Europe records best October sales since 2009, SUVs account for 40% share

Total sales grow by 8% to 1.21 million units riding on surging demand for SUVs which see 22% YoY growth; consumer shift away from diesel towards petrol and electric vehicles continies

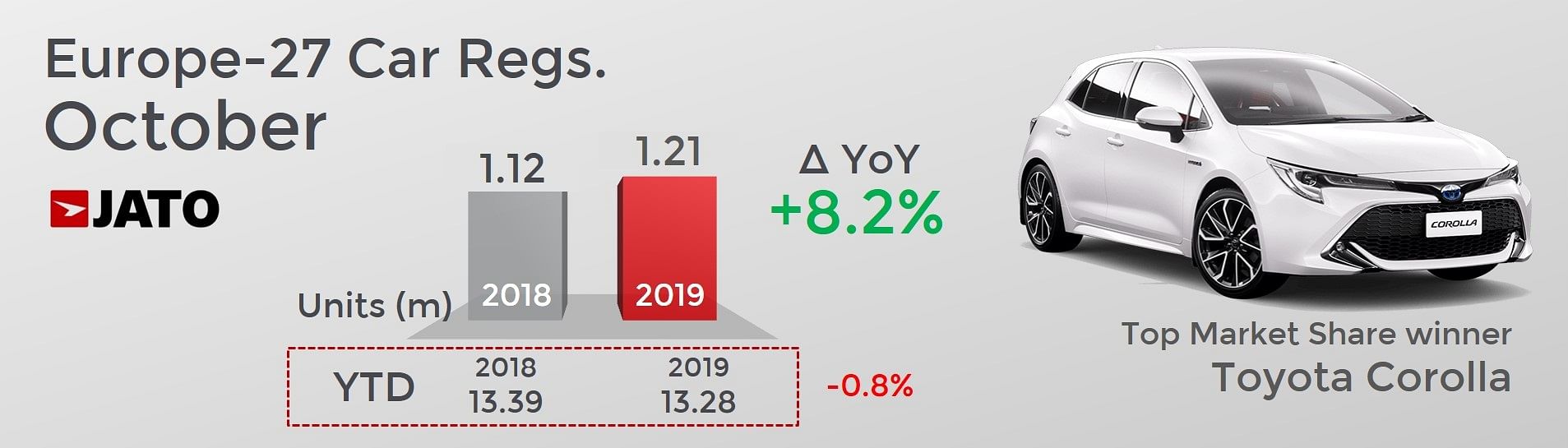

The European car market continued to grow in October 2019 as 1,208,700 vehicles were registered – the highest October volume of the last 10 years.

The strong growth, which can partly be explained by the market dropping in October 2018 following the introduction of WLTP, has improved the year-to-date figures overall. However, the market is still down 0.8% on the same period last year, with 13,284,600 vehicles registered so far in 2019.

“The European market is facing a myriad of challenges at the moment, but the biggest threats to growth are not having a significant impact on sales – at least for the time being,” said Felipe Munoz, JATO’s global analyst.

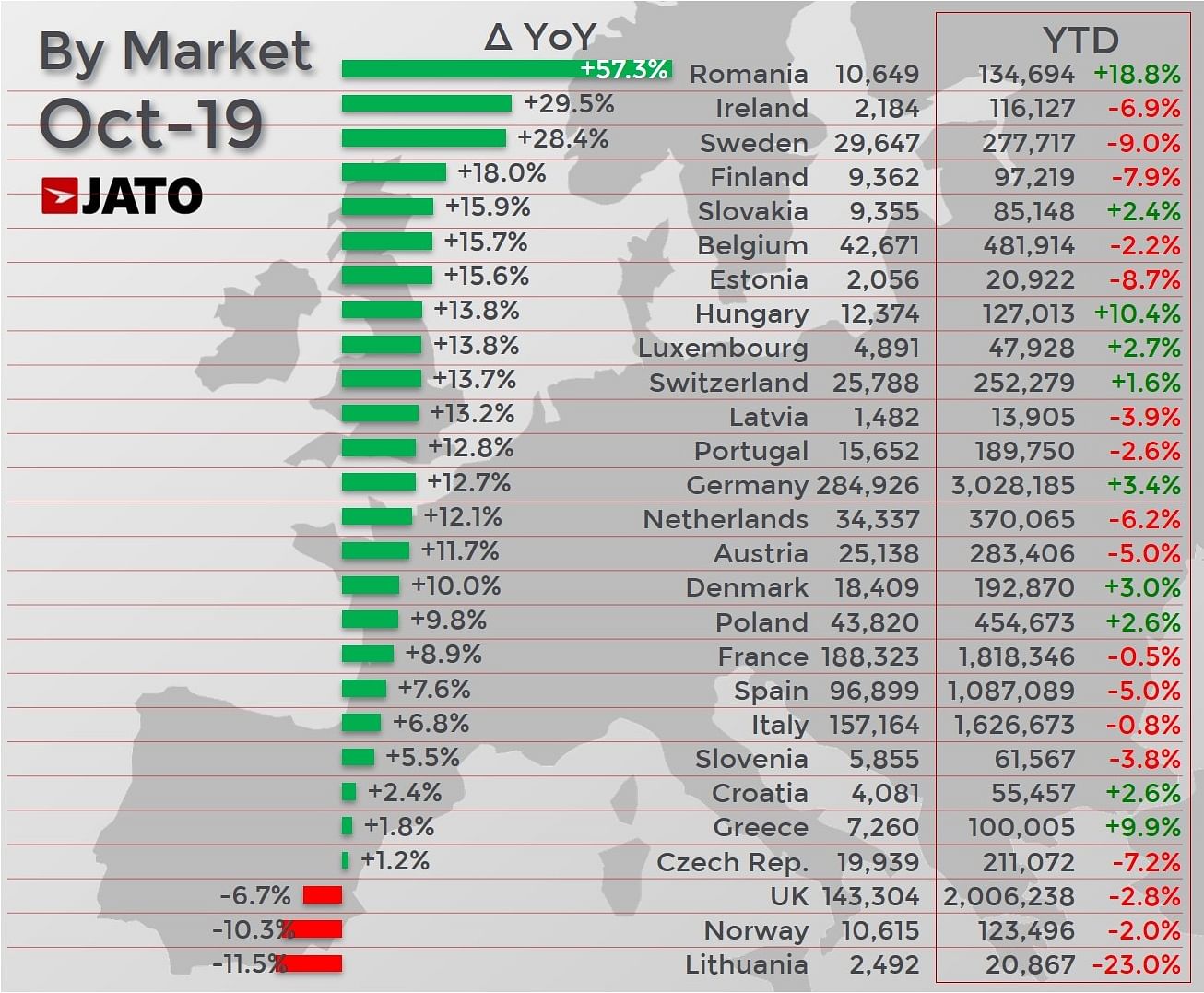

Seventeen of the 27 markets included in JATO’s analysis posted double-digit growth in October 2019. It was a particularly good month for Germany, where demand increased by 13%. “If the German market can continue to avoid a recession, then the state of the global industry might not be as bad as first expected,” continued Munoz.

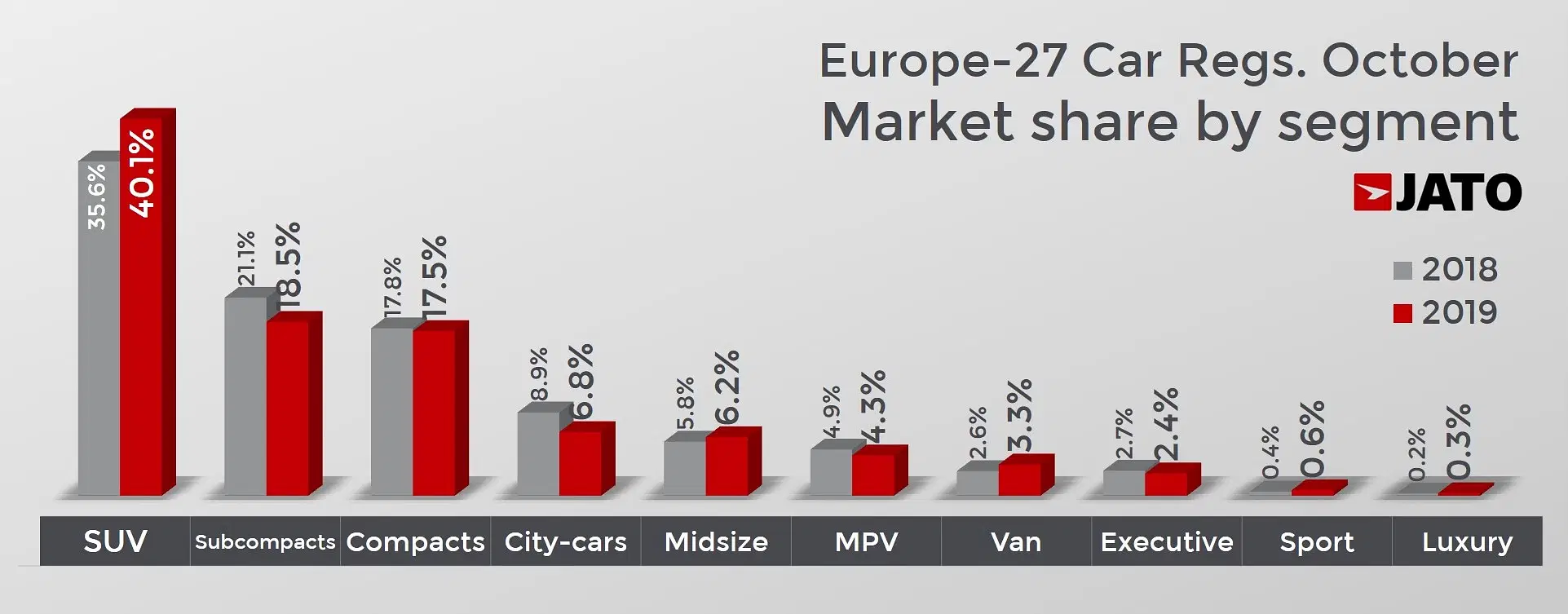

October’s results can also be explained by increased consumer demand for SUVs and electrified vehicles. SUVs, in particular, were an important source of growth during the month. In October, 484,400 SUVs were registered in Europe, as demand increased by 22% on the same period last year and the segment posted a record market share of 40%. “Europe is slowly equalling the USA and China in terms of SUV penetration. This is mostly because of small and compact SUVs, which are hugely popular across the continent and make up 79% of all SUV registrations,” explained Munoz.

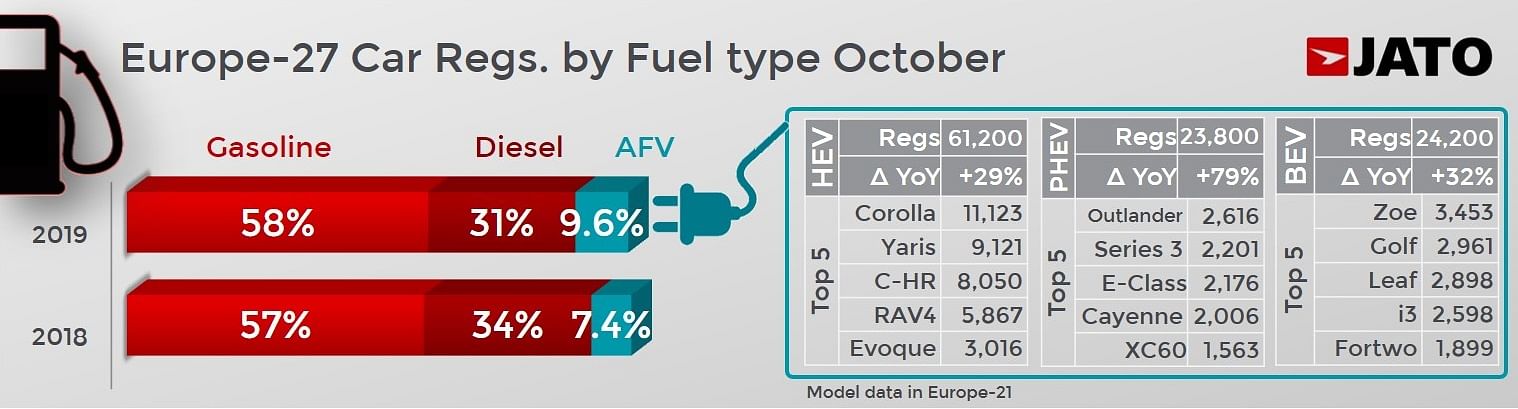

Electrified vehicles also boosted the overall market as they continued to gain traction in October. Demand increased by 79% for plug-in hybrid cars, 32% for pure electric cars and 29% for hybrid cars. European consumers bought 115,700 electrified vehicles during the month – which is 41% more than in October 2018 – as the fuel type counted for almost 10% of all passenger car registrations. “The results show that despite the high price of electrified vehicles, consumer interest is definitely there, and the latest market launches are being well-received,” commented Munoz.

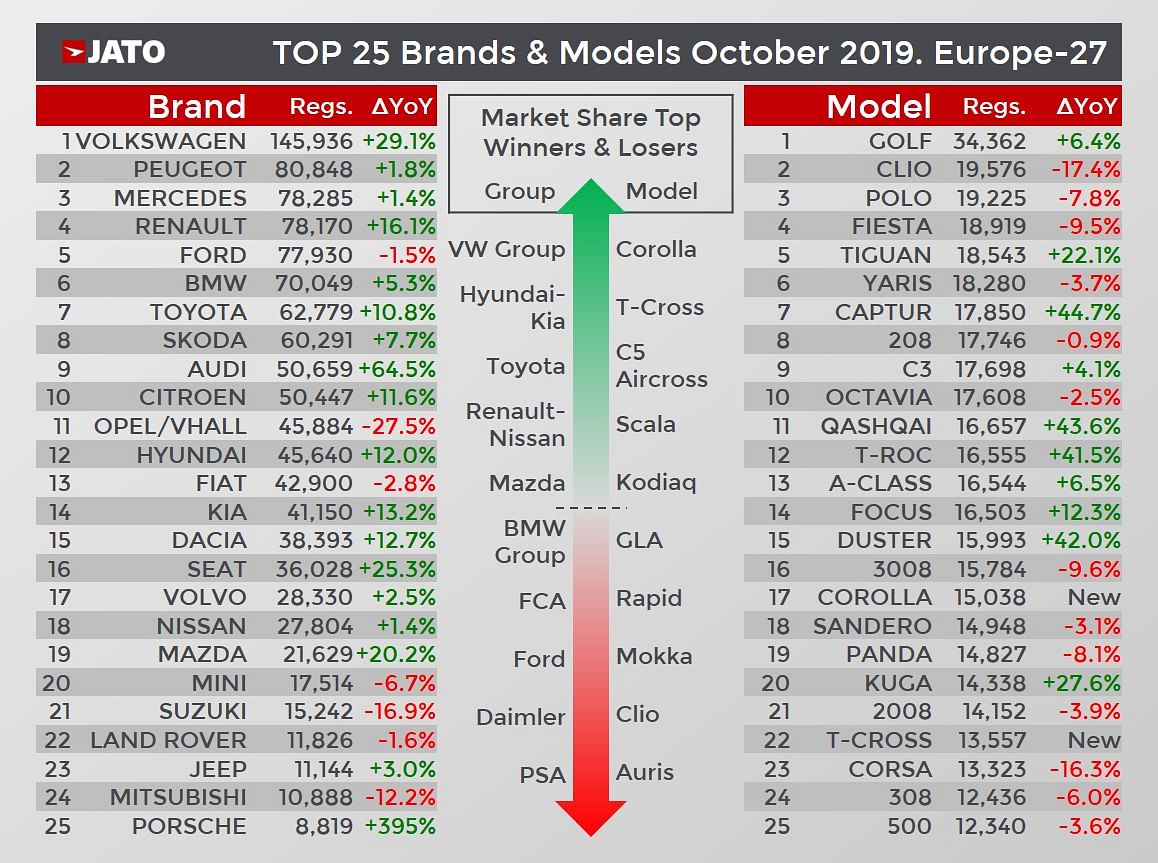

However, the market’s growth didn’t benefit all of the industry’s key players, with Volkswagen Group the sole winner of the month. The Germans posted a 4.4-point market share increase – the highest amongst all automakers – jumping from 20.7% in October 2018 to 25.1% last month. Hyundai-Kia, Toyota, Renault-Nissan, Mazda and Tesla also recorded market share gains, but their combined increase did not exceed 1 point overall. “Volkswagen Group is more solid than ever thanks to the SUV offensive. In fact, one in 10 vehicles registered in Europe is now an SUV made by the German group,” Munoz concluded.

Meanwhile, notable results from the brand rankings include Opel/Vauxhall and Fiat falling out of the top 10; Volvo outselling Nissan; Porsche outselling Honda; and Tesla recording a 129% volume increase to 2,093 registrations.

The model rankings saw the Volkswagen Golf occupy the overall top spot, while the Tiguan was the best- selling SUV. Other strong performers included the new Toyota Corolla, Renault Megane (+43%), Hyundai Kona (+37%), Seat Arona (+30%), Renault Kadjar (+58%), Skoda Kodiaq (+181%), Toyota RAV4 (+39%), Audi A4 (+225%), Audi A6 (+50%) and Audi Q2 (+63%).

Among the market’s latest launches, the following totals were registered: Volkswagen T-Cross with 13,557 units; Citroen C5 Aircross 8,461 units; Skoda Scala with 5,986 units; Mazda CX-30 with 3,180 units; Seat Tarraco with 2,986 units; Kia Xceed with 2,797 units; DS 3 Crossback with 2,370 units; and Skoda Kamiq with 2,104 units.

-Ends-

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

28 Nov 2019

28 Nov 2019

7058 Views

7058 Views

Ajit Dalvi

Ajit Dalvi