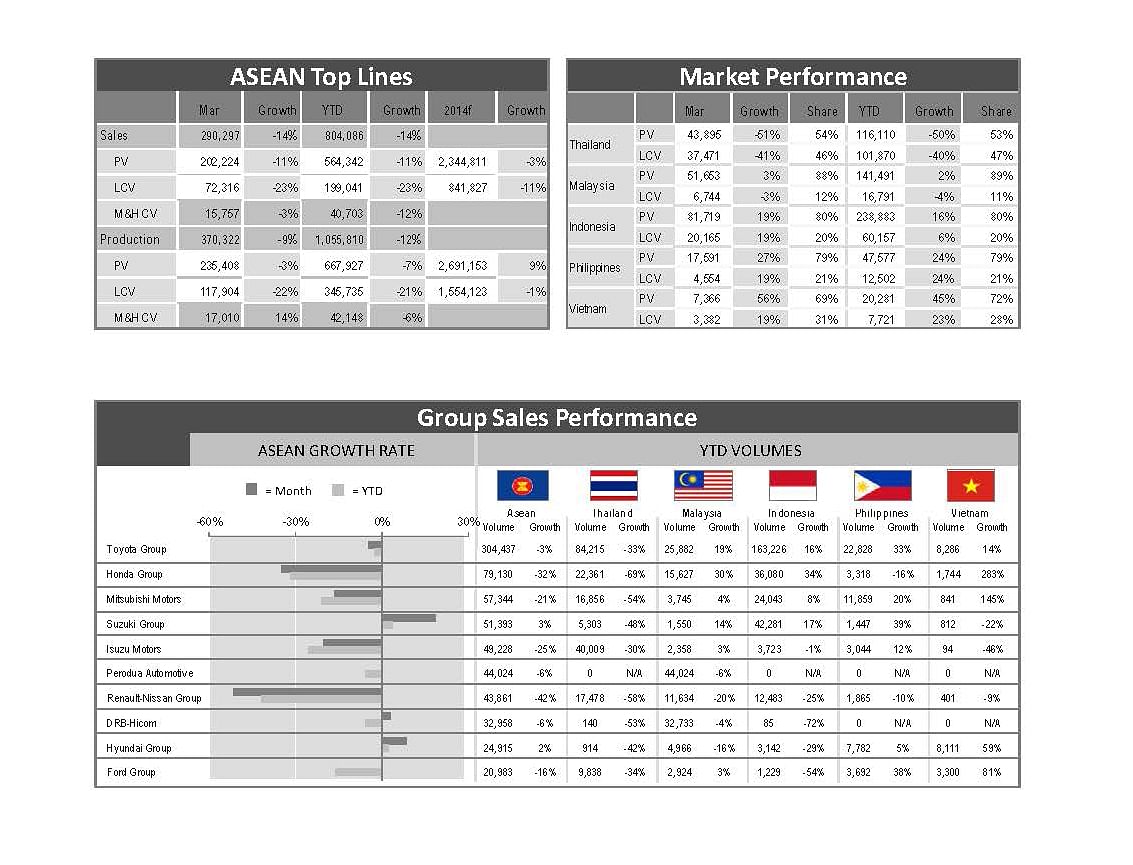

Light Vehicle sales in the top five ASEAN markets (Thailand, Malaysia, Indonesia, Philippines, Vietnam) continued to decline in March 2014. Total sales were around 275,000 units, a 15 percent fall compared to March 2013 sales. The declining trend has continued throughout the first quarter at 14 percent, according to the latest industry update from LMC Automotive, a global market intelligence provider.

This, says LMC Automotive, was mainly due to continually declining sales in Thailand, down by 47 percent in March or 46 percent for the quarter. Significant and considerable growth in the other four markets could not offset the much bigger reduction by volume in Thailand. The 2014 sales outlook has been kept unchanged at around 3.2 million units.

Market normalisation from Thailand’s First Car Buyer scheme continued its mechanism behind the contraction in Thailand. March sales at just above 81,000 were significantly lower than the 91,000 of March 2011 but exceptionally high compared to average monthly sales in 2011 of 64,000. LMC had earlier said that Thai sales would shrink back to the trendline prior to the First Car Buyer scheme in 2012, plus some addition on an expansion of the newly created Eco‐Car sub‐segment.

In contrast to the significant contraction of the Thai market, sales continue to grow considerably in the other four markets. The most significant growth by volume could be observed in Indonesia, followed by the Philippines, Vietnam and Malaysia. The growth, however, accounted for only 35 percent of the declined volume in Thailand.

Indonesia recorded another set of monthly sales at more than the 100,000 level, the sixth time since July 2013. March sales grew 19 percent to just below 102,000. Sales expanded most in the mini car segment, boosted by the introduction of new models under the government’s Low Cost Green Car (LCGC) project since September 2013. Mini car sales have expanded from a few hundreds units previously to a monthly average of 13,000 units since the introduction of the project.

Expansion of the MPV/Minivan segments is also equally behind the March expansion in Indonesia. This was purely driven by the newly launched Honda Mobilio MPV as sales of the model alone were comparable to the increased volume of the whole MPV/Minivan segment. As a result, quarterly sales increased by 13 percent. With these positive drives, LMC has slightly adjusted the yearly outlook upwards to around 1.2 million units.

March 2014 sales in the Philippines and Vietnam increased significantly with 26 percent and 42 percent growth, and sales registered at 22,000 and 11,000 units respectively. Quarterly sales also grew in line by 24 percent and 38 percent. Annual sales are expected at 224,000 and 120,000 units respectively.

Malaysian sales grew limitedly at 2 percent and 1 percent by month and quarter, mainly as a result of a combination of an expansion in the sub‐compact car segment and a contraction in the compact car segment. While the Toyota Vios and the Honda Jazz drove growth in sub‐compact cars, slowing demand for the Proton Preve and the Nissan Almera was the reason for the reduction in the compact car segment. Annual sales are expected to grow, also limitedly, by 4 percent at 674,000.

Photograph: The Mobilio manufacturing line at Honda’s plant in Indonesia.

Data source: LMC Automotive