'We're working with many globally renowned institutes to tap lightweighting tech.'

Rattan Kapur on plans to enable Tier 2 and 3 vendors to upgrade their skills, why Indian industry needs to develop its own IP and build scale, and how engaging with global institutes can sharpen the focus on R&D.

Rattan Kapur, the president of the Automotive Component Manufacturers Association of India (ACMA) and CMD of Mark Exhaust Systems on plans to enable Tier 2 and 3 vendors to upgrade their skills and technologies, why Indian industry needs to develop its own IP and build scale, and how engaging with global institutes can sharpen the focus on R&D. An interview by Shobha Mathur.

You have taken over the reins of ACMA at a time when new regulations on safety are around the corner in India. Vehicle manufacturers are also working on meeting upcoming BS VI emission norms and a cash crunch has put a spanner on automotive sales right now. Against this backdrop, what are your immediate priorities?

This year we have adopted ‘Make Quality and Innovation in India’ as our theme. Our endeavour is to strengthen our capabilities in new product development, improve quality standards, evolve our technology for meeting the changing emission and safety standards, upgrade people skills to support domestic and global expansion of OEMs, and embrace digital technology in manufacturing to transform productivity, thus enabling our industry and India to become an attractive destination for investments.

Our priorities for the future would be to focus on research and development to help generate IP in India, maintain world-class quality with zero defects and in the process, create the industry’s economic profit – greater returns on capital than the cost of capital. All this would draw more investments from the automotive components sector.

As automakers pursue vehicle lightweighting strategies, how open is the Indian component industry to working with new materials, processes and technologies?

Lightweighting strategies are a combination of component design, manufacturing process innovation and substitution of materials.

Vehicle manufacturers have been lightweighting with materials such as aluminium, magnesium alloy, high-performance engineering plastics and high-strength steel. Lightweighting in India is increasingly becoming relevant as the government focuses on stricter emission norms and electric mobility.

The auto component industry in India is indeed keen to work in this area and some companies have already started working closely with the OEMs. However, the bulk of the component manufacturers lack access to the right technologies. ACMA is engaged with several globally renowned institutes and is trying to help its members tap the relevant technologies in this area.

With the government’s push towards faster adoption of electric and hybrid vehicles, how is the component industry gearing up to support indigenous development of EV components?

As you rightly said, there are major changes taking place in the automotive sector due to the upcoming stringent emission norms, safety regulations, focus on fuel efficiency, sustainable development and changing usage habits of automotive consumers. The future of e-mobility in India will depend on technologies and solutions that cater to local Indian requirements and operating conditions.

The next 10 years would probably see several disruptive changes in the automotive industry. We are witnessing a move from the traditional internal combustion engine technology towards hybrids, electrics and other alternative fuels in the global market.

ACMA is closely involved with the FAME India scheme (Faster Adoption and Manufacturing of Electric and Hybrid Vehicles in India) of the Ministry of Heavy Industries and Public Enterprises and we do hope that as hybrid and e-mobility gains traction, vehicle manufacturers will support localisation of components.

How does ACMA plan to help Tier 2 and 3 vendors upgrade their skills and technologies? It is understood that a growing number of vehicle recalls could be traced to some of these inadequacies.

The auto component sector in India is largely dominated by the small and medium enterprises; in fact, 70 percent of the ACMA membership consists of SMEs.

The single biggest challenge faced by SMEs in India is access to capital. Furthermore, being small in scale, SMEs have limited access to technology and are also limited in capacity to absorb technology. That apart, they are unable to attract skilled labour and face challenges in retaining skilled workforce. To support the SMEs, ACMA has been urging the government for many years to create a Technology Upgradation Fund for the component sector. I do hope that our proposal will be considered favourably.

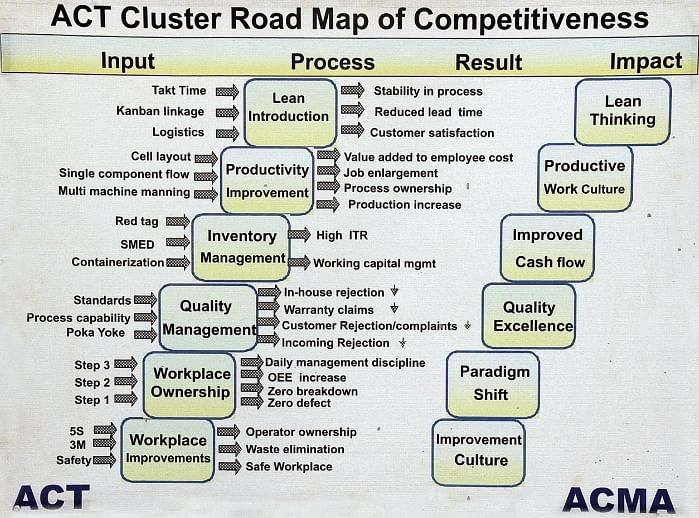

Each cluster programme of the ACMA Centre for Technology has a distinct roadmap wherein best practices are imparted right from the shopfloor to the top management.

It is heartening that the ACMA Centre for Technology (ACT), a technical wing of the industry body, has over the last decade helped upgrade technology within the membership through process intervention in over 600 plants across the country. It has made them world-class. Today, it runs several cluster programs such as the foundation, basic, advanced, engineering cluster programs, new product development cluster and zero defect cluster. Each cluster program has a distinct roadmap wherein best practices are imparted right from the shopfloor to the top management.

To facilitate upgrading of the capabilities of Tier 2s and 3s, ACMA has launched the ACMA-UNIDO cluster program with the support of the Department of Heavy Industries, government of India. I am glad that over 200 small and medium auto component manufacturers are taking advantage of this program.

Exports continue to be lower than imports. How do you plan to turn around this lacuna? What steps are being taken to curb illegal Chinese imports into the country?

While continuing higher imports over exports is an area of concern, the good news is that the CAGR of exports is 18 percent while that of imports is 13 percent. But with increased emphasis on localisation by the OEMs and the growing competence of the Indian component industry, imports are expected to decline.

It should also be noted that in a period when the overall exports of India declined by 9.58 percent, the Indian auto component sector’s exports grew by 3.5 percent to Rs 70,996 crore in 2015-16 from Rs 68,500 crore during 2014-15, registering a CAGR of 18 percent over a six-year period. ACMA has played a pivotal role in supporting its members in discovering new market opportunities; currently the industry exports to more than 160 countries.

Find out: Can India’s auto industry live up to the AMP export target?

ACMA has been facilitating exports development for its members in both the developed and emerging economies. Last year, ACMA participated at the Automechanika Frankfurt, IAA Commercial Vehicle Show in Hannover and the 11th International Autoparts Exhibition in Iran. It also organised a Buyers Sellers Meet in Indonesia, undertook a CEO’s Mission to South Korea and held an Aftermarket Show in Nigeria among others.

To further boost exports, ACMA has been working closely with the Union Ministry of Commerce and Industry, to ensure incentives for a very wide component base for exports under the Foreign Trade Policy 2015-20.

To curb illegal and substandard imports, ACMA is associating with the Ministry of Road Transport and Highways to facilitate standards for aftermarket products. Currently, a significant proportion of goods sold in the aftermarket are counterfeit.

How much success has ACMA and its member companies achieved when it comes to the menace of fake parts? What is the game-plan going ahead?

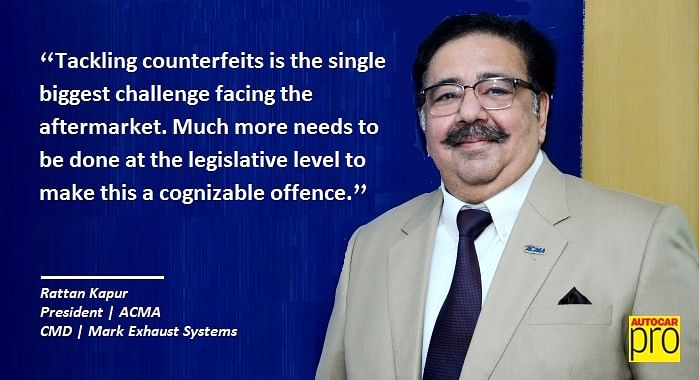

Tackling counterfeits is the single biggest challenge facing the aftermarket today. While the aftermarket is estimated to be (worth) $ 6.5 billion and growing, almost 36 percent of the components sold in the aftermarket are counterfeit. It is not very easy to identify counterfeits; added to this, consumer buying habits influenced by purchases without bills or invoices makes traceability difficult.

Fast-running parts like filters, condensers and spark plugs, brake linings, clutch facings, gaskets, seals and O-rings, ball bearings, PC linkages and fasteners are some of the products most vulnerable to counterfeiting. Each year, ACMA conducts almost 500 raids on retailers and dealers who stock fakes. Going forward, much more needs to be done at the legislative level to make this a cognizable offence, including awareness creation at the user's end as also conducting raids to curb this menace.

In continuation of its effort to generate awareness about the disadvantages of counterfeiting and on the need for usage of genuine parts, ACMA has, since many years, been running the Asli Naqli campaign which educates people on the ways in which genuine products can be distinguished from their fakes and the implications of using fake products.

AMP 2026 has set ambitious targets for the component industry: US$ 200 billion turnover, US$ 80 billion exports, US$ 32 billion domestic aftermarket and a direct employment of 3.2 million people. At present, where does the industry stand and are these targets achievable?

At present, the component industry has adapted well to the changes in the policy, regulatory environment and the needs of the customers. However, I would also like to point out the need for the industry to develop its own IP and build scale through significant export growth and domestic consolidation. Despite some challenges that we are witnessing in the short run, I am confident that by 2026, the component industry will meet the targets defined in the Automotive Mission Plan 2026.

ACMA conducted an Aftermarket Expo in Guwahati in November 2016. What potential do you see in North East India and how do you plan to tap it?

Currently, the market in the North East is estimated to be around Rs 2,000 crore. The North East has a heavy dependence on roads, which are the primary mode of transportation for passengers and goods, as connectivity through railways is poor. Moreover, the wear and tear of vehicles due to hilly terrain, heavy rainfall and poor roads in the remote areas leads to a faster replacement cycle of components. Therefore, given the current condition of the region, there is a huge demand for the aftermarket for brake and clutch parts, pistons, valves, oil seals, tyres, shock absorbers, leaf springs and wiper arm blades.

Looking at this huge upside opportunity, the Expo has served as a perfect platform for both manufacturers as well as sellers, dealers and workshop owners to interact and explore synergies for this unexplored high demand aftermarket.

What are the initiatives being taken to strengthen R&D activities in the industry and promote innovation?

We believe this is the time to invest in technology as the industry is going through significant change. To strengthen R&D activities, ACMA has been engaged with Fraunhofer, MIT, Cardiff University and other research institutes. The government is also encouraging R&D by giving a 150 percent deduction on R&D expenditure. We have requested the government to reinstate the reduction to 200 percent.

How can the government drive speedier growth for the component industry?

An overall stable economic environment and growth in the vehicle industry will ensure growth for the component sector. The government will soon announce the vehicle scrappage policy which will be beneficial to the industry as it will create demand for new vehicles.

There is a need to explore strategic trade agreements which would help increase component exports to countries where India-like vehicles are used – Nigeria, South Africa, Colombia, Brazil, Iran and Russia.

What will be the impact of GST on the automotive component sector?

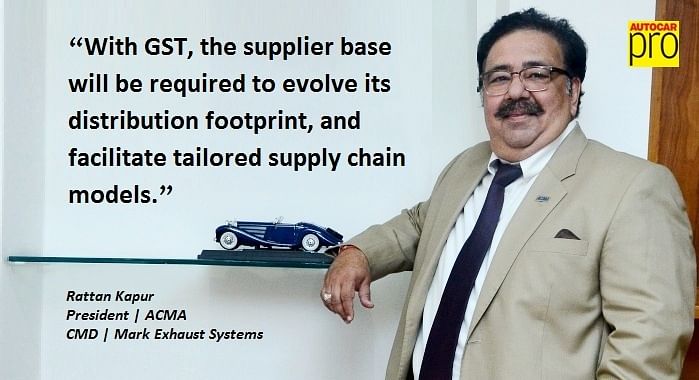

GST will enable creation of a ‘one-India-market’. The overall compliance burden is expected to decrease and bring in efficiency in operations. The Goods and Services Tax is expected to have a big impact on the aftermarket because of the current complex ecosystem of stock-keeping units and requirements for storage and retail penetration.

The supplier base will be required to evolve its distribution footprint to move away from consignment stocking, and facilitate tailored supply chain models while also ensuring high-quality service and availability at a lower cost. Overall, the industry will need to gear up to get the most out of the GST environment.

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

By Shobha Mathur

By Shobha Mathur

12 Jan 2017

12 Jan 2017

9495 Views

9495 Views

Darshan Nakhwa

Darshan Nakhwa