Sanjay Bhan: ‘Our new 200cc bikes are just the first of plenty of premium action to come from Hero MotoCorp.’

India's largest two-wheeler OEM is gunning for growth in FY2020 and will look to make the most of demand in 125cc scooters, premium executive motorcycles and is even eyeing the midsized bike market. Sanjay Bhan, Head – Sales & Aftersales, Hero MotoCorp speaks to AutocarPro.

Hero MotoCorp ended FY2019 with sales of 7,612,775 units, up 3.12% in what was a tough year. Now, in a bid to re-inject some pep into sales and oomph into products, the company has launched three new 200cc motorcycles – the XPulse 200, XPulse 200T and Xtreme 200S, is readying the Maestro 125 scooter and is also exploring entry into the middleweight 400-500cc segment in the near future. And as Sanjay Bhan, Head – Sales & Aftersales, Hero MotoCorp, tells Mayank Dhingra, the company is also logging in to digital India by reaching out to netizens who are two-wheeler aficionados.

How do you assess the Indian two-wheeler industry’s performance in FY2019?

The last fiscal was one of many surprises, some pleasant and some not-so-pleasant ones. It was a story of two halves – the first half was all glory and second all about dealing with multiple challenges.

It has been one of those years that one would be happy saying it's over. I think FY2020 has begun in decent fashion; while we believe there will be some recoveries, that may not happen immediately.

The first half (HI of FY2020) is going to be a little up and about but overall improvement should start kicking in sometime after September, which is when things will again start looking upwards.

What was your inventory level at the end of the last fiscal?

First of all, I would acknowledge that we were also in a tough situation like everybody else was. The industry quoted some insane numbers but thankfully we were not that bad. We took a call in March 2019 and corrected our inventories by 150,000 units at one go. Right now, we are operating at an inventory of around 45 days at the national level.

Has the NBFC situation improved compared to two quarters ago?

Yes, that was a big setback and a challenge in terms of liquidity overall. The situation has definitely improved compared to what it was in October, November and even December of 2018. While there have been some improvements in overall liquidity since then, it is still not there where it should ideally be and may take another three months. That is why we expect H2 to be far better than H1 in this fiscal.

Hero MotoCorp was still able to maintain its lead, especially in the entry-level motorcycle segment. What factors do you think contributed to that?

Not just maintain but I would say that we have increased the lead by more than 10 percent over the closest competitor. Continued strong traction for some of our brands was the key factor. A fairly decent response to the Destini 125 was another factor and good response to some of the updates that we brought in the existing mainstay brands for instance the Passion and Glamour. All these brands have started doing well and that gives us a lot of heart and courage that hopefully things would start getting better from here.

With the positive market response to the Destini, are you seeing a premiumisation trend in the scooter sub-segment?

Yes, within scooters, the 125cc segment has seen a 55 percent growth this year. Definitely, there is a premiumisation trend and scooter customers are looking to upgrade to slightly more powerful and feature-loaded propositions. I believe 100cc scooters are not offering them the excitement any more and they searching for that in the 125cc segment. Quite a few models, not just from Hero but also from the competition, have energised that segment. Thankfully, we introduced the Destini 125 and now have the Maestro 125 ready for launch. We will soon be packing that segment quite reasonably and participating in the fastest-growing segment more aggressively. This should give us some upside.

So, is your USP going to be pricing again as we have already seen in the Destini's case??

I don't think price was the USP with the Destini. We continue to believe, and the customer also makes sure to keep reminding us from time to time, that offering a unique and distinctive value proposition is what our USP is. The Destini’s biggest USP has been the idle-start-stop system (i3S). Customers have appreciated the i3S technology feature. We feel that it is a wow feature, one other two-wheeler in the country is offering. We are increasingly going to get the i3S in the other scooter products that we launch.

Would you consider bringing a product with a different body style, for instance a maxi-scooter?

There's a lot happening and the three launches – Impulse 200, Impulse 200T and the Xtreme 200S – have given a huge demonstration of the capability set at the CIT (Hero Centre of Innovation and Technology) in Jaipur.

I would say that Hero is capable of trying to look at unique segments and offerings and being able to create traction around them as we have seen in the past. So, we will take some serious leaps and not probably tread the normal path.

Are you hinting at some contemporary product features or is there something more?

No, not just the features but product segments overall. It is not usually all about what the product is but also why that product was made and for whom it was conceptualised in the first place. For instance, in this case, we found that there are enough people who want to buy a bike and use it over the week for going to the office but should also have the flexibility of taking it out on long rides over the weekend. There's a whole new group of customers who want to do that.

What is the void that you fill up with these three new products – the Xpulse 200, Xpulse 200T and the Xtreme 200S?

We saw that customers who were scouting for such a product are today settling for whatever closest they can get or making a stay with a 150cc motorcycle, thinking that the other possible product is too far away in terms of reach. Thus, we are trying to bring them closer to what they want.

Sanjay Bhan (centre), flanked by Dr Markus Braunsperger, Chief Technology Officer (far left) and Malo Le Masson, Head - Global Product Planning (far right).

In this manner, we are trying to challenge some of the existing segments. Our strategy is that of value proposition and we will create new value propositions for customers across segments, giving them better bang for the buck and a better reason to buy.

Taking that strategy into consideration, you have brought out 200cc at a price point below Rs 100,000. Can we expect Hero to offer middle-weight capacity motorcycles at a price below the competition?

It will all depend upon the customer segment that we are looking at and what the customer's (his or her) aspirations are.

Our pricing is not governed by the competition but by customer type/use case and how he or she is going to respond to the value proposition. Price is undoubtedly the integral part of the value proposition and it's not looked at separately. We always strive to create the right value pack, which obviously should be very strong for the customer to say, ‘This is what I was really holding back for’. It's not just the premium segment but across categories, we have done exactly that with the biggest example being the Splendor. The Splendor story is as much about the brand as it is about value proposition the product offers.

Therefore, our core has been to give the best value for the money and the best value proposition. I think we should be able to keep our customers excited across segments.

Are you also looking at establishing a parallel retail channel with these new products?

Not necessarily. We don't need to do that. However, what we are definitely wanting to do is upgrade our existing channel over the next 18-20 months. We are bringing a lot of experiential elements into our showrooms.

The strategy for our premium products is all about engagement, wherein we want to engage with our customers both inside the showroom and outside.

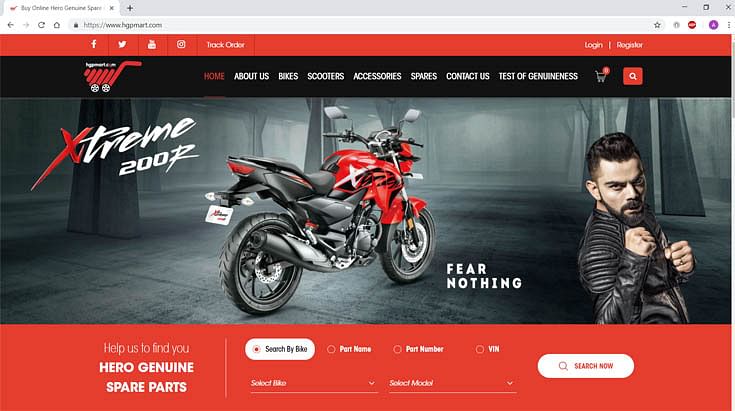

Hero MotoCorp is plugging into digital in a big way. Its HGP Mart online parts retail platform is the retail point for all Xtreme 200R sales.

Are you leveraging digital technologies to enhance a customer's pre- and post-sales experience with Hero?

Yes, we are already doing that. For instance, all the Xtreme 200R sales are being routed through the HGP Mart, our online parts retail platform. We are encouraging that even if the customer is there inside the showroom. We are going to be 100 percent online for free service coupons – there will not be a leaflet for that in the owner's manual. We are trying to create a digital ecosystem and inculcating a digital habit and culture with our customers.

With new safety regulations in place and also BS VI norms coming in soon, do you think it will be a challenge making the end consumer understand the reason behind the price increment, given that no perceptible change is observed in the products?

I think customers are smart and we at Hero believe that the customer understands everything. They are able to figure it out eventually and rationalise it. Having said that, while one thing is understanding, the other is being able to absorb which might take some time. That remains a challenge as an industry that we all need to deal with in the near future. We just have to be clear about what and how we are communicating it with them and I think they will be able to understand.

Do you see good potential in the premium motorcycling segment in India?

Yes, the industry has seen a 15 percent CAGR in the above-150cc category over the past 10 years. I would say that there is a lot of customer aspiration which is kicking in and there are a lot of people who want to move into premium biking today. Earlier, biking was more about commuting, but today even if a person owns a car, he wants to buy a bike as well. We are seeing multiple ownerships within households and a lot of new type of customers is increasingly coming in.

Are you going to look at the middle-weight 400cc-500cc motorcycle segment in the future?

Over the next five years, we will be getting to it in every which form that you can expect us to. One question which I am frequently asked is: how come Hero is thinking so differently in a category that it does not really operate very strongly in?

The reason is very simple. It is just a great demonstration of our capabilities and the way we are trying to put our weight behind a segment where we are not present. So, it is not that we will continue to only build what we are very strong on, but we will continue to do that even as we try to get into new areas because that is where the maximum headroom for growth is.

Also read: Hero MotoCorp targets premium bike buyers with new XPulse 200, 200T and Xtreme 200S

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

02 May 2019

02 May 2019

51035 Views

51035 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa