High steel prices and reduced vehicle production hammer Indian forging industry

The forging and auto component industries are anticipating a bleak festive season this year.

The sharp increase in steel prices, rising input costs and high fuel prices, which have impacted the automotive industry in India, is also pulling down allied industries. According to the Association of Indian Forging Industry (AIFI), the apex body of the Indian forging industry with over 200 members, high steel prices have “hammered the forging industry in India.”

The association says the industry anticipated a rebound for the overall passenger vehicle market following the second wave of the Covid-19 pandemic. However, it is the supply, not the demand, that is likely to lead to longer wait times, which will have a long-term impact on consumer sentiment. "Maruti Suzuki India, Toyota Motor Corporation, Hyundai Motor India, and Mahindra & Mahindra have already indicated that their vehicles will be more expensive in the coming months. As a result, the forging and auto component industries are anticipating a bleak festive season this year," says AIFI in a statement.

This year AIFI had raised its concern over high steel prices to the Prime Minister, Narendra Modi. The association also wrote to the Ministry of Micro, Small and Medium Enterprises, Ministry of Heavy industries, Ministry of Steel, and Ministry of Commerce and Industry.

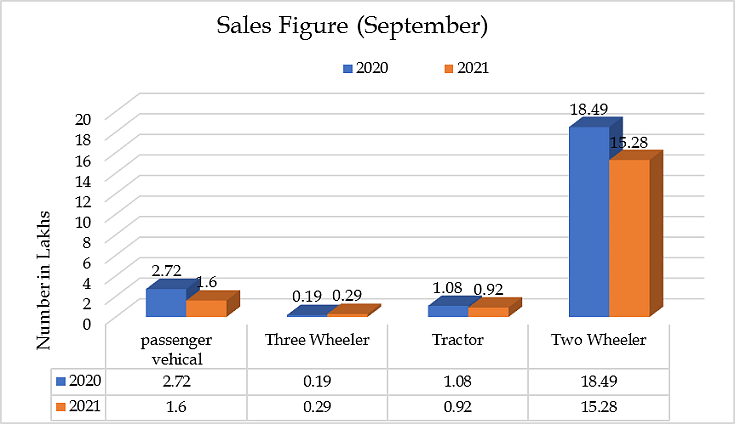

With the ripple-down effect of declining automobile sales, the forging industry is facing the heat with a sharp decline in demand which has resulted in substantial production cuts. The Indian forging industry primarily caters to the Indian auto industry, which accounts for 60-70 percent of its production. With the auto sector witnessing a slowdown, the forging industry has witnessed an average slowdown of 50 percent of the total capacity.

Vikas Bajaj, president, Association of Indian Forging Industry said, “The industry is still going through challenging times after the second wave. The sector faces new obstacles on a regular basis. The industry is currently concerned due to the lack of semiconductor chips. It has an indirect impact on India's forging sector. Additionally, customers are experiencing extended wait times, and the demand-supply imbalance may have an impact on automakers throughout the festive season.:

He added, "Furthermore, the rise in steel prices has harmed India's forging industry. The basic requirement in the forging industry is steel and the current price hike has disturbed the supply chain. If this continues to exist, the high steel prices will reach inflation levels more than what the country is currently witnessing. Additionally, high raw material prices continue to be a challenge and high fuel prices continue to have an impact on customers and purchase decisions. If manufacturing production and demand does not improve in the coming months, the forging and auto-component sectors will continue to struggle.”

The forging industry in India is said to comprise 85 percent of the MSME sector, employing over 300,000 people directly, with an equal number employed indirectly. The Indian forging industry is the second largest in the world, next only to China. The forging sector has been identified by EEPC as one of the key sectors for export growth.

Yash Jinendra Munot, VP, Association of Indian Forging Industry said, “We believe that the government must take a comprehensive approach to reviving the reeling Indian forging sector and providing the necessary impetus. The industry hopes the government will take a few immediate steps. The revival will be critical in strengthening the forging Industry and providing collaborative platforms to address the industry's challenges."

He added, "The introduction of electric vehicles will be a direct impact on the forging industry, reducing demand for moveable parts used in vehicles which will result in major unutilised forging capacities. However, the industry continues to support our government in its green mission. As a result, it is time for the forging industry to expand into non-automotive domains such as infrastructure, defence, healthcare, and railways where the current government is also investing heavily”.

With an annual output of about 20 lakh metric ton (FY2021 ), the Indian forging industry has about close to 400 forging units, of which 80-82% can broadly be categorised as tiny and small enterprises. While 10% are medium sized, the remaining are large scale. While SMEs contribute 30% of forging production, the Medium and Large-Scale units contribute 70%.

With a total production worth Rs 45,000-50,000 crore, the forging industry provides direct employment to more than 300,000 people in the country along with an additional 60,000 contract labourers.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

15 Nov 2021

15 Nov 2021

9821 Views

9821 Views