Strong demand in EU ‘Big 5’ markets drives September growth in European new car sales

Spain led the way as Europe’s new car sales increased by 6.0 percent compared to September last year, according to the latest analysis from JATO Dynamics, the leading global provider of automotive intelligence.

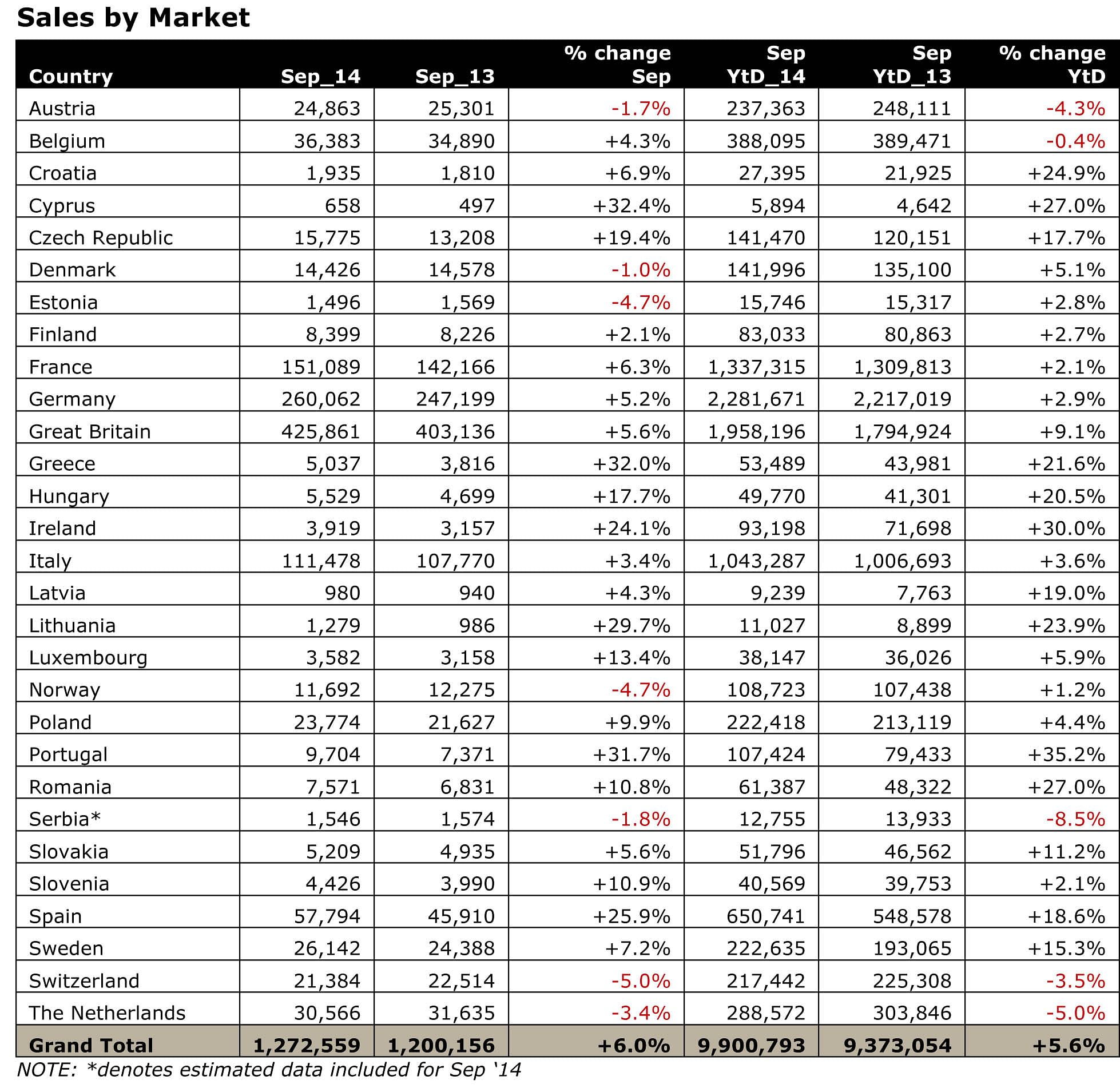

SPAIN LED THE way as Europe’s new car sales increased by 6.0 percent compared to September last year, according to the latest analysis from JATO Dynamics, the leading global provider of automotive intelligence. Sales in Spain were up 25.9 percent year-on-year, while Germany and Great Britain both increased sales by 5.2 percent and 5.6 percent respectively in September.

The key highlights of this report are:

- 22 of the 29 countries studied grew sales year-on-year in September

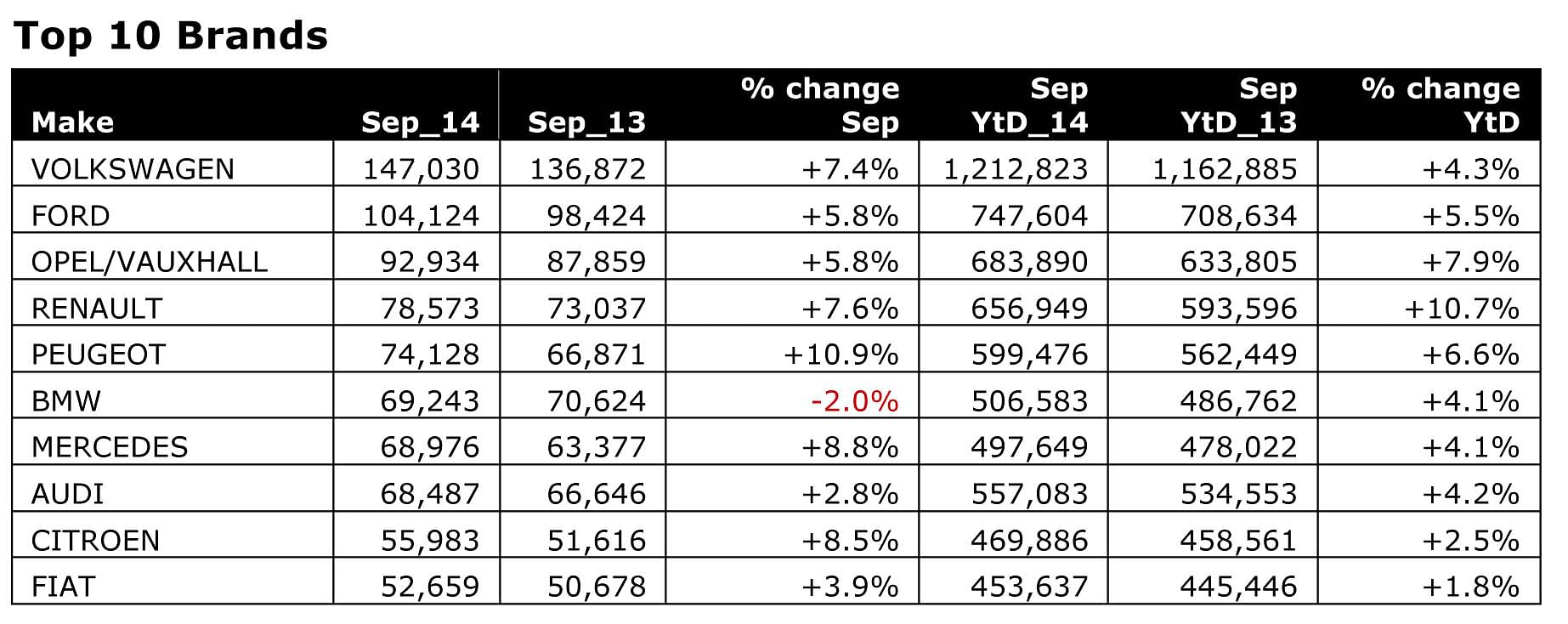

- Nine of the top 10 brands recorded sales growth for the month

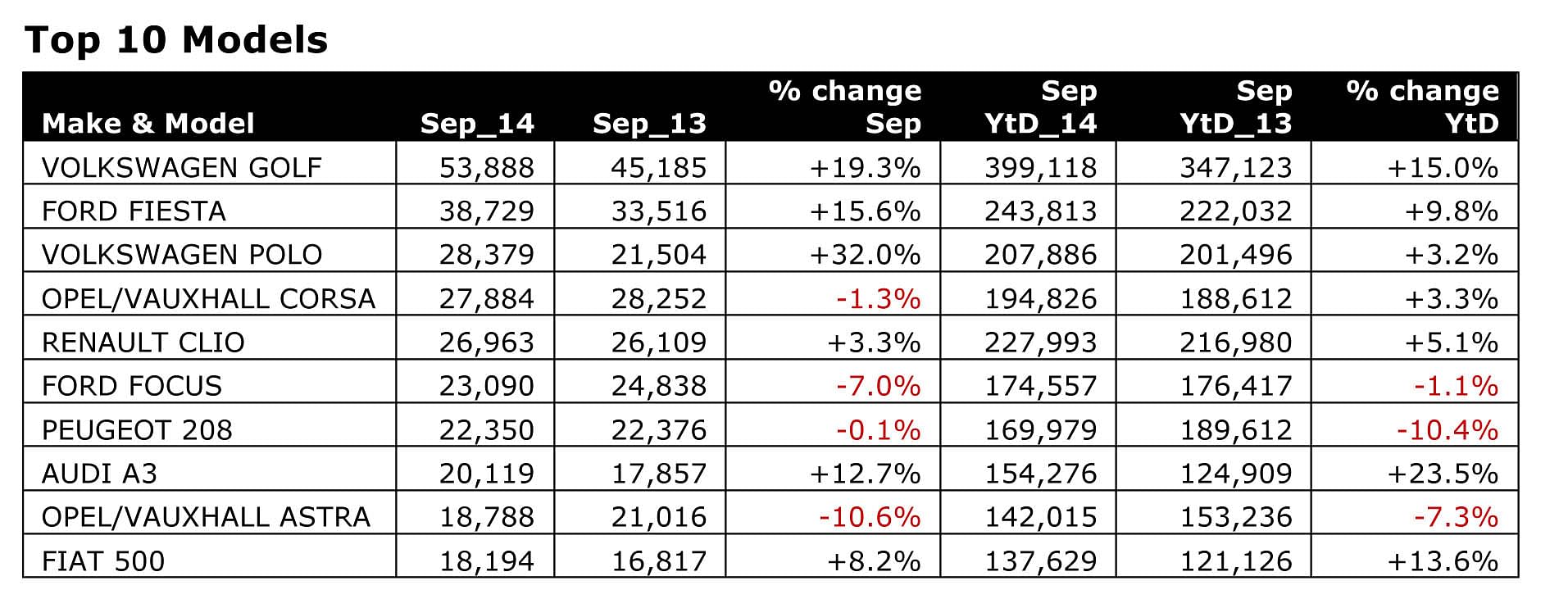

- Volkswagen increased its market share, boosted by year-on-year sales of its Golf (+19.3%) and Polo (+32.0%) models

The ‘Big 5’ European car markets all registered growth in September, rebounding from the traditional summer dip in sales. The Spanish new car market saw impressive growth (+25.9%) compared to the same month last year; a result of the continued impact of government incentives. Europe’s two biggest markets – Germany (+5.2%) and Great Britain (+5.6%) – also performed well.

Growth, however, was not restricted to Europe’s biggest markets. Eight smaller markets have grown their sales by over 20% for the year-to-date period, notably Greece (+21.6%), Portugal (+31.7%) and Ireland (+30.0%), where the global recession had its greatest European impact.

Overall, 24 of the 29 countries studied increased their year-to-date sales compared to the same period last year.

Performance was mixed among the medium-sized markets. Romania increased its sales by 10.8 percent for the month, contributing to a year-to-date increase of 27.0 percent. The Czech Republic also performed well in September with a sales gain of 19.4 percent compared to the same month last year. On the other hand, the downturn in The Netherlands continued with year-to-date sales falling 5.0 percent. Austria’s 1.7 percent dip in September also means that new car sales have decreased 4.3 percent for the year-to-date.

European Monthly Sales Volumes Year-on-Year Comparison

Volkswagen remained the top-selling brand in Europe and continued to increase its market share. Skoda’s growth, led by new models, kept it in the top 10 even though its best-selling Octavia slipped outside the top 10 models.

Ford retained second place in the top 10 brands as its Fiesta model reclaimed second spot from Volkswagen’s Polo in the top 10 models table. Peugeot registered double-digit growth year-on-year as its newly introduced 308, 2008, and 108 models all performed strongly. This helped the French carmaker jump one place to fifth in the European top 10.

Outside of the top 10 Dacia continued to capitalise on the appetite for budget models as it grew its year-to-date sales by 29.0 percent. Mazda’s new Mazda3 model helped the brand increase sales by 21.8 percent in September, while its crossover CX-5 also performed well. Strong sales of the Outlander, particularly the low-emission plug-in-hybrid version, helped Mitsubishi increase sales by 65.4 percent in September.

Six of the top 10 models registered sales growth both for September and for the year-to-date. The VW Golf further strengthened its lead at the top of the market, growing sales by 19.3 percent. Higher demand for the Volkswagen Polo, especially in Great Britain and Germany, also saw its sales climb 32.0 percent in September. As a result, Volkswagen had the fastest growing models in September’s top 10. Sales of Audi’s A3 also continued to grow, resulting in a year-to-date increase of 23.5 percent, the highest among the top 10 models.

Outside of the top 10, year-to-date sales of the new Seat Leon grew by 60.8%, while the new Peugeot 308 also increased sales by 60.2 percent over the same period. Small crossover models continued to take market share in Europe, with the Renault Captur (+4.5%), Opel/Vauxhall Mokka (+117.3%) and Peugeot 2008 (+83.8%) having all increased sales in September.

Interestingly, Tesla’s Model S electric luxury car is shaking up the market, outselling well-established competitors such as the Audi A8, BMW 7-series and Jaguar XJ. In this segment only the Mercedes-Benz S-Class (+151.2%) has sold more year-to-date.

Brian Walters, vice-president of data at JATO Dynamics, commented: “It is reassuring to see Europe’s recovery continue to strengthen for another month, particularly with the five largest markets all returning to growth in September. Not only are many established brands improving sales, but we are also seeing challengers like the Tesla Model S shaking up the market.”

Data source: JATO DYNAMICS

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

17 Oct 2014

17 Oct 2014

3219 Views

3219 Views

Ajit Dalvi

Ajit Dalvi