By 2020, 15% of new cars sold in India will be automatics

Growing demand for automatic transmission-equipped cars in India as a result of worsening traffic conditions will have a sizeable impact on new car sales in the coming years, says a report from ICRA.

Growing demand for automatic transmission-equipped cars in India will have a sizeable impact on new car sales in the coming years.

The worsening traffic situation in most Indian cities is one of the major motivating factors for acceptance of the AT-equipped vehicles, as it considerably reduces the fatigue level of the driver during bumper-to-bumper traffic movement. Also, the declining cost differential between manual and automatic gearboxes, due to maturity in technology, has resulted in the rising trend of AT in models offered by OEMs.

The introduction of automatic manual transmission (AMT) variants has been a key growth driver for improving penetration of AT in overall PV sales.

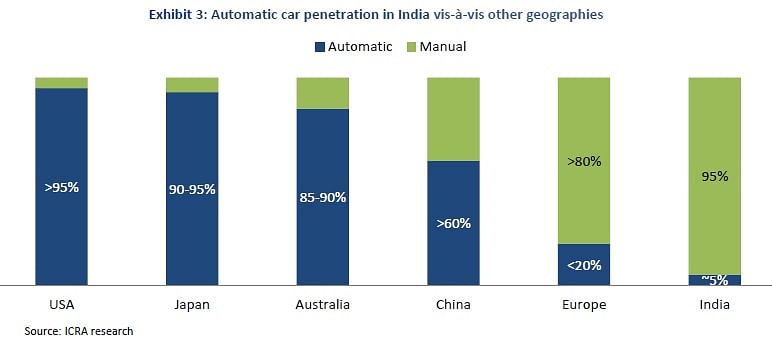

AT has significantly high penetration in the luxury segment (>Rs 30 lakh) but their penetration in the mass segment is quite low. In FY2016, AT vehicles constituted less than 5% in domestic new vehicle sales (excluding luxury cars) but their share is likely to cross 15% level in the medium term, says ratings agency ICRA.

“The utility vehicle segment, which currently has relatively lower AT penetration, will also witness an upshift with some of the recent launches in the compact UV segment like the Creta, BR-V, TUV 3OO as well as large UVs like the Innova Crysta and Ford Endeavour are already available with an AT variant and the acceptance level is also encouraging,” says Subrata Ray, senior VP, Co-head, Corporate Sector Ratings, ICRA.

AT is still considered a luxury feature amongst Indian car buyers, though rising awareness and usage of AT in entry level cars is slowly resulting in improving acceptance/penetration of AT in the domestic PV market. At present, the automatic transmission option is available in entry-level cars like the Tata Nano and Maruti Alto K10, catering to a much wider car audience as compared to the AT option available few years ago in the Rs 700,000-plus price bracket.

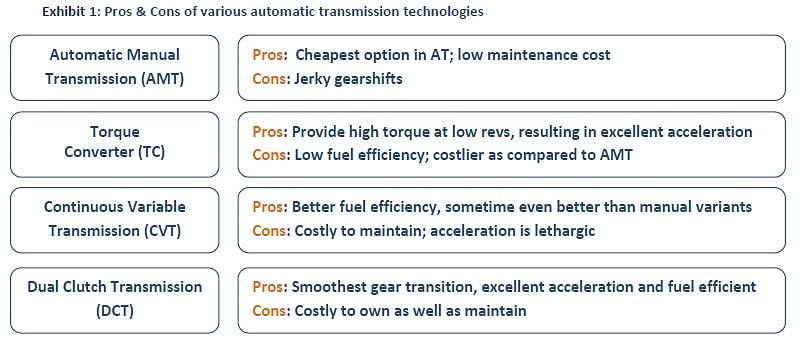

Concerns related to low fuel efficiency in AT have been addressed by the present technology in AT, with some models with continuous variable transmission (CVT), dual clutch transmission (DCT) or even AMT reporting relatively better fuel efficiency than manual transmission variants. However, OEMs have to invest towards consumer awareness to allay these concerns. AMT penetration is likely to increase further as it addresses both concerns of fuel efficiency as well as ownership cost.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

12 Aug 2016

12 Aug 2016

9985 Views

9985 Views