Budget 2020-21 dashes India Auto Inc's hopes for a speedy revival

India Auto Inc, which was expecting a vehicle scrappage policy immediately, reduction of GST on BS VI vehicles and components and other measures to inject growth speedily, will now have to contend with slower measures of revival.

India Auto Inc, which continues to battle a prolonged downturn which has nearly brought the industry down to its knees, was fervently expecting a dose of growth-injecting measures from the Union Budget FY2020-21 but has been left with little to smile about.

India Auto Inc, whose overall automobile sales across segments are down 15.73 percent year on year in the April-December 2019 period, and has already spent in the region of Rs 1 lakh crore on the fast-tracked technological upgrade to meet BS emission norms, was pinning its hopes on the much-awaited vehicle scrappage policy to drive new vehicle sales as also a 10 percent reduction from 28% GST to 18% for BS VI vehicle as also all types of components. But there was little forthcoming on this score from the Budget.

In fact, ACMA had reiterated the need for a uniform 18% GST rate on all auto components in its recommendations for the Union Budget 2020. Given the sector is challenged due to the prolonged slowdown, the industry association that represents over 850 companies in the auto component sector had recommended supportive measures that would enable revival of automotive growth. ACMA had also urged the setting up of a Technology Development & Acquisition Fund to support R&D and indigenous technology development especially in light of the technological disruptions the automotive industry is witnessing, along with incentivising R&D spend. But their hopes seem to have been dashed.

In fact, ACMA had reiterated the need for a uniform 18% GST rate on all auto components in its recommendations for the Union Budget 2020. Given the sector is challenged due to the prolonged slowdown, the industry association that represents over 850 companies in the auto component sector had recommended supportive measures that would enable revival of automotive growth. ACMA had also urged the setting up of a Technology Development & Acquisition Fund to support R&D and indigenous technology development especially in light of the technological disruptions the automotive industry is witnessing, along with incentivising R&D spend. But their hopes seem to have been dashed.

IT relief could translate into entry level sales of bikes and cars; infra push to drive sales of M&HCVs

Not all is doom and gloom though. The finance minister announced substantial income tax relief for tax payers for those forgoing exemption and deductions, which is expected to benefit the middle class to some extent.

As per the Budget proposals, income between Rs 250,000 to Rs 500,000 will be taxed at the same 5%; between Rs 500,000 to Rs 750,000 will be taxed at 10% (down from the existing 20%), between Rs 750,000 to Rs 10 lakh taxed at 15% (down from existing 20%) and between Rs 12.5 lakh to Rs 15 lakh to 25% (down from 30%). Income above Rs 30 lakh will continue to be taxed at 30%. In the new tax regime, tax benefit will accrue to a taxpayer depending upon exemptions and deductions claimed by him. For example, a person earning Rs 15 lakh in a year and not availing any deductions will pay Rs, 195,000 as compared to Rs 273,000 in the old regime, reducing the tax burden by 78,000 in the new regime.

This extra income in the hands of the tax payer could be expected to translate into purchase of entry level bikes and cars, albeit consumer sentiment seems to be at an all-time low.

The Budget proposals continue the government's focus on developing road infrastructure across the country. As per the plan, accelerated development of 14,500 kilometres of highways is to be undertaken, including:

- 2,500km access control highways.

- 9,000km of economic corridors.

- 2,000km of coastal and land port roads.

- 2,000km of strategic highways.

While the Delhi-Mumbai Expressway and two other packages to be completed by 2023, work on the Chennai-Bengaluru Expressway is to be started while there is a proposal to monetise at least 12 lots of highway bundles of over 6,000km before 2024. This focus on infrastructure is expected to lead to demand for medium and heavy duty commercial vehicles used for infrastructure development activity.

MSMEs get a boost

The medium and small scale enterprises (MSMEs) sector get a much-needed boost in the form of their turnover threshold for audit increasing 5 times to Rs 5 crore. Ms Sitharaman said: "Medium & Small Scale Enterprises are vital to keep the wheels of the economy moving. I propose to make amendments to enable NBFCs to extend invoice financing to MSMEs as working capital credit remains a major issue."

The Rs 1,000 crore scheme for handholding mid-sized automotive component suppliers for exports as well as measure for technological upgradation will be welcomed by the domestic component industry and it has been a longstanding recommendation by industry body ACMA.

Skill development a focus area

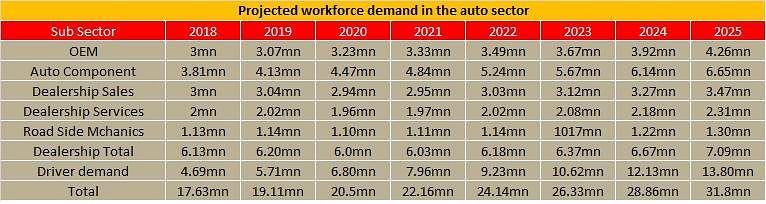

By 2030, India will have the largest working population in the world, which is why jobs and skills will continue to be focus area for industry and the government. The Budget allocates Rs 3,000 crore for skill development in FY2021. Furthermore, 150 higher educational institutions will commence integrated diploma-apprenticeship programmes by March 2021 while urban-local bodies will offer opportunities to fresh engineers for a one-year period to intern and learn.

As is known, the Indian automotive industry is grappling with a serious shortage of skilled workers and industry associations like SIAM, ACMA and ASDC are putting their shoulder to the wheel to 'grow' new generations of skilled workers, which is even more imperative in an era of technological disruptions.

Targeting clean air in 1-million-plus populated cities

The finance minister has proposed allocation of Rs 4,400 crore for clean air-improving measures in Indian cities with an above-1 million population. The specific parameters and incentives to Indian states with such cities are to be detailed later. This move will spell good news for manufacturers of electric buses and vehicles.

All in all, while there are a fair number of measures aimed at revving up the economy over the next year or so, the struggling domestic automotive industry per se could have done with some immediate growth reviving moves.

News Update: Vehicle scrappage policy coming

Meanwhile, it is understood that the much-awaited vehicle scrappage policy might finally see the light of day. As per a PTI report, in an interaction with the media after presenting the Budget, the finance minister said that such a policy for scrapping old vehicle "is in the works" and will be announced once the specific ministeries "fine-tune it".

"Scrappage policy is in the works ... I would wait for the concerned ministries also to fine tune everything and tie up the loose ends and then come to a stage where it can be announced by the ministry," said Nirmala Sitharaman.

"So many things depend on how far they are mature and right for me to use it in the budget, but that does not mean because I''ve not announced it in the budget no work is going on in that area," she added, as per the PTI report.

The proposed policy, once approved, will be applicable on all vehicles including two- and three-wheelers. Good news then on the horizon for India Auto Inc.

BUDGET-SPEAK: WHAT INDUSTRY STAKEHOLDERS SAY

Here's what leading captains of India Auto Inc have said on the Budget.

Rajan Wadhera, President, Society of Indian Automobile Manufacturers (SIAM): "The Indian Automobile industry was looking forward to some direct benefits in the budget, which could have helped in reviving demand in the context of the current slowdown and huge investments made by the Industry for transition to BS-6 and from that aspect, the Budget speech was not what we were expecting.

On behalf of the Automobile Industry, SIAM had made specific recommendations on steps that could revive demand like an incentive-based vehicle scrappage scheme; Budget allocation for diesel buses procurement by STUs and NIL customs duty for lithium-ion batteries, doesn’t seem to have been considered, although we are yet to go through all the fine print."

"The increase in customs duty for CKDs and SKDs of electric vehicles and CBUs of commercial vehicles however are positive steps for Make in India. The announcements made with respect to rural economy and infrastructural development are some positives and we are hopeful to see quick execution on ground, since it can act as an enabler for increased economic activity and hence increase in vehicle demand."

"Being significantly dominated by MSMEs, enabling measures to extend invoice financing to MSMEs and creating access to working capital through a new scheme are a welcome step. That apart, enhancing the turnover threshold for audit of MSMEs from Rs 1 crore to Rs 5 crore will facilitate ‘ease of doing business.”

Dr Pawan Goenka's Top 7 takeways from the Budget

Deepak Jain, President, Automotive Component Manufacturers Association (ACMA): “We are glad that the Government has announced a Rs 1,000 crore handholding scheme for mid-sized companies including those in the Auto Components to give a thrust to export development, R&D and technology upgradation. The scheme will help the component sector remain relevant and competitive. This has also been a longstanding request of ACMA."

"Measures adopted by the government to strengthen checks on imports due to FTA, review of Rules of Origin, enhancing safeguard duties and invoking Quality Control Order on import sensitive items will encourage ‘Make in India’. Focus on electronics manufacturing including electronic equipment and semiconductor packaging is welcome and will encourage manufacturing of auto electronics and components of electric vehicles. That apart, increase in import duty of CBUs – CVs, commercial EVs, SKD rate on electric vehicles and CKD rate of electric vehicles will encourage localisation.

“While we are happy that the process of GST continues to be streamlined and made effective, it is critical that the GST rate on all auto components be a uniform 18%. Currently 60% of auto components attract 18% while the rest are at 28%. Being an intermediary industry, reduction in rate will be revenue neutral. It will also help curb grey operations in the auto components aftermarket."

Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV): "Despite the adverse effect on the cost of the electric vehicles, the increase in import duties on the components (other than the powertrain and battery cells) is a rational step under the Make In India initiative. It will have a bit of an adverse impact on the vehicles that have high import content forcing the manufacturers to either localise or pass on the costs to the customers.

We believe that the objectives of the EV policy won’t be entirely fulfilled until we ensure the energy required to run EVs also starts becoming cleaner. The government's increased focus on renewable energy in the Budget is a positive move towards cleaner energy.

The industry needs innovative ideas and technology, and the start-ups can play important roles in shaping the EV industry. The measures announced by the government on taxation and funding support would encourage numbers of start-ups to foray into the industry with their innovative solution."

Ashish Kale, President, FADA: "The Budget is an inclusive budget but lacks immediate demand boosters. Its focus on agriculture, irrigation and rural development will have a rub-off effect on rural demand in the next 3-4 months if all the measures are actioned immediately and will give a fillip to rural auto demand, especially two-wheelers, tractors and small CV's. It was disappointing that as part of the auto ecosystem, no direct benefits for the automobile Industry were announced. A Budget allocation for an attractive incentive-based scrappage policy would have been a demand booster for CVs and also a positive for a cleaner environment and road safety. Even though GST is not a part of the Budget, an indication of rationalisation of GST rates in automobiles would have also brought much respite for the industry which is stumbling under extensive stress for more than a year now.

On the other hand, liquidity support for NBFCs will act as a confidence booster for them to lend, helping the auto Sector. The Income Tax amnesty scheme will also free up allocated resources and will thus help businesses to allocate fund for growth. The continued focus on infrastructure, especially highways, will support CV demand at current levels till high growth revival. The personal IT rates under the new regime, if they are net positive for the tax payer, will act as an immediate sentiment booster, especially for two-wheelers and entry level passenger vehicles."

Vikram Kirloskar, President, CII: "The Finance Minister has done a tight rope walk while adding pace to reforms and sending positive sentiments to industry."

Vipin Sondhi, MD & CEO, Ashok Leyland: “The Budget overall covers a wide spectrum of areas such as health, skill, infrastructure, agriculture – as a boost to the economy. The allocation of Rs 2.83 lakh crore for Agriculture, Irrigation and Rural Development will assist the rural economy and will be good for the CV industry in the long run.

Further push to infrastructure of Rs100 lakh crore over the next 5 years, including increased allocation of funds for roads and highways and the proposal to develop five new smart cities in collaboration with states in PPP mode, will bring positive sentiments for the commercial vehicle sector by increasing demand.

Overall economic activity and job creation will increase demand for goods and consumption and Increase freight movement on trucks.

The provision of invoice financing by NBFCs will improve working capital financing for MSMEs and revive the current business cycle.”

Rajeev Chaba, President & Managing Director, MG Motor India: "We welcome the Budget announcements to lift the overall consumer sentiment and bring the economy back into the growth trajectory. The tax reforms being undertaken to boost income levels and the steps taken towards Make in India are also encouraging. Furthermore, we also applaud the proposal to encourage and incentivise states that are formulating plans for ensuring cleaner air. However, we feel that the customs duty hike on EVs assembled in India from 10% to 15% is a bit harsh, as this may impact the nascent category which was beginning to expand off late."

Nishant Arya, Executive Director, JBM Group: "The Government's attempt to boost consumption by cutting the income tax rates could have a knock-on effect on the automotive sector. The cut could leave more money in the hands of people, encouraging them to spend. Also, the finance minister's attempt at offering some support to the auto component manufacturers could give an impetus to the indigenous manufacture of auto components, but that would take a while.

We had expected this year’s Budget to propel the auto industry to a higher orbit and help it recover from the lows it has touched last year. We were also hoping for a much-required push to EVs and greater clarity on the EV plans with a longer-term perspective as an industry."

Diego Graffi, CEO & MD, Piaggio Vehicles: "The incentives that have been introduced for the manufacturing sector will give automotive a boost and help promote new technologies such as connected platforms to help in the Indian automotive industry besides attracting investment from FDI in the market. Over the last few years the government has been looking to make India a hub for manufacturing industry and with the abolition of Dividend Distribution Tax (DDT), we will further see an increase in investments from foreign players. It will also help in covering the revenue losses partially for corporates. The new scheme would encourage the manufacture and assemble of automotive electronics and semi-conductors to attract foreign investment. It will also boost the development of EVs in the country.

The 'handholding support' that the government has announced for the Indian automotive component industry for product improvements, research and development, and business strategy will help the industry to improve manifold. The scheme is launched at a time when the Indian automobile industry is undergoing a major transformation. Linking of technology in vehicles is going to significantly assist the automotive sector in the coming years. I am confident that the government will continue to help the automotive sector and give it a push in 2020.”

Naveen Soni, Senior VP, Sales & Services, Toyota Kirloskar Motor: “The Budget exhibits a fine balance between spending to drive growth and maintain fiscal prudence. Directionally, continued thrust towards world class infrastructure will drive growth and create employment besides improving the ease of living. Especially noteworthy is the attempt to enhance infrastructure funding by encouraging the use of equity and not to rely too much on debt. The attempt to address the trust deficit by institutionalisation of taxpayers’ charter’ would exude more business confidence and trust amongst tax payers and is a welcome step. Attempt towards simplification of individual taxation will drive better compliance, increase disposable income for consumption and generally augur well stimulating growth."

Suresh KV, President, ZF India: "The Union Budget shows a positive path for our country’s economy. In order to augment India’s infrastructure and create jobs, the announcement of the launch of Rs 103 lakh crore infrastructure projects is a good move. The government’s aim to accelerate the development of highways along with 2,500km access controlled highways and 9,000 km of economic corridor and in addition to create 2,000 km each of strategic highway and port connectivity projects are great policy initiatives, thus creating a big boost for the infrastructure segment. Policy initiatives like these would eventually result in employment generation followed by an increased demand for commercial vehicles and the construction equipment industry. In addition, the announcement of highway projects worth 6,000km being monetised before 2021 is a welcome move."

"The abolishment of the Dividend Distribution Tax (DDT) is a positive step towards helping India become a more attractive investment destination. The announcement of the scheme to boost mobile, electronic manufacturing and semi-conductors packaging will further support the manufacturing of electric vehicles in the country. This would indirectly propel the growth of the Indian automotive industry. Also, boost to rural infrastructure and agriculture (PPP in agriculture and transportation) will increase the demand for cars, tractors and utility vehicles in the coming days."

Udit Sheth, Vice-Chairman, Setco Automotive: "The Budget is a very progressive one - the focus on infrastructure and spending will boost the job market and build confidence of the industry hand in hand. It’s a step towards a robust economic reform agenda.”

Sulajja Firodia Motwani, Founder and CEO of Kinetic Green and VP, Kinetic Group: "The Budget 2020 is a practical budget, with directional announcements towards improved ease of business, with ideas such as amendments to Companies Act, simplified GST returns, reduced tax harassments and also various developmental schemes. However, we look forward to speedy and efficient implementation. There are some measures to attract foreign investments as well and a new optional income tax regime, for a feel good factor. DDT has been abolished but dividend taxed at the hands of the investor will pinch her or him.

From an EV industry point of view, the Budget is quite neutral. FM has announced new scheme to promote automotive electronics and semi-conductors manufacturing which in the long run, can aid EV component manufacturing in the country. The

Budget also contains notifications on increased customs duty on EV imported in form of CBU/SKD/CKD, to encourage 'Make in India'. In coming years, we feel that duty on EV component import should also be increased to promote local component manufacturing.

Overall, while the Budget lacks big impact announcements, we welcome this budget and appreciate Government’s steps towards development, ease of doing business and steps to increase EV manufacturing by the industry."

Nagesh Basavanhalli, MD & CEO, Greaves Cotton:"The Budget has looked to boost the sentiment of the common Indian with emphasis on agri improvement, thrust on job creation through public infrastructure spending, skilling initiative and revision of direct tax optional provisions to lower the personal income tax slabs. It is hoped that efforts to increase liquidity in the financial sector, putting more money in the hands of the taxpayer and promoting start-up ecosystem should indirectly revive the manufacturing and engineering industry. For the corporate sector, revision in direct taxation and amendment in Companies Act to decriminalise civil offenses can lower litigation risks and costs. The overall orientation of the Budget seems to be to energise rural economy, revive consumption, build taxpayer trust in banking system and support entrepreneurs with progressive measures."

Ayush Lohia, CEO, Lohia Auto Industries: "Budget 2020 contains no major reforms for the EV sector specifically, while the sector was hopeful that the government would take steps to spur demand. However, it has some positives as there is massive state funding to help India’s farm sector, aiming to get broader economic growth back up from its lowest in a decade.

Furthermore, there is some support for MSMEs as the government will now allow NBFCs to extend invoice financing to MSMEs. The MSME Ministry's allocation stood at Rs 7,011 crore which is a 71 percent rise over and above the budgetary allocation made last year."

N Nagasatyam, Executive Director, Olectra Greentech: "The financial support for the EV sector was already earlier addressed in the FAME – 2 scheme, but allocation of Rs 4,400 crores towards promoting clean air in cities with more than 1 million population and steps to close the thermal power stations surpassing the permissible emission limits, reaffirms the government's commitment towards curbing the pollution.

"The allocation of Rs 1.7 lakh crore will help in better transport infrastructure offering a comfortable travel to the commuters across the country.The reduction in the corporate tax rate is also going to benefit the companies with an additional availability of funds for more R&D including EV companies."

Shamsher Dewan, VP and Sector Head, Corporate Ratings, ICRA: "The automobile sector, especially CVs, would continue to reap the benefits of the government’s continued thrust on infrastructure development. The effort to mobilise funds through multiple avenues besides addressing inherent bottlenecks to ensure faster execution of infrastructure projects will be critical for uplifting the sentiments of construction equipment segment including tipper trucks.

The M&HCV truck segment which has witnessed sharp demand contraction (down 41% in 9 months of FY2020) may see some support from the increased allocation towards the infrastructure sector. In addition, further liquidity support to the NBFC sector through extension of partial guarantee scheme will also be supportive in improving finance availability for smaller fleet operators with weaker credit profile.

The focus on improving quality of clean air in cities with 1mn+ population will also augur well towards enhancing penetration of Electric Buses in key cities.

Further, the changes in the Income Tax slabs will result in higher disposable income for middle class households and will therefore be favourable to revive demand for two-wheeler sector, especially during a period when vehicle prices have been on an upward trend."

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Feb 2020

01 Feb 2020

15321 Views

15321 Views

Autocar Professional Bureau

Autocar Professional Bureau