'Our aim is to have a presence and a lion's share in the demand segments'

Sunil Bohra, the CFO of Uno Minda Group speaks to Autocar Professional about how the premiumisation trend in various vehicle segments in the market is driving up its kit value and more.

After making an early entry and gearing itself to cater to the growing demand for EV components from the electric two- and three-wheeler segments, the Gurugram-headquartered Tier I components giant is eyeing stabilising its operations and targeting vertical growth in the near- to mid-term future. The company is bullish about the growing demand for high-value products and services such as alloy wheels and telematics, and is driving innovation across both ICE and EV domains to remain future-ready, whilst keeping its backbone strong.

Is EV domain the new area of focus for Uno Minda from a growth perspective?

While the EV segment is a big lever of growth, it is an additional area of focus as we are also working on multiple fronts within our existing product lines of lightings, switches, and blow-moulding parts, which are all seeing good traction from our customers owing to the premiumisation trend in the market. In this regard, components such as wireless chargers, and telematics, among others, are gaining robust traction. Although we have recently commissioned the two EV-specific plants under our JVs with FRIWO and Beuhler, we are also currently working on eight more expansion projects within our legacy product portfolio. Hence, we are witnessing good uptake for not just our EV components but our products across the board. While our primary focus with EV components is the domestic market, we export a range of conventional components such as switches, lamps and seats to markets including ASEAN, Europe and the US. We supply to a whole host of global OEMs including the likes of Toyota, Harley-Davidson, and the Volkswagen Group. The contribution of exports to our total revenue has tripled in the last five years, from being pegged Rs 600 crore to around Rs 1,800 crore. And all the product lines that we are diversifying into are being considered both from a domestic and exports potential.

How has Uno Minda's kit value evolved over the years and what are the key drivers behind the growth?

In the last four years, our kit value in the economy two-wheeler category has grown from around Rs 6,200 to Rs 10,600 per vehicle, and this is only based on the components which are common to both ICE and EVs. On top of it, we have also built our EV kit value profile of almost Rs 35,000, and therefore, our EV kit value for the electric two-wheeler segment is almost four times that of our ICE business. In the four-wheeler segment, our kit value, particularly in the SUV category, has grown from Rs 120,000 to almost Rs 2,00,000 per vehicle. The key enabler of this drive is the premiumisation trend, for instance, the increasing shift from halogen to LED lighting, which boosts the kit value by three to six times. Moreover, the shift from steel to alloy wheels is another premiumisation trend in the market. Additionally, the introduction of new products such as wireless chargers, and other advanced feature components in our portfolio, have been driving the growth in our kit value over the last four-five years.

Does the decline in demand for entry-level vehicles create a gridlock for the company's investments?

For us, we see total vehicle sales in the market as our growth metric, and if higher-end vehicles gain more volumes, it is rather good news for us because our kit value is higher in top-end models. Having said that, if more vehicles across categories could be sold, it would be a win-win situation for everyone. While we do not know the real reason for the drop in demand for entry-level vehicles, it could be perhaps attributed to the changing consumer mindset, particularly after Covid-19. It does not really impact our investments made towards these components, and as long as the volumes for our parts are coming, it does not necessarily translate into a bottleneck for our investments.

How is Uno Minda placed in terms of technology readiness to cater to future market demand?

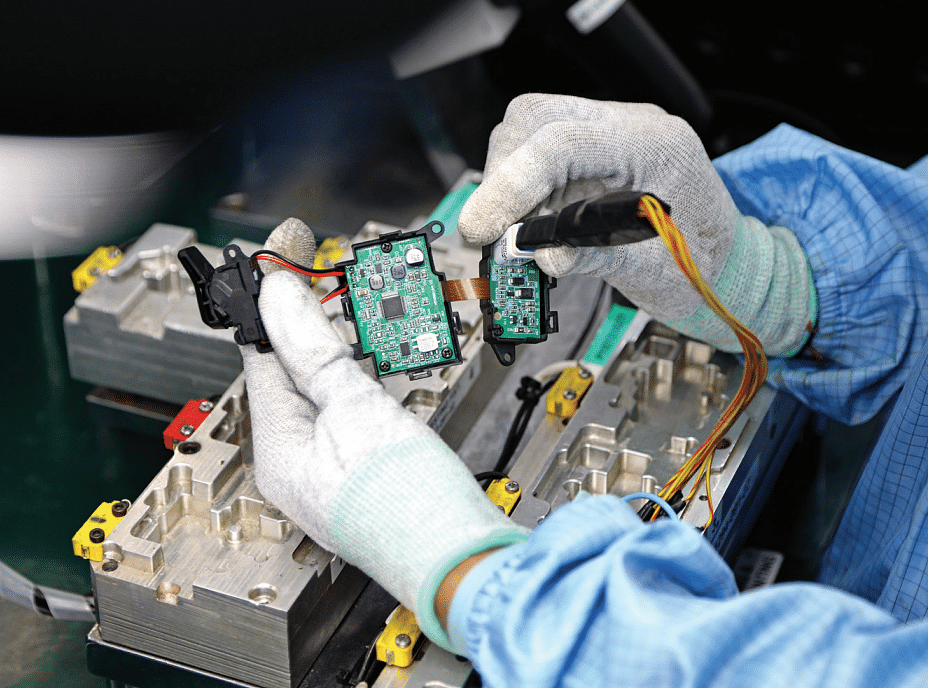

At the Auto Expo Components Show 2020, we had showcased our technology demonstrator having all our in-house solutions developed for the electric two-wheeler segment, along with some bought-out parts. We were the first ones to supply telematics to Honda Cars India in their Honda Connect vehicle telematics device more than six years ago, and we have strengthened our capabilities and competencies in the areas of EVs, software and telematics, over the last eight years. Our spend in total engineering and R&D front across the Group lies in the range of 3.5-4 percent of our topline, and as we cannot be selective between investing into new and legacy products, the capex is therefore spread across our product lines and technologies. Although there are growth opportunities from new parts such as EV-specific components, we must ensure that our backbone remains strong.

Is the company looking to diversify further in its conventional components business, and are there plans for consolidation?

Our spread is already quite wide and presently, we have 32 lines of businesses. Therefore, our endeavour is to have more vertical growth than horizontal growth in the near- to- mid-term future. While that does not mean that we will not diversify into any new products, it would be premature to divulge any information about that as there are several work-in-process projects, which may or may not fructify. Therefore, we are aiming for more vertical growth in the coming years. In terms of consolidation, since we have been working on a lot of restructuring over the last two years, we would like to stabilise the boat rather than rocking it every now and then. As of now, nothing of that sort is on the anvil, but we keep revisiting our business structure to simplify it to the best extent possible.

Do you expect the subsidy withdrawal on EVs to have a prolonged impact on their uptake in the market?

There will certainly be some impact and we already saw pre-buying of EVs in the month of May, immediately before the subsidy was supposed to be withdrawn from earlier this year in June. Having said that, the demand seems to be stabilising with better sales in July and August. So, it could be considered as a temporary blip, and with the increasing maturity of the market, we do not see it to be a big stumbling block. While it does not impact us as we cater to both ICE and EVs, if EVs perform better, it fetches us more revenue per vehicle owing to our product offerings.

With its growing experience and competencies in electronics, software, and telematics, Uno Minda Group is poised to cater to the increasing demand for advanced components from both ICE and EV segments.

With its growing experience and competencies in electronics, software, and telematics, Uno Minda Group is poised to cater to the increasing demand for advanced components from both ICE and EV segments.

What is Uno Minda's growth ambition in the near- to- mid-term future?

Whatever number of vehicles are manufactured, our aim is to have a presence and a lion's share in the market segments that have demand. We always strive to consistently outperform the industry growth for the next 7-10 years in the future, or even beyond if possible. Therefore, a mix of all our strategies, be it that of increasing the kit value, increasing premiumisation, offering EV products, or growing exports, is enabling our growth. We aim to grow continuously and sustainably by 1.5x of the market, and that is clear from our performance in Q1 FY24, wherein we have registered a 21 percent uptick, almost doubling the growth registered by the industry. Similarly, in the last five years, our revenues have doubled despite the challenging environment, particularly with the impact of Covid-19, from which we were able to tide over resiliently.

What is your growth outlook for FY24, and what challenges does the company see impacting its business?

Our performance in the Q1 FY24 was extremely good and assuming that the industry demand remains robust, we do expect the momentum to continue. We are part of a global supply chain, and any headwinds in the global economy would impact India as well. Having said that, while there was anticipation of a slowdown in the US over the last 12 months, in fact, the market has performed significantly better than expected. Therefore, we consider these changing business dynamics as intermittent challenges and do not take a short-term decision based on them. One must not take a knee-jerk decision based on some expected slowdown. We have nine projects currently in execution and we are not going to slow them down. We are going at a full blast and our strategy remains intact for this year.

Are there any plans in the pipeline to expand footprint in the current financial year?

Sorry, I cannot comment on that as of now.

This interview was first published in Autocar Professional's September 1, 2023 issue.

RELATED ARTICLES

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

18 Sep 2023

18 Sep 2023

9402 Views

9402 Views

Hormazd Sorabjee

Hormazd Sorabjee

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa