FADA president welcomes Mercedes-Benz India's new retail dynamic

Elimination of inventory costs being seen as a booster shot for dealer profitability.

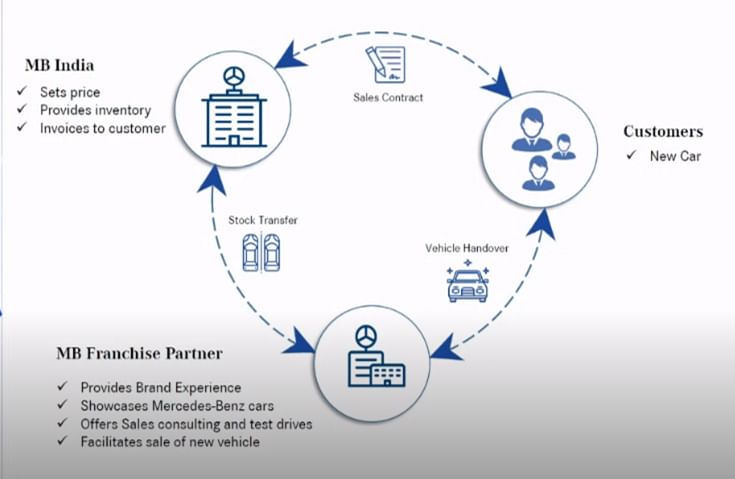

Earlier today, Martin Schwenk, MD and CEO of Mercedes-Benz India, today made a landmark announcement to adopt an approach similar to a D2C (direct-to-consumer) model for the company’s vehicle retail strategy in India, citing improved profitability for dealers, getting more consumer insights to deliver better value as well as enhancing their buying experiences.

India becomes only the fourth country after Sweden, South Africa and Australia for the German luxury carmaker to embrace this revolutionary sales model. This new retail dynamic is in line with Merccedes-Benz's global strategy to drive up to 25 percent of new car sales through online channels by 2025.

According to Schwenk, “There are bound to be financial benefits of this model. All of our existing dealer partners want to go along with us together into the future. We have decided and agreed on it for a clear go-ahead across the Mercedes-Benz India organisation, and we will grow business together by keeping the customer at the focal point of this new retail model.”

The Federation of Automobile Dealers Associations (FADA), India’s apex dealer body, has welcomed Mercedes-Benz India’s move that will kick in by Q4 of this calendar.

Speaking to Autocar Professional, Vinkesh Gulati, President, FADA, said, "On the face of it, it looks like a very good strategy. Any dealer would be happy if he is able to minimise the inventory costs. In this case, not just the interest on unsold inventory, even the stockyard and pre-sales expenses will be completely eliminated," he added.

Gulati explained that most dealer principals are even used to giving a collateral in terms of their residential properties to build up an inventory of these high-end luxury cars on credit. "Now, we would be secured about that expense and it would be a win-win for dealers," he said.

Potential threat to market share

However, the revolutionary retail strategy also comes with a word of caution. With customers always keen to get the best deal while purchasing a new vehicle, Mercedes' centralised offer and pricing approach might deter sales and could potentially be a threat to its market share as well.

"In case the prospective customer is not a Mercedes-Benz loyalist, he or she could opt for a competing brand where the dealer is able to offer a better deal on a similar model due to readily available stock in the inventory," cautioned Gulati.

Moreover, a centralised order system would degrade dealer aggressiveness especially when one showroom is catering to a number of nearby towns and cities and would be the de-facto delivery location of all new Mercedes-Benz orders.

Dealers who are used to doing as much as 40 percent of their business by selling cars outside of their regional territories would also end up losing a significant amount of business by this centralised retail model as well.

Dealer revenue model

However, despite Mercedes-Benz India switching to an inventory-free approach to improve dealer profitability, the revenue streams will continue. Dealerships will continue to facilitate the new car buying journey, including providing assistance in finance, insurance and old-car exchange, which collectively are key sources of cash-flow generation.

"The margins (on new sales) will continue too, but they will be lesser. However, in the end, the dealer will end up benefiting from the entire exercise," said Gulati.

The average dealer margin on every new sale in the luxury-car segment is learnt to be to the tune of 8 percent, which could come down to 6 percent with Mercedes-Benz India's new retail approach.

But with several benefits to customers and dealers, will other players follow in the footsteps of the luxury car market leader in India? "It will not be so early. Only the premium players can do it because the volumes are low and they can still control a small number of dealers," Gulati signed off.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Jun 2021

02 Jun 2021

16550 Views

16550 Views

Autocar Professional Bureau

Autocar Professional Bureau