EV buyers in India to pay significantly lower third-party insurance premium

The new premium rates come into effect from June 16, 2019.

The drive for electric mobility in India could become much more attractive. Customers purchasing electric vehicles (EVs) have got another reason for cheer, as the Insurance Regulatory and Development Authority of India (IRDAI), the regulatory body for insurance and reinsurance industry in India, has announced the revised third-party insurance premium rates.

The new premium rates which come into effect from June 16, 2019 have got dearer for consumers of internal combustion-engined vehicles across the range. On the other hand, EV buyers will see their third-party insurance premium become comparatively lighter on their pocket. If one goes by the drafts and proposals planned by the government to introduce higher taxation on ICE vehicles to drive adoption of EVs by making them cheaper, the recent ruling by IRDAI could very well be the first among many steps.

Considering the mandatory nature of third party liability insurance policy in India, the regulatory body has asked insurance companies to make available the new premium for all vehicle categories from the implementation dates. Interestingly, the insurance premium rates on two-wheelers is a minimum of four percent; for four-wheelers, it has increased by 12 percent (mass-market products).

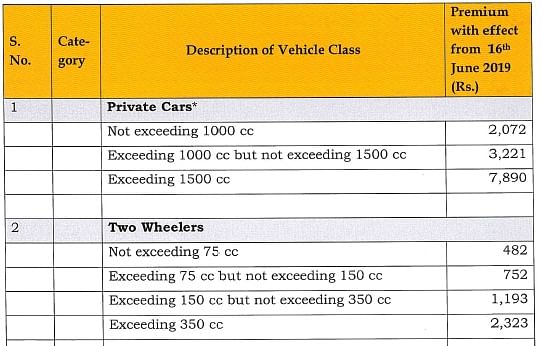

According to the update, yearly premiums for private four-wheelers, with engines under 1,000cc, will be Rs 2,072, (+12%), cars between 1,000cc and 1,500cc will now pay a premium of Rs 3,221 (+12.5%). However, cars with engines larger than 1,500cc will continue to pay a premium of Rs 7,890 as there is no price hike in this segment.

Owners of two-wheelers with engines less than 75cc will face a 12.9 percent hike, with the annual premium rising from Rs 427 to Rs 482. For two-wheelers between 75-150cc, the premium will be Rs 752 (+4.4%). The 150-350cc two-wheeler segment sees the largest hike of 21.1 percent. Owners will now have to pay a premium of Rs 1,193, instead of last year’s Rs 985. Similar to private cars, two-wheelers above 350cc see no change in premium rates, with the amount set at Rs 2,323.

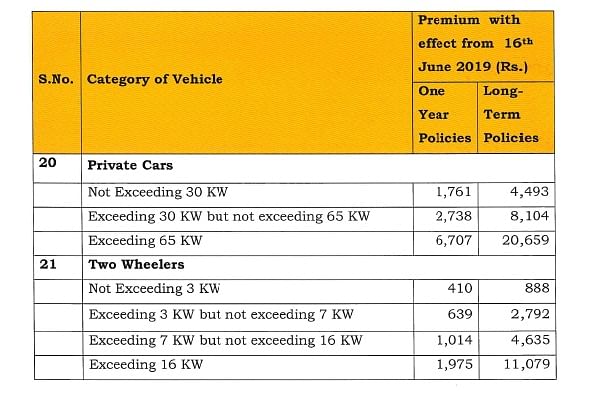

On the other hand, electric car owners will pay almost half the insurance premium compared to their ICE siblings, while electric two-wheeler owners will pay significantly lower on both yearly as well as the long-term (5-year) policies.

(data courtesy: IRDAI)

Also read: EIB loans €73.5 million to Barcelona for hybrid, CNG and electric vehicles

Mahle develops new oil management module for electric vehicles

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

07 Jun 2019

07 Jun 2019

15446 Views

15446 Views

Autocar Professional Bureau

Autocar Professional Bureau