EU new car sales up 21% in August, BEVs exceed 20% share for the first time

There were double-digit percentage gains in most markets, including the three largest: Germany (+37.3%), France (+24.3%), and Italy (+11.9%); BEV sales jump 118% to 165,165 units, accounting for 21% of the market and overtake diesel for the second time this year.

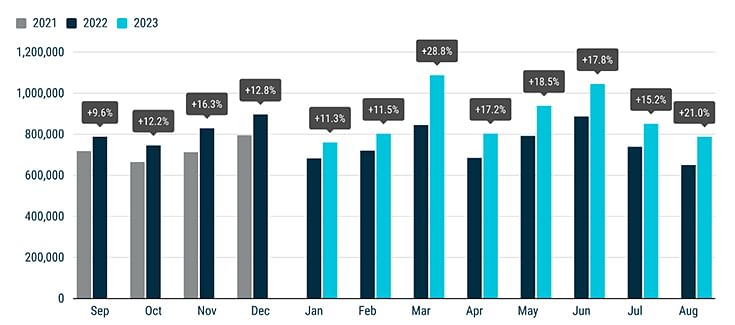

In August 2023, the EU car market expanded by 21%, reaching 787,626 registered units, marking the 13th consecutive month of growth. Despite August typically being a slower month for car sales, double-digit gains indicate that the EU market is rebounding from last year’s component shortages. There were double-digit percentage gains in most markets, including the three largest: Germany (+37.3%), France (+24.3%), and Italy (+11.9%).

From January to August 2023, new EU car registrations grew substantially (+17.9%), totalling 7.1 million units. Despite this year-to-date improvement, the market trails the pre-Covid-pandemic level of 9 million units sold in 2019. Notably, most markets experienced double-digit percentage gains in this eight-month period, including the four largest: Spain (+20.5%), Italy (+20.2%), France (+16.6%), and Germany (+16.5%).

BEV SALES OVERTAKE DIESEL FOR SECOND TIME THIS YEAR

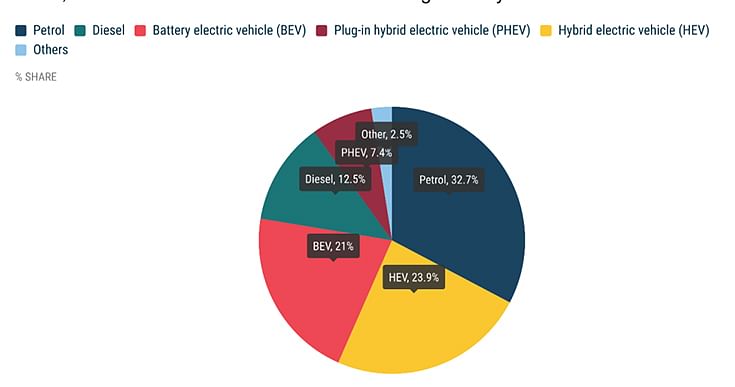

In August, the market share of battery-electric cars exceeded 20% for the first time (up from 11.6% in August last year), overtaking diesel for the second time this year and becoming the third-most-popular choice for new car buyers. Hybrid-electric cars held their position as buyers’ second choice, with a 24% market share. While petrol cars are still the most popular choice, market share decreased from 38.7% in August last year to 32.7%.

In August 2023, EU battery-electric car registrations surged by 118.1%, reaching 165,165 units, accounting for 21% of the market. Except for Malta (-22.6%), all EU markets saw double- and triple-digit percentage growth, with Germany, the largest market by volume, growing by a remarkable 170.7%. Belgium recorded the highest growth rate of 224.5%. Overall, battery-electric car sales increased by a significant 62.7%, with nearly 1 million units registered from January to August.

In August, new EU hybrid-electric car registrations expanded by 29%, primarily driven by robust growth in three of its four largest markets: Germany (+59%), France (+38.7%), and Spain (+21.5%), while Italy recorded a slight decline (-2.3%). This resulted in a cumulative 28.6% increase, with nearly 1.8 million units sold between January and August, equivalent to a quarter of the market.

Last month, new EU plug-in hybrid car registrations grew by 5.5%, totalling 58,557 units. Strong performance in major markets such as the Netherlands (+44.7%), France (+40.5%), and Sweden (+24.9%) helped offset the decline in Germany (-41.1%), the largest market for this power source. Despite this growth, the market share of plug-in hybrid cars decreased from 8.5% to 7.4% in August this year.

DIESEL CAR MARKET DECLINE CONTINUES

In August, the EU petrol car market slightly increased by 2.1%, although its market share decreased from 38.7% to 32.7% compared to August last year. A solid performance in Italy (+25.3%) and France (+21.5%) primarily drove this growth, while most of the bloc’s markets declined.

Conversely, the EU’s diesel car market continued its decline in August (-6%), despite growth in Germany (+9.2%) and Central and Eastern European markets, notably Slovakia (+22.6%) and Romania (+19.4%). Diesel cars now have a market share of 12.5%, down from 16.1% in August of the previous year.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

25 Sep 2023

25 Sep 2023

2118 Views

2118 Views

Ajit Dalvi

Ajit Dalvi