’s similar with diesel, which costs Rs 83.22 a litre in Delhi today. While Central taxes comprise Rs 31.80 or 38.21% of the price, state VAT accounts for Rs 12.19 or 14.64% of the retail price. Cumulatively, taxes comprise Rs 43.99 or 52.85% of the final selling price to the consumer.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

17 May 2021

17 May 2021

10711 Views

10711 Views

Autocar Professional Bureau

Autocar Professional Bureau