Covid-19 drags global car sales down by 39% in March

Lock-downs in key markets combined with widespread fear of economic uncertainty and panic among consumers contribute to record sales drop.

As the world tries to make a difficult return to normalcy after getting battered by the Covid-19 pandemic, the underlying economic implications of preventive nation-wide lock-downs enforced in various countries are increasingly coming to the surface.

The automotive industry has been one of the worst-hit sectors due to the big-ticket nature of the products which is keeping buyers away from discretionary spending in these times of global economic uncertainty.

Global vehicle sales in the month of March 2020 dropped to 5.55 million units (March 2019: 9.03mn / -39%), with most non-essential services including vehicle production and sales being put to a complete standstill and people unable to leave their homes in countries such as the US, Germany, China, India and the UK.

Europe worst hit, EVs on the rise

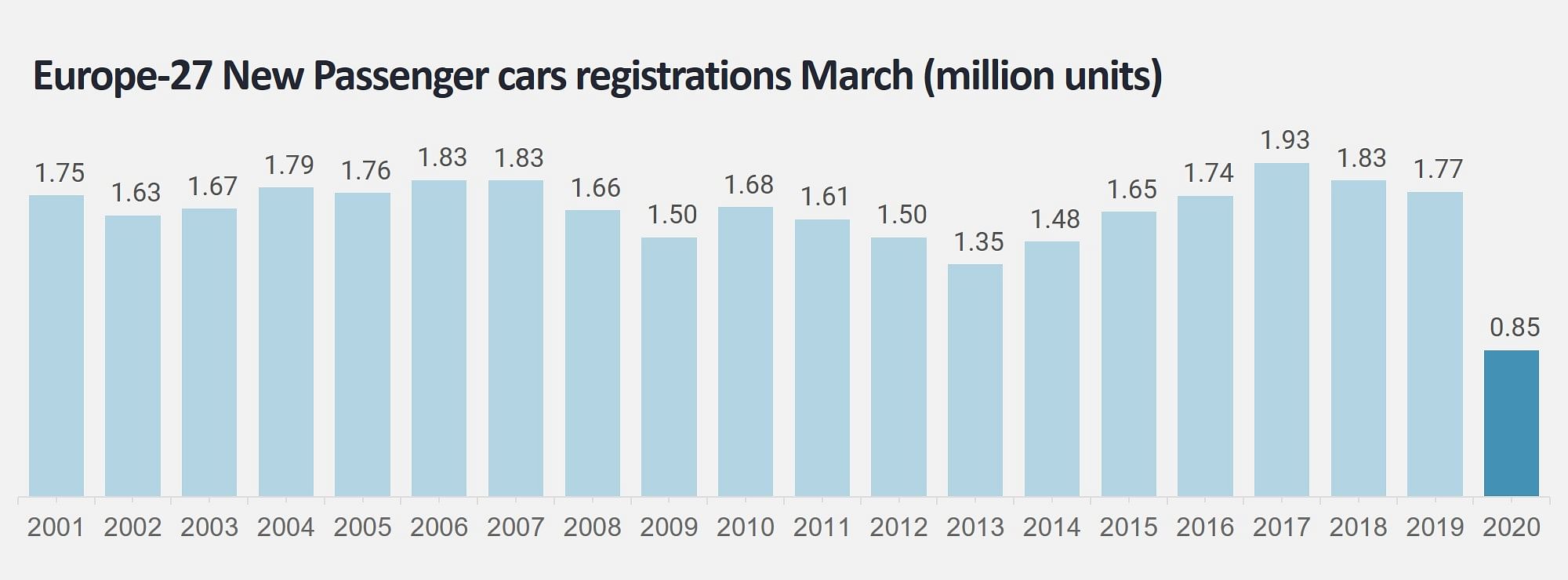

According to a report released by Jato Dynamics, even as China and the US posted double-digit declines, Europe was the worst hit with March numbers plummeting to a record 38-year low. The combined passenger car registrations for all 27 countries part of the ‘Europe-27’ group tallied 848,800 units, registering a 52 percent year-on-year drop.

However, the report suggests that de-growth in these fresh registrations varied from country to country. So, while Finland, Lithuania and Sweden recorded marginal fluctuations ranging between 1 and 9 percent as in Sweden’s case, due to the less severe isolation guidelines mandated by their respective governments, the octet of Italy, France, Spain, Austria, Ireland, Slovenia, Greece and Portugal recorded a substantial 74.5 percent drop in collective sales which fell from 634,600 units in March 2019 to 161,800 units last month.

Furthermore, while all passenger vehicle categories were affected in Europe, city cars, MPVs and subcompacts attracted the most of the detrimental impact. The report explains this phenomenon occurring because of the collapse of the Italian and French markets, on which small cars are heavily reliant for sales – for instance, 38 percent of all A- and B-segment registrations came from these two countries in 2019. On the other hand, what sprung as a surprise was the mid-sized (D-segment) segment led by the all-electric Tesla Model 3, which emerged as Europe’s best-selling car in March.

Electrified vehicles including hybrids, plug-ins and full-electrics, in totality, were able to record an uptick of 15 percent in their registrations to 147,500 units in the month, also clinching a 17.4 percent market share – a new record, which comes with an increment of 10 percentage points compared to March 2019.

Not just Tesla, electrified versions of vehicles from the stables of top automakers including Volkswagen (+240%), Volvo (+79%), Mercedes-Benz (+44%), BMW (+15%) and Hyundai (+25%) also saw a spurt in sales. However, even as consumers were seen shifting to eco-friendly vehicles, it were the full-electric and plug-in sub-segments that recorded growth, while sales of conventional hybrids went downhill by as much as 11 percent in the continent. Volkswagen e-Golf, e-Up, Audi E-Tron, Mini Electric, Peugeot 208-e and the MG ZS EV together accounted 17 percent of all registrations of fully-electric vehicles.

SUV sales dive 48% in Europe

Even as it’s been a trending vehicle category and the preferred body style for most car shoppers around the world for quite some time, registrations of utility vehicles dropped to almost half to 338,300 units, albeit, having still increased their market share to over 40 percent in Europe last month. From an individual manufacturer’s point of view, while MG Motors doubled UV sales from 1,327 to 2,592 units and Volvo’s compact XC40 became the top-selling premium model, the Range Rover Evoque registered a drop of 3 percent to 5,700 units.

Americas and India badly impacted too

While Europe was the second worst-hit region by the coronavirus following China in March, the US emerged as a ticking time bomb with the country taking too long to act and announce a proactive lock-down. With mere self-quarantine guidelines, the country still posted a 38 percent drop in PV sales to 1 million units. According to Felipe Munoz, global analyst, Jato Dynamics, “The US market’s growth slowed last year after many years of witnessing strong growth. At the beginning of 2020, we expected the market to face a slow stagnation; however, this is now more likely to decline to a faster pace due to the impact of the global pandemic.”

Demand in Latin America fell by 30 percent to 318,000 units, following restrictions in Argentina,

Colombia, Chile, Peru, and more recently Brazil and Mexico. The volume was also affected by the economic crisis in Argentina, the region’s third-largest market.

India, the fifth-largest PV market in the world, India has been indoors since March 25, forcing a cessation of all non-essential activities in the country, and bringing the auto industry to a grinding halt. The PV segment posted a significant 51 percent decline in the month of March with total sales of 143,014 units (March 2019: 291,861). The ailing sales of PVs were amplified by the coronavirus crisis, which saw footfalls becoming thinner, closer to the government’s announcement of a nation-wide lock-down and held back buyers who wanted to finalise upon lucrative deals on BS IV models before the cleaner, and more expensive BS VI emission technology-equipped cars became mandatory on April 1.

“This downward trend is not simply due to the restrictions of free movement. The industry is being impacted largely by the uncertainty for the future, and this issue started to arise even before the pandemic took hold. We have to remember that the industry was already operating in a challenging environment, especially towards the end of last year. The trade wars, lower economic growth and tougher emissions regulations came long before the Covid-19 crisis. And unlike previous recessions, we’re not just dealing with people’s fears or purchase delays. This time we have to consider that consumers are simply unable to leave their homes,” said Munoz.

China on the road to recovery

With the epicentre of the coronavirus pandemic having managed the situation to some extent and the 76-day lock-down in the city of Wuhan getting released on midnight April 8, China could well be on the road to recovery.

According to the report, there has been a significant improvement in the Greater China region with the insurance volumes reaching a cumulative 1 million in the month, determining a 38 percent year-on-year decline, compared to the 78 percent drop in the month of February.

“We are positive about the state of the automotive industry in China. Sales figures are on the rise and businesses are returning to normal as remote working is being lifted. COVID-19 will have a lasting impact on the working world and how people across the globe choose to travel. As social distancing continues and consumers start to place greater emphasis on personal space, private car sales are likely to benefit. We continue to closely monitor the environment but early indications from the Chinese market could signal a potential resurgence for OEMs as we move into the post-Covid-19 era,” commented Bo Yu, country manager for Greater China, Jato Dynamics.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

29 Apr 2020

29 Apr 2020

9820 Views

9820 Views

Ajit Dalvi

Ajit Dalvi