Bajaj Auto stock gains on record Q3 profit

On a one-year basis too, the gains on Bajaj Auto are striking. The stock has gained more than 20 percent over the past year and is just 2.72 percent away from its 52-week high.

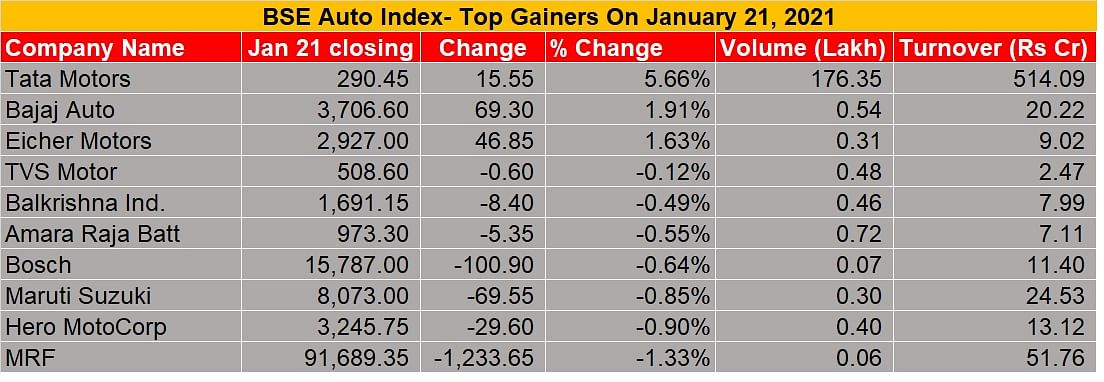

January 21, 2021 will go down the pages of history for many reasons. The Sensex hit 50,000 and the Nifty scaled fresh peaks in early trade, above the 14,000 mark and Bajaj Auto stood out as a star performer. By the end of trade, while most of the market succumbed to profit booking, it was among the handful of stocks that ensured the benchmark index closed the day in green zone.

The Bajaj Auto stock closed the day with close to two percent gains and a market capitalisation of Rs 107,106 crore. If you observe the stock’s performance over the past one month, it is up more than 14 percent compared to 9 percent-plus gains in the Nifty-50 Index in the same period. The Sensex in the past one month has also garnered about similar 9 percent gains. A clear outperformer compared to the key indices, it is one of the top performers in the BSE Auto Index.

On a one-year basis too, the gains in the stock are striking. It has gained more than 20 percent over the past one year and is just 2.72 percent away from its 52-week high. Its strong financial performance and record profit, no doubt helped the northward journey of the stock. Despite the lockdown and the washout April, the two-wheeler major has increased market share to close to 19 percent in the third quarter of FY2021. A zero debt-to-equity ratio, 1.2 million bike exports in the first three quarters of FY2021 and the recent MoU with Maharashtra government to set up a new Rs 650 crore plant to manufacture high-end motorcycles and electric vehicles is also adding impetus to the stock’s gains in the market.

Headwinds with respect to the impact of higher input costs are, however, a key factor to watch out for the stock’s performance. The comparatively higher commodity prices may also impact Bajaj Auto’s margin expansion in Q4 FY2021.

ALSO READ

Bajaj Auto becomes world’s most valuable two-wheeler company

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

22 Jan 2021

22 Jan 2021

4801 Views

4801 Views

Autocar Professional Bureau

Autocar Professional Bureau