China light vehicle market to see flat growth this year

Although China’s light vehicle market has not performed strongly since the beginning of the year, some positive trends have been seen in April, the first month of Q2 2014.

Although China’s light vehicle market has not performed strongly since the beginning of the year, some positive trends have been seen in April, the first month of Q2 2014.

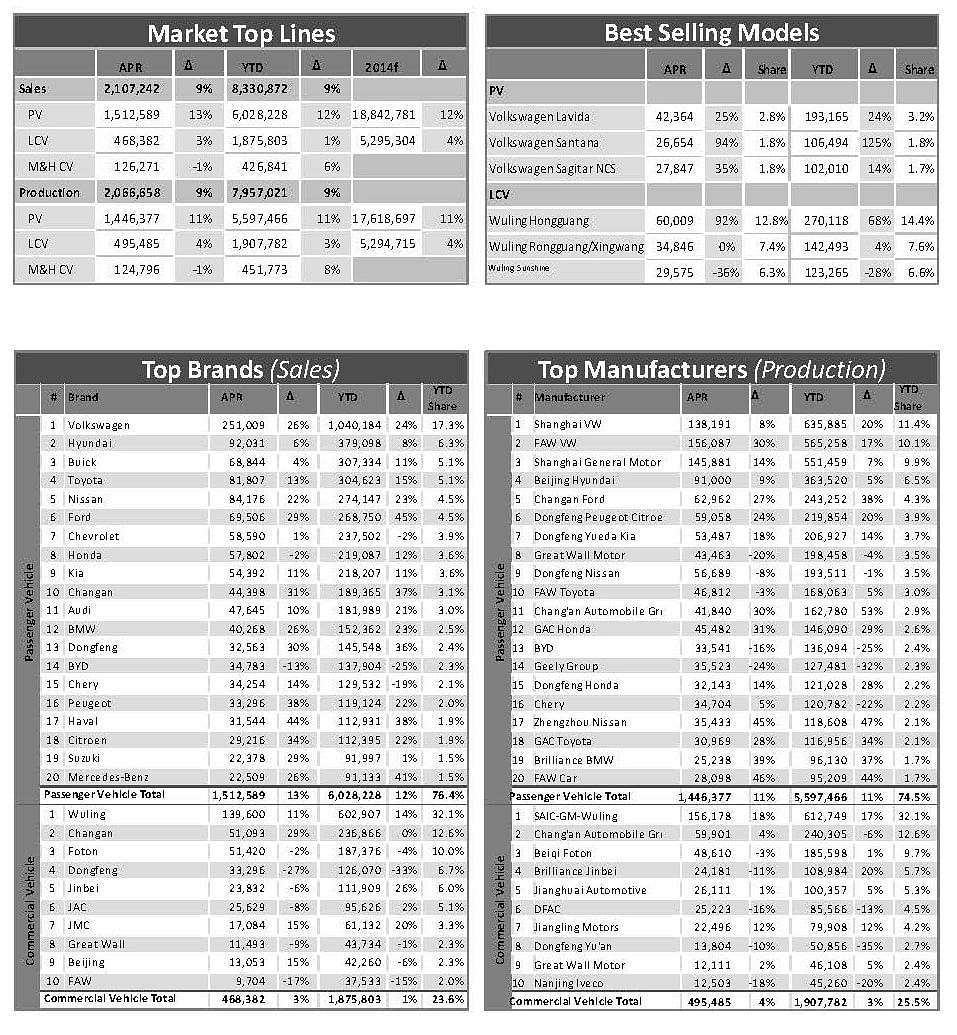

As per global automotive market intelligence provider LMC Automotive, sales of locally‐made light vehicles totaled 1.88 million units, up by 9.5 percent on the previous year, and higher than the 6.7 percent seen in March and the 9.1 percent achieved overall in Q1 2014. Light Commercial Vehicle sales saw a clear improvement, with year‐on‐year growth increasing to 2.6 percent in April, from 0.7 percent in Q1 2014. In the Passenger Vehicle market, however, with year‐on‐year growth staying at a very similar level as seen in Q1 2014, the improving trend looks vague, says LMC.

The improving trend would be more explicit if indicated by the SAAR (seasonally adjusted annualised rate). In April, the SAAR of passenger vehicle sales reached 18.3 million units, edging up from an average of 17.7 million units in Q1 2014. Furthermore, the SAAR in April was higher than the average SAAR of 18.1 million units in Q4 2013, and even slightly above the previous peak of 18.25 million units achieved in December 2013.

The positive trend in dealer‐level inventory has continued into April. Although CADA’s inventory index climbed seasonally to 1.52 in April from 1.38 in March, it was still 10 percent lower than the same period in 2013, indicating the improvement in passenger vehicle wholesales is sustainable.

Recent economic data indicates that China’s economy has remained sluggish, after expanding by 7.4 percent year‐on‐year in Q1 2014. In April, with the exception of export growth picking up to 0.9 percent, year‐on‐year growth in industrial production, fixed asset investment, and retail sales all moderated.

China’s weaker domestic activity reflects a recent marked slowdown in sales and investment in the property sector, which is said to account for nearly a fifth of the country’s GDP. Falling property sales and prices will strain the country’s fragile banking system and the finances of local governments. While the government has introduced mini stimulus measures to prop up the economy, it remains reluctant to resort to large fiscal stimulus spending that could exacerbate

already excessive investment and high local government debt.

Going forward, more stimulus measures for China’s economy and more car purchasing restrictions in China’s Tier‐2 cities are still likely to realise, and will likely push up Light Vehicle sales this year leading to another scenario which LMC calls the ‘sea‐saw effect’. But for now, the neutral scenario remains standard for its sales forecast.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

05 Jun 2014

05 Jun 2014

2771 Views

2771 Views

Ajit Dalvi

Ajit Dalvi