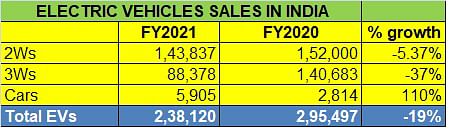

EV sales in India down 19% in FY2021 but demand grows for electric cars

While e-PVs saw 110% growth in a difficult year, the off-take for e-two- and three-wheelers is down, indicating the need for more affordably priced models.

Earth Day today saw the Society of Manufacturers of Electric Vehicles (SMEV) release official sales data for EVs sold in India in FY2021. In a year badly impacted by the pandemic and resultant lockdowns, like the rest of the automotive industry, the EV sector too has felt the pressure of a slowing economy and tepid sales.

Cumulative EV sales numbers for FY2021 are 238,120 units, down 19.41% year on year (FY2020: 295,497). Electric two- and three-wheelers, termed the ‘low-hanging fruit’ came under pressure with sales of 143,837 units (-5.37%) and 88,378 units (-59%). The bulk of the e-two-wheeler demand came from low-speed models (103,000 units) while 40,836 high-speed models found buyers last fiscal.

While the decline in electric three-wheeler numbers looks rather high at 37% YoY, the fact is that the SMEV data doesn’t include vehicles that are not registered with the transport authority.

The electric passenger vehicle segment though witnessed segment though witnessed robust YoY growth albeit on a low year-ago base – 5,905 units, up 110% (FY2020: 2,814 units). The bulk of these sales came from the Tata Nexon EV, which sold 3,805 units and accounted for 64% of total electric PV sales. The MG ZS EV, with 1,499 units, was the second best-selling e-car.

Commenting on the sales report, Sohinder Gill, Director-General, SMEV, said: “We were anticipating a good growth before the start of FY2021 but sales remained stagnant due to various reasons. Sales in the electric three- and two-wheeler segments stood low as compared to FY2020. A good thing is that people have started moving towards advanced batteries i.e. lithium. The city speed and high-speed categories in the two-wheeler segment have witnessed growth. However, a lot more needs to be done to achieve the target under the FAME II scheme. Timely intervention by the government in a form of policy change is required to fuel the growth and achieve the target by the end of FY2022.”

Challenges to greater EV adoption

According to the SMEV chief, a strong bank finance mechanism for EVs is still missing in the country. Only banks like State Bank of India and Axis, to name a few, offer loans on selected models. The government should urge banks to offer loans on EVs, which will augment sales.

There also needs to be greater awareness about green vehicles. Sohinder Gill is of the opinion that the Central and state governments can play a crucial role in motivating and encouraging citizens to adopt e-vehicles. :We have seen in the case of Delhi wherein the state government is doing a tremendous job in creating awareness, which has encouraged more people to adopt EVs,” he said.

A big positive, and a recent one at that, is the growing demand for EVs from the booming e-commerce sector in India. The need for last-mile mobility and cost-efficient logistics means e-commerce firms see EVs being cheaper to maintain compared to ICE vehicles. Recent moves in this direction are Amazon India and Flipkart confirming plans to use EVs in their fleet of delivery vehicles.

What augurs well for the long-term future of e-mobility in the country is that a number of states, including Delhi, Maharashtra, Andhra Pradesh, Bihar, Chandigarh, Haryana, Karnataka, Kerala, Madhya Pradesh, Odisha, Meghalaya Punjab, Tamil Nadu, Telangana, Uttar Pradesh and Uttarakhand have rolled out their EV policies. However, some states are yet to implement the policy. “The early implementation of state-level policy could assist in creating a larger ecosystem in the country that would help the industry to grow at a much faster pace. Additionally, the state government policy should be focused on demand generation for the initial period that would help in getting more volumes on the road,” said Gill.

Yet another positive is the fast-growing EV charging infrastructure in India. At present, around, 1,300 charging stations have been set up and a number of leading players like Tata Power have announced rapid expansion plans. Other corporates have also ventured into the segment and begun installing charging stations across the country. It is expected that by 2026, India should have a robust charging infrastructure in place.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

22 Apr 2021

22 Apr 2021

25368 Views

25368 Views

Autocar Professional Bureau

Autocar Professional Bureau