In a rapidly changing world, more so in the automotive space, homegrown OEM Mahindra & Mahindra (M&M) is drawing new strategies to sustain, and grow, its businesses. And to do so well in the backdrop of globalisation, it is working on setting up another home overseas.

While the company, which is yet to set up a manufacturing plant abroad, did not officially comment on the ‘second home’, it is likely the choice of country could be the USA. M&M cherishes a vision to enter the North American passenger vehicle market; some earlier attempts didn’t fructify.

It is to be noted that M&M already has a good presence and brand equity in the small tractor market in the USA and it would be looking to build on that.

There are a "variety of reasons" behind this move. Pravin Shah, president of M&M's automotive sector, without sharing any further details, says: "Currently my team and I are working to figure out which is that destination where we should be going, and soon we will take that call."

Hedging against global risks

One of the reasons for the new approach could be hedge against risks as the global geo-political scenario sees significant changes. M&M's automotive and farm equipment sectors earn 40 percent of their total revenue from overseas. Thirty percent of the automotive sector's volume is sold overseas while 20 percent of its tractors outside India.

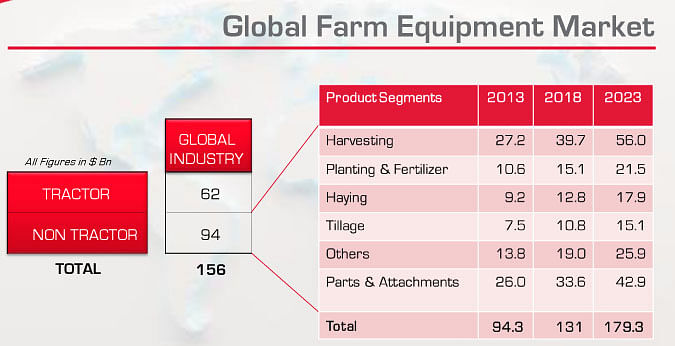

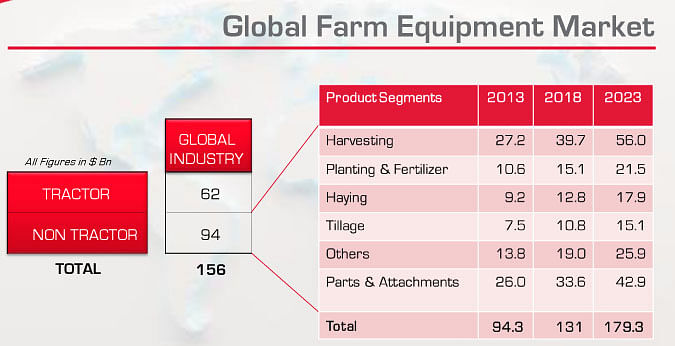

Dr Pawan Goenka, managing director, M&M, says globalisation is one of the three "planks" for the company's growth strategy in a fast-changing world. The other two are technology and customer intimacy. The company's betting on the farm equipment business to drive the globalisation strategy at a rapid pace. Over the past nine years, this sector has made four key inorganic moves to strengthen its business and also expand overseas. The global farm equipment market is pegged at a humongous $156 billion (Rs 985,452 crore), to which tractors contribute $62 billion (Rs 391,654 crore). The rest comes from multiple farm equipment segments.

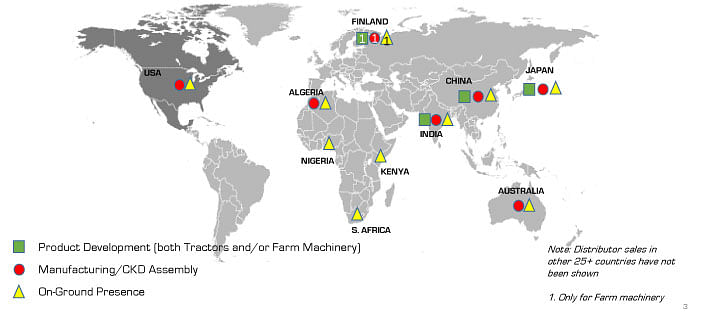

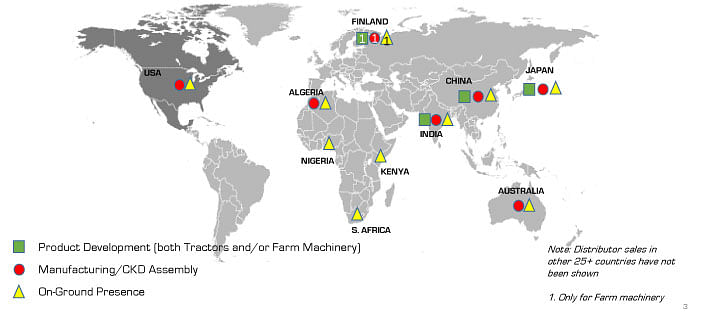

The strong global prospects have led M&M to draw a strategy to build a 'truly global tractor and full line farm machinery business'. Currently, 85 percent of M&M's Farm Equipment Sector product mix is tractors, which is expected to go down to 79 percent in the next two years as its farm machinery and new business models expand their presence. In terms of global reach, M&M plans to tap 50 percent of the global markets by March 2019, says Rajesh Jejurikar, President -- Farm Equipment and Two-Wheeler Sectors, M&M.

M&M's automotive and farm equipment sectors have been clocking a good growth rate over the years. Combined global sales volume of the sectors have grown from 129,000 units in 2003 to 889,000 units in 2016. The combined revenue for the same period rose from Rs 3,900 crore to Rs 63,300 crore during the same period. The automotive sector, however, has been facing some challenges from new competitors.

M&M says it is investing on R&D, new technologies and working together with SsangYong to race successfully in the core automotive business. Dr Goenka points out that from Rs 74 crore in 2003, the investment figure on R&D and product development has grown to Rs 1,938 crore in 2016.

Recent acquisitions to help drive growth

In line with its strategy to become a global tractor and full line farm machinery business, M&M has in the recent past made three key acquisitions. These comprise Mitsubishi Mahindra Agricultural Machinery, Japan, which addresses the global rice value chain, Sampo Rosenlew of Finland which addresses the global combine harvester market, and Hisarlar of Turkey, which addresses the global farm machinery range.

Also read: M&M to electrify Peugeot two-wheelers, Indian electric 2W market not priority yet