ACMA's Vinnie Mehta: ‘The Value Chain Summit in Gujarat is an attempt to create a robust supply chain.'

ACMA's director general on the first-ever Value Chain Summit in Gandhi Nagar, Gujarat (May 18-19), the need to set up more auto hubs in India, more collaboration potential among suppliers.

Vinnie Mehta, director general of the Automotive Component Manufacturers Association of India (ACMA) on hosting the first-ever Value Chain Summit in Gujarat (May 18-19), the need to establish more automotive manufacturing hubs in India, how Gujarat is aggressively building itself as a lucrative investment destination, and the potential of collaboration among suppliers in a disruptive technology era.

Why has ACMA chosen Gujarat as the destination to host the Value Chain Summit?

Essentially, India has three well-established automotive manufacturing hubs, spread across the Delhi NCR, Bangalore-Hosur-Chennai belt and the Pune-Aurangabad-Nashik region. With the kind of projections in the Automotive Mission Plan for the vehicle and the component industries, the existing hubs will not suffice. This calls for the setting up of at least two to three more automotive manufacturing hubs across India. Therefore, considering that requirement, Gujarat has very well begun.

Gujarat is already scaling up very fast as it is home to India’s largest passenger carmaker (Maruti Suzuki) and the largest two-wheeler manufacturer (Hero MotoCorp). It also has the production plant of the fastest-growing two-wheeler company (Honda Motorcycle & Scooter India). That apart, Gujarat has witnessed sizeable investment in engine manufacturing as Ford is making not just cars but also engines. The state also has a new automaker – MG Motors – with them. And Tata Motors is now witnessing surging production activity at its Gujarat plant.

However, the challenge that the auto industry is currently facing in Gujarat is the lack of an adequate ecosystem of component suppliers to match the planned production capacities and the rate of planned growth. This is with respect to the presence of both the Tier 1 and 2 suppliers in the state. Of course, component suppliers did not rush to the state because till about a year ago or so, production capacities in Gujarat were all underutilised. Nevertheless, vehicle production is now back in full swing and, hence, the supplier community is also looking at its next phase of growth and investments.

In March 2018, the Maxxis Group opened its Rs 2,640 crore two-wheeler tyre plant in Sanand. This is a recent example of a supplier's big-ticket investment in Gujarat.

Therefore, ACMA primarily aims to achieve a few objectives through the upcoming Value Chain Summit. We will bring a large set of suppliers who already exist in Gujarat to this platform and they can evaluate further expansion opportunities in the state. We are also bringing the top leadership from all the OEMs present in Gujarat for the planned ACMA event. Secondly, we also plan to provide the right exposure to the new Tier 1 suppliers who do not have their presence in Gujarat yet. They can also gauge the growing automotive ecosystem and look at the opportunities in the state.

Basically, the idea is to create a robust supply chain and an entire independent ecosystem. The next step includes bringing the Tier 2 suppliers who are present and not present in Gujarat to understand the opportunities. This is from the value chain perspective.

Thirdly, on the back of the Summit, we are also attempting to address the challenges that the automotive industry currently faces in Gujarat — in terms of the (availability of) logistics providers, warehousing facilities, people skilling centres and financial institutions. While financial institutions are present, they haven’t been able to reach out to the right companies looking for expansion.

All in all, the ACMA Value Chain Summit aims to help in setting up a robust (automotive) ecosystem in Gujarat.

Also, besides looking at strengthening the supplier base in Gujarat, we have planned a meeting for the IPO (international procurement officers) forum during the event. So, within this, some of the companies may also strike opportunities of exporting their products from Gujarat.

Is ACMA also mobilised by the state-level efforts of consolidating Gujarat’s relevance as an important automotive manufacturing hub?

Yes, we see a lot of traction coming in from the state itself because it has a vision of becoming of one of the top three destinations for automotive manufacturing in India. Gujarat also has a vision of enhancing the contribution of automotive in the overall manufacturing industry from 3.5 percent to about 10 percent by 2020. So the state also has its own vision and drive for industrialisation, and in this case to drive the automotive industry.

The chief minister is expected to inaugurate the ACMA Value Chain Summit. We also endeavour to create a forum, which opens up a dialogue between the industry and the government because there are several state-level issues that need to be addressed.

Gujarat’s Mundra Port offers a RoRo service to vehicle manufacturers. Is there also a focus on boosting export opportunities for component suppliers in Gujarat?

Yes, the Mundra Port is a strategic port from where OEMs like Maruti Suzuki currently export made-in-India cars. As a first priority, we want to set up a robust value chain for the OEMs in Gujarat. However, in a first, we are also organising an IPO forum during the event. So, within that, we expect that the procurement heads across the companies will meet up and discuss potential export opportunities also. The exports this year (FY2017-18) have been extremely buoyant.

How do you foresee the future of auto ancillary companies in Gujarat compared to other hubs that are coming up, for instance, Andhra Pradesh?

We are very happy with the kind of competition we see between the states now. ACMA has recently signed an MoU with the Andhra Government (February 2018) and we would like to help in having a supplier presence there as well. We already know that the OEMs such as Hero MotoCorp, Ashok Leyland, Bharat Forge, Kia Motors and Isuzu Motors have gone there.

The auto component industry is heavily dependent on vehicle manufacturers. Gujarat, which has six leading OEMs with their manufacturing facilities, is coming up with many special economic zones and economic corridors, which will all contribute to the pace of its industrialisation. So there is no reason to doubt the future of the entire automotive industry in that state, leave aside doubting the future of the auto ancillary companies there.

That does not mean there are no challenges. There are issues around labour, availability of manpower and others but these are not insurmountable. The state seems to be fairly committed to its vision of developing itself as a preferred automotive hub.

Is there any specific theme or focus area for the upcoming ACMA Value Chain Summit in Gujarat?

The event will be similar to the Components Expo (Auto Expo) held in February. The show will be by the industry, for the industry. It will be focused on the OEMs and their (regional) value chain that is present there. We will be focusing on the need of the industry in Gujarat at this hour, and maybe we will be looking at the next five years.

How many participants are confirmed for the event?

We are targeting anywhere between 150-200 participants. As of now (mid-April), we already have confirmation of over 100 participants, including several big names. We are very confident that we will be able to deliver what we are aiming for through this event. Expect a lot of Tier 1 and 2 suppliers to be present at the event.

Suzuki is setting up a battery manufacturing plant in Gujarat for EVs of the future. What is the sentiment among component suppliers in terms of planning new investments in Gujarat for EVs, or looking to associate with Suzuki for supplies of various parts?

Suzuki’s battery plant in Gujarat sends out a very important signal about establishing the seriousness of the manufacturer (and other carmakers) for making electric vehicles in the future.

In the absence of any direction, guidelines and any policy from the government, Suzuki’s announcement surely reflects the seriousness of the OEM in its product roadmap for future technologies.

Suzuki and Toyota recently joined forces to stay relevant by making minimal investments across multiple markets globally. What is your perspective on component suppliers partnering for survival in these disruptive times? Why don’t we see domestic suppliers coming together from a sustainability point of view?

There are two things in this regard. We are not unduly concerned that the opportunities are drying out. Actually, it is a misnomer. The opportunities are not drying out. As per the Roland Berger report on the potential for EVs in India, probably the most optimistic scenario for the EVs in 2030 in India would be in the range of 20-30 percent. Now considering the upper limit in that case, we will still have about 70 percent of the market that will be traditional. By 2030, even the numbers in the traditional market would have grown very significantly. So I am of the opinion that there is no threat to the traditional industry.

However, having said that, I do recognise that even the traditional vehicle industry would move up in terms of technology, development cycles and other critical parameters. So definitely the industry needs to invest in new technologies to stay relevant, even in the existing ICE engine technology areas. I think the existing players will soon figure out where their strengths are, and accordingly, they will invest in the newest technologies including the pure electrics.

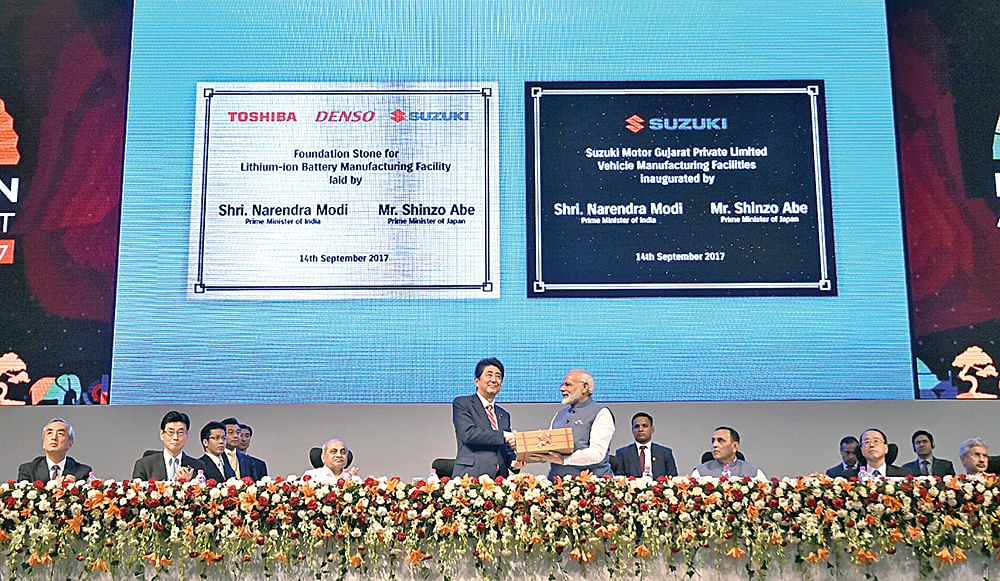

On September 11, 2017, prime minister Narendra Modi and Japanese prime minister Shinzo Abe inaugurated Suzuki Motor Gujarat's vehicle manufacturing plant and laid the foundation stone for the lithium-ion battery joint venture. Image: PIB

Therefore, I do not see concerns about the survival in the foreseeable future. I am sure we are not going to see 100 percent electrification of the vehicles by 2030. But we do need to prepare for the future.

Additionally, the government is talking about zero emissions and I think they know that the way forward is technology agnostic, and not necessarily pure electrics. So probably electric vehicles are one of the solutions within many zero-emission technologies.

A number of public and private sector banks have a lot of NPAs. This is creating a lot of difficulty in raising new loans and generating new capital among the small- and medium-scale businesses. How do you think this can be addressed, as many auto component suppliers would be looking for credit facilities for expansion?

You have rightly pointed out that it is increasingly becoming a challenge to raise money to get credit and loans. We haven’t yet initiated any dialogue with financial institutions on this. But I guess there are many credit rating agencies which rate the companies that raise loans.

I think the players would need to be more professional in terms of getting their credit ratings verified or validated by these agencies to establish their credentials in the market. But this is a substantial challenge currently, there’s no denying that.

This interview was first published in the 1 May 2018 issue of Autocar Professional

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

16 May 2018

16 May 2018

17658 Views

17658 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa