FADA 'cautiously optimistic of auto market turnaround'

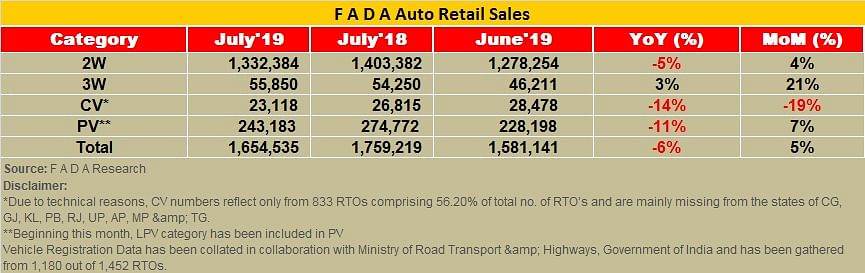

Auto retails in July witnessed growth on a MoM basis, with overall sales up by 5%.

The ongoing slowdown in the economy has caused a lot of distress among the industry, and what's more is that the prime minister of India, Narendra Modi has taken cognisance of the same and has pitched for reduction in GST across vehicle segments. On the other hand the data released by the Federation of Automobile Dealers Associations (FADA) today for July 2019, shows despite a YoY dip, the retail industry reported a positive month-on-month growth.

In July 2019, the auto retail came at 1,654,535 units, a growth of 5 percent over last month, while the YoY sales were down 6 percent, compared to 1,759,219 units in July 2018.

Commenting on performance, Ashish Harsharaj Kale, president, FADA said, “Consumer sentiment and overall demand continued to be quite weak across all segments and most geographies. The July sales continue to be in the negative zone YoY. Although Some respite seen with growth in MoM numbers which was mainly due to revival of the monsoon bringing some positivity and also June having the second lowest volume base this calendar year after February. With June being a completely dry and rain deficient month, consumer sentiment was at its lowest and with July rains covering up a lot of the deficit, some confidence in consumer demand led to pending purchase conclusion in July. Despite these factors CV sales continued to be in the negative even on month-on-month basis.”

2W and CV inventory a worry for dealers

The dealer body says that continued steps taken by PV manufacturers in reducing wholesale billing as well as regulating production has further led to decrease in inventory in July, which is "now very close to FADA’s 21 days inventory levels."

FADA says it thankful to all PV OEMs for initiating necessary steps and helping dealers in reducing inventory thus helping manage dealers profitability and viability in these challenging times.

In contrast, the CV inventory continues to remain at high levels and unlike the slight uptick in sales seen in July for PV and 2W, CV Sales continued to be negative in 'double-digit' both YoY and MoM basis. This gave little room to the dealers to reduce inventory.

The dealer body has urged OEMs to help regulate the inventory at the earliest by regulating wholesale supplies. Kale says the current weakness in overall demand, especially in the CV Space, the present inventory is a worry for the dealers. This was especially looking at the transition to BS VI now being just 6 months away.

He said, FADA members reached out have suggested and requested level of 21 days in CV inventory by end-September.

FADA says two-wheeler inventory has seen very slight reduction, and continues to be at very high levels. The high levels of inventory in 2W segment has continued from the start of this beginning of the slowdown in September 2018, without respite in any month and is a very serious concern of dealers, which is threatening the financial viability of many and therefore has become a 'cause of serious worry' to FADA.

The apex dealer body has urged 2W OEMs to help regulate the inventory to regular levels of three weeks.

FADA maintains cautiously optimistic outlook

The industry with no major relief in sight has been maintaining a cautious approach. In fact, with a number of OEMs and suppliers announcing temporary suspension to avoid high-inventory build-up. For FADA the situation is similar and it has maintained its near-term outlook as 'cautiously optimistic'.

The industry body says its cautiousness is on the back of the weak consumer sentiment and low demand that sees consumer continuing to postponed purchase decisions. The overall economic situation also continues to be weak, and transmission of surplus liquidity and interest rate cuts still not reflecting in retail lending. This bundled with confusion in consumer perception in regards to EV and BS6 leading to postponement, with even the flood situation being quite severe in many states that reported a large auto sales.

On the flip side, FADA is optimistic for growth to pick-up on the revival of monsoon with 'average' or 'above average' rainfall in most parts of the country. Surplus liquidity in the system after a prolonged shortage of it will hopefully lead to aggression in retail lending soon, says FADA. The subdued fuel prices unlike last festive season, and the meeting with the finance minister in which 'all measures for growth revival suggested and were seriously listened to' including temporary reduction in GST, an attractive scrappage policy and continued liquidity availability, building confidence in banking and NBFC sector to facilitate aggressive retail lending along with transmission of the rate cuts.

More importantly, FADA says it is optimistic on growth on the back of the prime minister himself leading the efforts for growth and demand revival and a strong and positive statement, which put to rest the confusion on co-existence of IC Engines and EV.

On the liquidity front, Kale said: “Liquidity currently seems to be surplus in the banking system and with the strong focus of the RBI and finance ministry, should continue to be so. The recent rate cut by the RBI is an indication of its policy of monetary easing and is a big positive. The need now is in transmission of the liquidity and rate cuts in lending at retail levels to spur growth, as banks and NBFC’s still continue to tread with a cautious approach for obvious reasons.”

Key findings from FADA online members survey

On the Current Sentiments of the Industry

65% Dealers rated it as Bad (56% in June’19)

34% Dealers rated it as Neutral (39% in June’19)

On the Liquidity Front

38% Dealers rates it as Neutral (46% in June’19)

55% Dealers rated it as Bad (46% in June’19)

On the Current Inventory Front

Average inventory for PVs ranges from 25 – 30 days (30-35 days in June’19)

Average inventory for 2W ranges from 60 – 65 days (60-65 days in June’19)

Average inventory for CV ranges from 55 – 60 days (55-60 days in June’19)

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

19 Aug 2019

19 Aug 2019

5190 Views

5190 Views