Demonetisation likely to boost organised used car market in India

While demonetisation has hugely impacted the new car market in India, the fundamental growth drivers of the used car market are still intact, which should help in quick recovery of business volumes.

The ongoing cash crunch, brought about by demonetisation since November 9, 2016, has already had its impact on the Indian automobile industry. December 2016 sales have crashed and overall numbers are down 18 percent year on year to 1,221,929 units, the lowest in 16 years. Passenger vehicle sales have dropped 1.3 percent to 227,824 units.

The paucity of cash has led to consumers delaying their purchasing decisions, as a result of which there are fewer footfalls in car showrooms and poorer sales. Also, it is plausible that there could be more pain to come in the next few months. Both industry and consumers are hopeful new income-tax benefits and other incentives, which will re-energise the new car market, will be offered in the Union Budget 2017-18.

However, the flipside of the current situation is that consumer demand in the used car market is set to grow. The fundamental growth drivers of the used car market are still intact, which should help in quick recovery of business volumes.

The used car market plays a critical role in the new car industry by enabling over 900,000 trade-ins (exchanged vehicles) at new car dealerships. These trade-ins are essential for new car sales.

Vehicle pricing guide, IndianBlueBook, has released a study on the ‘Impact of Demonetisation on the Used Car Market’. Data gathered from more than 38,000 in-market customers throws light on the impact of demonetisation on the consumer purchase cycle. It also provides insights into how the industry is expected to recover and structural shifts over the next 12 month.

Some of the key highlights of the study are:

- 85 percent of used vehicles are purchased through cash or informal borrowings.

- Customers have only delayed their car-buying decision. This pent-up demand will get serviced when consumer purchase cycles return in the coming months.

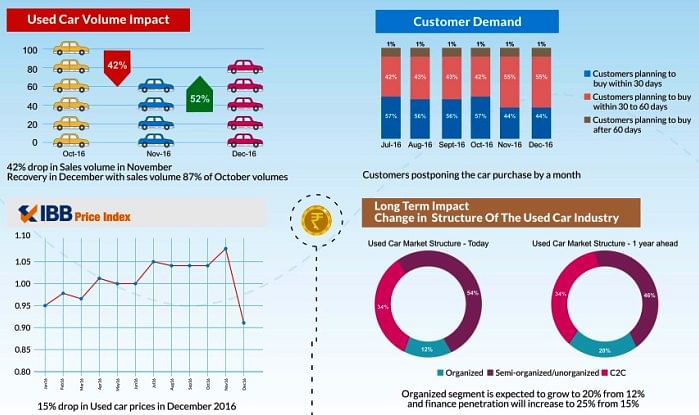

- The cash crunch has led to customers postponing their decision to buy used cars, leading to a sharp decline of almost 13 percent in customers who planned to complete the car purchase cycle within 30 days as compared to the period from April-October 2016. This has led to an over-42 percent drop in sales volumes in November 2016.

- The Northern and Eastern regions of India were more severely impacted compared to the South and West.

Impact on used car prices

The IBB index, which tracks relative pre-owned vehicle price changes on a monthly basis across India, registered a sharp spike in November 2016 before going down by 15 percent in December 2016. In December 2016, four-wheeler prices were doubly impacted by both demonetisation and the impact of new models to be released in the new year.

Economic uncertainty and a weaker new car market saw consumers tighten their belts and choose to postpone their decision to replace their current cars, leading to a decrease in supply of used cars. On the demand side, 60 percent of Indian used car customers are first-time car buyers who are extremely susceptible to any macro-economic shocks. They are the first to leave the market during a period of uncertainty, meaning that demonetisation has resulted in a decrease in demand for used cars. These movements in supply and demand have led to a new price equilibrium in the used car market.

The road to recovery has already started with December being at 87 percent of pre-demonetisation sales volumes. The volumes are expected to improve further in the coming months. In the long term, the organised segment of the used car market will grow faster at the expense of the semi-organised or unorganised market.

The used car market is expected to see a structural change In the long term – the organised used car segment will grow to 20 percent from the current 12 percent. Aided by the movement of the market towards organised players, used car finance penetration is expected to increase from 15 percent at present to 25 percent over the next 12 months.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

12 Jan 2017

12 Jan 2017

25249 Views

25249 Views