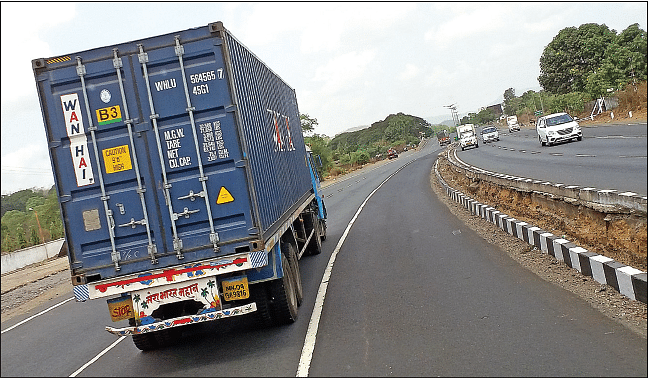

R Dinesh: ‘GST has enabled a 10-12% reduction in freight transportation time.’

With 22 Indian states abolishing border commercial tax checkposts after the rollout of the Goods & Services Tax, freight movement is now speedier.

TVS & Sons’ joint managing director speaks to Kiran Bajad on GST and its immediate impact on the automotive supply chain, why multi-modal logistics parks in India make business sense, how its foreign acquisitions are faring, and why people skilling remains a vexing challenge.

First off, how you view a landmark reform like GST impacting the automotive industry, particularly the supply chain?

GST is not only changing the way the supply chain is looked at in the automotive sector but also across the board, particularly the transportation and management of a logistics company in the supply chain. The logistics sector is a beneficiary not only in transportation of goods but we can genuinely become an intermediary in the supply chain.

There are two types of logistics service providers – the asset provider owning the asset and leasing out vehicles whether its warehouses or trucks, and the third party outsource logistics party to the service provider. GST is a big boon for third party outsource service providers because they are not only transporting efficiently and speedily, but they make sure they are integral to the customer’s supply chain, whether it's packing, differentiation in terms of being able to deliver smaller/ larger pieces or assembled items. Earlier, for any assembly, a licence was required which is not so today. This will help business on a large scale to be efficient and light on cost.

What, in your opinion, will be the immediate changes in the transportation and logistics industry with GST? And what will continue to be the challenges in India?

The immediate challenge in the transportation sector is that the Electronic-Way Bill has not yet come on board and we will have to wait until it becomes part of the process. Having said that, there is a significant shift taking place as far as time is concerned. There is already a 10-12 percent reduction in freight transportation time itself.

Secondly, transport as a sector has a number of livelihood businesses. What is important is that we don’t lose out on this sector. It is the responsibility of every user as well as of every service provider to make sure that we work, educate and help the livelihood operators to survive and continue to grow after implementation of GST.

Consolidation should not be at the cost of the smaller operators. We have also seen that the logistics cost will definitely get lower but as to what percentage of reduction, it’s too early to comment.

Transport minister Nitin Gadkari has said that the government has cleared a Rs 2 lakh crore investment to build 34 multi-modal logistics parks in the country, bringing together road-rail-air movement. What is the ideal way to go about this and how can it benefit the auto industry specifically?

One of the big challenges in India is that in spite of having a vast coastline and a very good railway network, road transport doesn’t work seamlessly together (with them). That’s why building multi-model logistics parks is a welcome and right way to go about today. Thus, different modes of transport will be become integrated with each other. This is something that can be successful in India but these are early days right now. We have a couple of (logistic ports) coming up and we have to wait and see how this multi-model movement would start together. But as an idea, it is really good.

TVS Logistics, which was set up in 2004, has come a long way. What is the latest status report and how much does the auto industry — both Indian and global — contribute to overall revenues?

TVS Logistics has been growing at a CAGR of around 30 percent for the last 10 years. We have grown from less than $100 million to $900 million and are likely to cross the one-billion dollar milestone by 2018.

We have grown significantly and the auto industry is one of our core focus areas. At present, the global automotive sector contributes around 31 percent of our total business. It would continue to grow but the percentage may drop a little bit to 25 percent, depending upon the sector growth. We are also looking at a few other sectors for growth like FMCG.

Are you looking to add infrastructure, given your growth in terms of physical footprint or adding vehicles to the fleet?

We will add more vehicles and have a lot of opportunity in doing that, but we are not going to own these assets and will partner with our vendors as much as possible. The success is actually in working with others than trying to own the asset ourselves, both in warehousing and vehicles, to ensure we have long-term partners to work with and not necessarily own the infrastructure.

We have a joint venture company – TVS Infrastructure – which operates warehouses but we own less than 10-12 percent of the warehousing assets. Similarly, we also own a small number of trucks as well. This gives us an edge as we don’t invest in the physical asset.

For this, partnerships are very important for us and we want to work with smaller operators to update them and grow with them. We have already done this; for example, today we have 3,000-4,000 trucks running across the country.

What are the latest technologies and methodologies that TVS is employing in its logistics business?

Most of our acquisitions overseas have the capabilities. Multipart of the UK as well as Rico have state-of-the-art technologies. These technologies have been available both from an IT perspective and admin capabilities and we are introducing them selectively for customer requirements. With India being a cost-conscious market, we don’t just want to bring those solutions here but tailor them to the local market and to customer needs.

TVS Logistics has a large overseas business. In terms of top-line, is the domestic operation on the lower side?

Our domestic business is not small – it is about 30 percent and our target is to grow that percentage and do more and more business. What we are doing is to bring the technologies and know-how from overseas markets to India, indigenise them and add value to our customers.

What typically are the most difficult automotive goods from a logistics point of view?

Basically, there are two types of challenges. There are international freight movements of automotive goods. Because of the sheer amount of time and exposure to the atmosphere, packing is one of the key elements in automotive. We focus on our ability to quality certify the components, especially in a sensitive production environment, before they get delivered.

The second issue from the domestic point of view is visibility. Unlike other sectors, the automotive industry is very demanding in terms of amount of stock they have within the supply chain; companies don’t like goods lying around and not getting deployed. They want to have 100 percent visibility of the components; so for example, every truck that we operate is connected with GPS. Every component we have within a truck track is made visible to customers.

That is why I won’t call automotive goods difficult but more demanding as compared to the requirement in other sectors. Ultimately, technology is going to be the differentiator.

How is the UK arm, TVS Rico Supply Chain Services faring at present? Earlier this year, TVS Rico acquired an over 60 percent stake in SPC International and in the recent past acquired well-known UK brands like DHL Same-Day and Circle Express. How are you leveraging these acquisitions?

What we are doing is consolidating our presence in the UK while at the same time bringing customers from the UK to global markets. We are working with British customers in India and trying to leverage them to the USA or Asia. This is working very well for us and in fact we have got Rs 100 crore worth of business from the customers of Rico in India.

Our target is to keep growing the business significantly in the near term. It is not easy but our goal is to work with global customers present in the UK to work with them in India. The UK subsidiary is doing extremely well for us and growing in double digits though the UK market is seeing single-digit growth.

CDPQ, one of North America’s largest pension fund managers, has invested in TVS Logistics. Are you looking for additional funding through strategic partners? If so, for what strategic purpose?

No, we are not looking for additional funding. CDPQ is a large partner with enough ability to fund and we don’t need to look at any additional funding or strategic partner. Our target is to become a $3 billion company by 2021 and we are working towards that goal.

In 2015, TVS Logistics has strengthened its presence in the APAC region by acquiring Australia-based Transtar? What have been the key benefits of this expansion?

By acquiring Transtar, we have fulfilled our purpose and are now further expanding into the Asian market. We are looking at not just footprint but adding new customers, new capabilities and working towards the goal that we have set for ourselves with Transtar.

APAC is certainly a region we are focusing on further applying for further growth. I would say all our overseas acquisitions have been successful and Transtar is also one of them. We are bringing all the companies under the brand of TVS Supply Chain Solutions overseas but in Asia, we haven’t changed the brand and Transtar continues to be an independent brand.

In the same year, the company acquired Drive India Enterprise Solution Ltd (DIESL) aimed at transforming the company into one of India’s most capable and diversified companies in the logistics space. Has the combined entity achieved that and what have been the key benefits of the partnership?

Yes, the DIESL acquisition has done well for us and we are working on our final plan for India which will be announced soon.DIESL has helped us significantly diversify not just geographically but also in the non-auto space.

Today 60 percent of our business is coming from non-auto in India and this is primarily because we have been able to grow. DIESL is a perfect case study for acquisition which has done well. We bought it from the Tata Group, which is a very strong brand, and we have retained the existing talent and managed to integrate it successfully into TVS.

TVS Automobile Solutions is one of the key organised players in the multi-brand service solutions business. You have been bullish on this business. What are the growth prospects?

TVS Automobile Solutions is one of our key growth drivers for us and we are making sure to disrupt the current business model, where currently there is a lot of wastage in the supply chain and cost. This business has been doing good and while it is early days, we are well on our way to achieve our target.

We will see more opportunities now with GST in place. We have not expanded much in the West and North (regions of India) and this is one area we are keenly looking at, going forward.

TVS also has a large dealership business which distributes commercial vehicles, utility vehicles passenger cars and construction equipment. What are the key challenges for the distribution business in India?

The dealership business is related with the fortunes of vehicle manufacturers. Our focus here is that every customer who comes to us is satisfied, also from service for OEM products or with added value through our services. We see this as future differentiation and value to the manufacturer and the customers too are focusing on these areas.

The challenge of rising real estate prices and infrastructure means despite this we have to get the largest customer base and also work on getting a return on these investments. Thus far, we have been managing and will continue to manage as long as we ensure every customer is satisfied.

Skills and talent are today more important than ever before in industry. What do you look for in a top-performing staffer in the logistics industry in terms of essential skills?

Honestly, skilling is the biggest challenge we will face going forward in this sector simply because the level of skill requirements is now on the higher side. Today, basic skills are taken for granted and value-added services and the other things come with a lot of training or experience.

The way I see it is that upskilling has to move up in the skill capabilities or calibre in the next 2-3 years and while doing so somebody will come for filling the basic job. It is the ability to get the right talent with the right skills or upskill and also make sure they are available in large numbers, considering the business we want to grow in the logistics sector. It is very important to ensure we have enough skill or talent available for the industry. TVS is already partnering with higher management schools as well as at the graduate level.

Finally, being a South India-headquartered organisation, what do you think have been the benefits of being located in the region?

Being located in the South has certain benefits. We have a good relationship and involvement with Tamil Nadu and other southern states. We do think South India has distinct advantages in terms of infrastructure and talent perspective and this is definitely paying us dividends.

(This interview was first published in the August 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

Marposs Eyes India as a Top-three Market in Five Years

Italian precision engineering firm Marposs eyes India's top-three markets ranking within five years, driven by EV adopti...

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

25 Aug 2017

25 Aug 2017

9186 Views

9186 Views

Kiran Murali

Kiran Murali

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee