With all vehicle segments, barring mopeds and M&HCV and LCV (passenger carriers), registering strong growth in the first 11 months of the ongoing fiscal, FY2018 looks set to be a news-making year for the Indian automobile industry. The three-wheeler segment too is firing on all cylinders, having recorded total sales of 563,233 units (+19.11%).

These numbers indicate that demand in the three-wheeler market, which in FY2016-17 fell 4.93 percent to 511,658 units, has returned. Industry experts had said that the decline was due to three-wheelers being replaced by aggressively priced, small four-wheeled mini-trucks. But current industry numbers belie that. Within the three-wheeler segment, both passenger carriers (457,719 / +22.36%) and goods carriers (105,514 / +6.80%) have seen demand come their way this fiscal.

How the OEMs fared

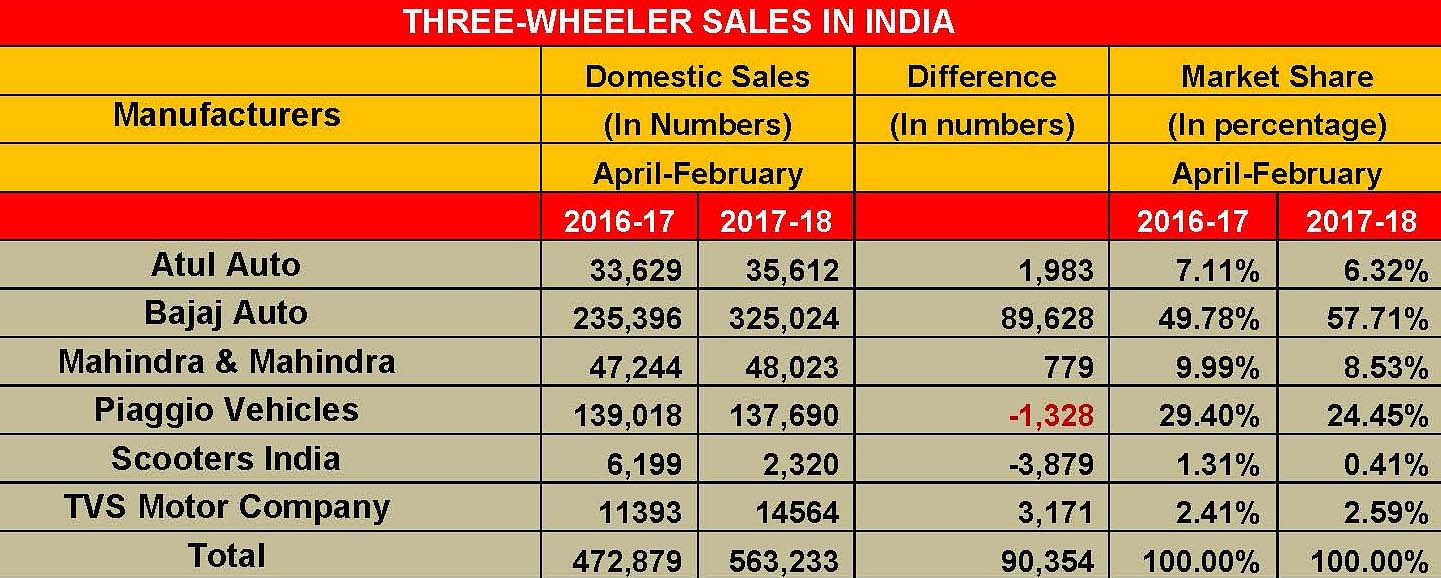

Making the most of the resurgent demand for three-wheelers is market leader Bajaj Auto, which has sold a total of 325,024 units in the first 11 months of FY2018, notching year-on-year growth of 38.07 percent. This comprises 305,053 passenger carriers (+36.23%) and 19,971 goods carriers (73.87%). This handsome uptick in its sales has seen Bajaj Auto record a remarkable increase in market share – from 49.78 percent in April-February 2017 to 57.71 percent in April-February 2018.

TVS Motor Co has also made gains, albeit smaller. The Chennai-based manufacturer sold 14,564 units in the fiscal year till now, which marks a YoY growth of 27.83 percent. This performance has helped the company increase its market share to 2.59 percent from 2.41 percent a year ago.

All the other players in this segment have seen market share declines, which could be a result of Bajaj Auto and TVS eating into their share despite the overall market growing by 19.10 percent to 563,233 units from 472,879 units a year ago.

While Piaggio Vehicles, the No. 2 player, has sold 137,690 units, which marks flat growth of 0.95 percent, Mahindra & Mahindra sold 48,023 units (+1.64%). Meanwhile, the Rajkot-based Atul Auto sold a total of 35,612 units, a 5.89 YoY increase.The final OEM in the segment is Scooters India which, with sales of 2,320 units, is down 62.57 percent.

Also Read:

Exclusive: TVS Motor sells a million scooters in India for first time ever in a fiscal

Winners and losers in the SUV market share game

Two-wheeler sales grow by 26.33% YoY in February 2018

Boom time for midsize motorcycles in India

Movers and shakers in the Indian two-wheeler industry

Scooters power two-wheeler industry growth in Q1 FY2018

Top 10 Scooters – January 2018 | Honda Activa and TVS Jupiter firing on all cylinders