New car sales in Europe down 0.5% in October even as SUVs continue to perform well

SUV sales totalled 302,851 - but this was not enough to offset losses seen in other segments.

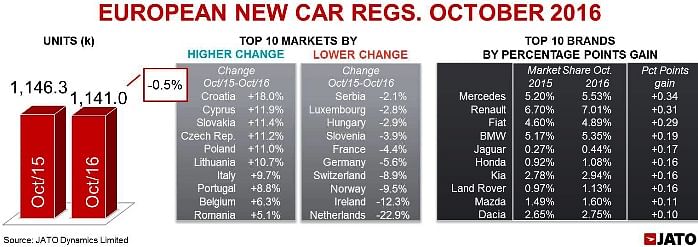

New car sales in the 29 European markets analysed by JATO Dynamics declined by 0.5% compared to the same month last year, with 1,140,978 units sold.

This decline can be attributed to there being one less working day in October in several markets and indicates that after months of consistent growth the market is heading towards a peak. Despite October’s decline, its results still represent the second highest October sales since 2009 – showing how strong the market is on a macro level despite month-on-month fluctuations.

In October the biggest manufacturers all saw their market share fluctuate. Volkswagen Group, Renault-Nissan, PSA and Ford all posted market share declines whilst the premium manufacturers BMW and Daimler, along with FCA, Hyundai-Kia and General Motors all gained ground. PSA posted the biggest market share drop of all the manufacturers, losing 0.73 percentage points of market share as a result of its three brands – Peugeot, Citroen and DS Automobiles posting declines in sales of 4.7%, 9.1% and 28.9% respectively. Volkswagen Group’s market share in October 2016 was 0.32 percentage points lower than in the same month last year, falling from 25.2% to 24.9%. This decline was driven by significant decreases from the manufacturer’s core brand Volkswagen which dropped by 8%, as well as Porsche which posted a 12.2% decline.

In contrast, FCA was the biggest market share winner, increasing its share by 0.40 percentage points, going from 6.2% in October 2015 to 6.6% in October 2016. This increase was driven by the Lancia and Alfa Romeo brands with both posting double digit growth of 24.5% and 21.3% respectively. Daimler also increased its market share by 0.39 percentage points as a result of the strong performance of Mercedes which increased its sales by 6.7% which was enough to offset the 0.5% decline of Smart. Other brands that sold significant increases were Kia, Seat, Jaguar, Abarth, Infiniti and Maserati with increases of 6.8%, 12.7%, 76.4%, 25.3%, 67.4% and 47.3% respectively.

Felipe Munoz, Global Automotive Analyst at JATO Dynamics commented, “As the growth in the market slowed in October, it was the manufacturers that rely most heavily on the Southern European countries or premium brands that performed the best. This shows that the market is shifting and going through a transition phase and we would expect the market to continue to fluctuate over the coming months.”

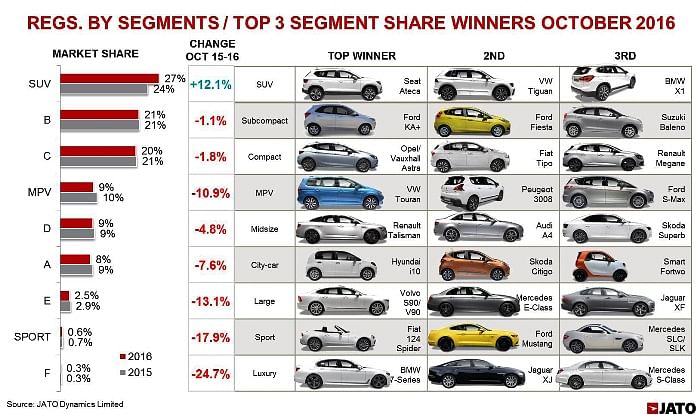

In the segment ranking, SUVs continued to perform well, with 302,851 sales in October: a 12.1% increase on the same month last year. The compact (C-SUV) and midsize SUVs (D-SUV) posted increases of 22.5% and 20.1% respectively, whilst the B-SUV segment posted a small increase of 1.3%, and E-SUVs a decline of 1.8%. The MPV segment showed the biggest market share decline of more than 1 percentage points, and a significant decline in sales of 10.9%.

Amongst the model ranking, the Volkswagen Golf maintained its lead, despite a significant drop in sales that saw its sales decline by 21.2%, as a result of the continuing impact of its emissions issue, and the expected fall in demand as a result of the imminent launch of its 2017 Model Year. In contrast, the Golf’s main rival, the Opel/Vauxhall Astra was the fifth best-selling car in Europe, its volume was up by 55.8% and it gained the most market share of any of the top 20 best-selling models with an increase of 0.65 percentage points, largely due to the launch of the new generation of the model. The subcompact segment was dominated by the Ford Fiesta, which posted an increase of 7.5%. In contrast, the Volkswagen Polo, Renault Clio, Peugeot 208 and Vauxhall Corsa all lost ground, declining by 9.9%, 3.2%, 3.5% and 6.5% respectively.

Amongst the SUVs, the Volkswagen Tiguan regained its position as the best-selling SUV after losing the top spot to the Nissan Qashqai in September. The Tiguan posted a significant increase of 52.5% which was largely due to the launch of the new generation of the model in April 2016. Amongst the premium models, the Audi A3 was the best-selling vehicle with 16,288 sales in October. The Volkswagen Passat was the best-selling midsize car, registering 16,113 vehicles, despite this being a 22% decline on the same period last year. In the city-car segment, the Fiat Panda was the best-selling vehicle, registering 15,032 vehicles. Other market share winners included the Fiat Tipo, Seat Ateca, BMW X1, Renault Talisman and Hyundai Tuscon.

Felipe Munoz, Global Automotive Analyst at JATO Dynamics concluded: “In October we saw the impact of the new generations of the Opel/Vauxhall Astra and the Volkswagen Tiguan. Both helped offset the significant losses suffered by both manufacturers’ other models.”

Read more:

RELATED ARTICLES

Volvo Cars signs recycled steel supply pact with SSAB

The recycled steel will be used in selected components of the forthcoming, fully electric EX60 SUV, as well as other car...

Schaeffler and NVIDIA ink technology collaboration to advance digital manufacturing

Using NVIDIA Omniverse, Schaeffler is expanding its production elements, which will be integrated and simulated as digit...

BMW Group to industrialise Virtual Factory, slash production planning costs

What once required several weeks of real-world modifications and testing can now be precisely simulated in the BMW Group...

By Autocar Professional Bureau

By Autocar Professional Bureau

24 Nov 2016

24 Nov 2016

5219 Views

5219 Views