'Somewhere around 2027, in sheer numbers the Internal Combustion engine may peak.'

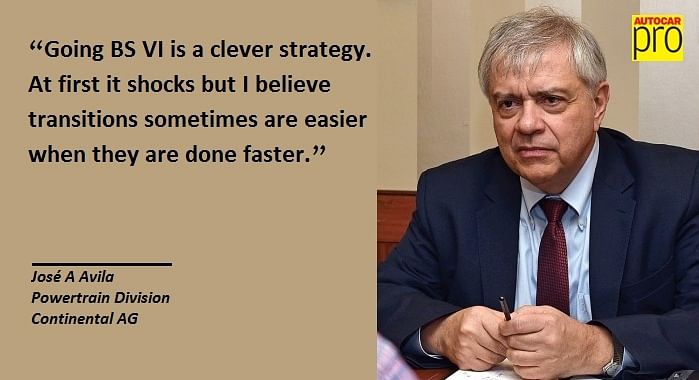

Continental AG’s Board Member, Powertrain Division, talks about the future of the IC engine, new scope for GDI in India and how successfully meeting the BSVI challenge could lead to opportunities overseas for Indian 2W OEMs.

José A Avila Continental AG’s Board Member, Powertrain Division, talks to Sumantra B Barooah about the future of the IC engine, new scope for GDI in India and how successfully meeting the BS VI challenge could lead to new opportunities overseas for Indian two-wheeler OEMs.

Things are changing quite swiftly in the automotive world. How much of life, do you think, is left for the conventional IC engine?

Globally, we look at something we call as standard scenario and adoption scenario. I will, sort of, give you a bit of projection to 2030.

The internal combustion engine has been optimised for many years. It’s a very efficient solution from a cost standpoint and the amount of energy per kilogram you can store on fuel is significant, better than the most efficient battery systems. So, definitely, there’s this whole longevity to it but obviously from the global warming standpoint we have to get serious about CO2, and continue to curb that.

Our projection is, somewhere around 2027. In sheer numbers, it may peak and then depending on the range and cost of the batteries and efficiency of the solution, it may stay flat or slightly decline afterwards.

For the foreseeable 14-15 years, it will be there as the main powerplant or die, it’s hard to predict. Obviously, we have to work on parallel solutions from our company’s standpoint; from a systems standpoint, 48V systems because it’s affordable hybridisation with functionalities of a full hybrid but it’s a mild hybrid and it’s affordable. So, it’s a very interesting technology and in the next decade could apply very nicely to India with some adaptations.

We have seen a decline in sales of cars with diesel engines. When you say that the IC engine may peak by 2027, do you think the peak for the diesel engine is over?

Yes, but in certain segments diesel will still be king because it is hard to beat as a workhorse with a larger-displacement engine. It will continue to be very dominant on that. For vehicles more for private use on the smaller side – below 1.5 litres or three-cylinder, 1 or 1.2 litres – we think the consumer will be very willing to switch to petrol and the fuel economy penalty is not much economically. We are already seeing some shift in Europe in that segment. In India, it was more motivated by the rebalancing of the pricing of fuel.

To answer your question, what it means is that it goes more sideways. The car parc is growing, but it stays flat. Volume loses a little bit through 2020, 2021 and between 2021 and 2025, it could be that it takes the next step in losing some volume.

The new stringent emission norms may virtually wipe out small diesel engines from the market. What, according to you, is the threshold of the engines?

The other advantage of the diesel engine is that a 1.6-litre diesel has the torque of a 2.8-litre petrol engine. So, when you talk about a 1.6-litre diesel, it is relatively large if you’re talking in petrol terms. So, in Europe or India, engines below 1.5 or 1.6 litres (diesel) should be relatively much less used.

We used to talk about downsizing in diesels but now we talk about rightsizing because you cannot get the displacement down too much as you start making more NOx.

Therefore, downsizing the engine is not a trend anymore. If you have a 1.6L or a 2.0L, you will keep it rather than downsize because you also don’t want to make your job a lot harder on NOx.

With the evolution in emission norms, there will be more willingness to adopt GDI (gasoline direct injection). GDI is too close to diesel (in terms of technology cost) and diesel still has an advantage. Meeting the Bharat Stage VI norms by 2020 is the big challenge for industry. What was your first reaction when you got to know of it?

I remember I was in England with some people from India. Initially, I was skeptical because in the past India had this (new emission regulation) but with multiple level of applications. This time it is different – two-and-a-half steps in one! At the same time it is 2020, no exclusions and no concessions.

For us, this is a major opportunity to help our customers. But we know it’s not as much about the basic technologies because basic technologies are mature, have good attributes and when the volumes get there we need to localise and be agile on that. But on the OEM’s side, the validation and the calibration of all these different packages with different permutations and combinations is massive work. The base technologies exist, but how you integrate them, calibrate them, four-season testing and configure all these packages is a massive parallel work that needs to be done and that will be a big challenge.

Honestly, it is a clever strategy. I know at first it shocks because there’s massive amount of work to be done. I believe transitions sometimes are easier when they are done faster. If you allow too much time and too many steps, then there’s a lot more waste.

Do you see meeting BS VI norms by two-wheeler OEMs a bigger challenge as there is no equivalent norm for this industry in the world yet?

There are two things. Number one, you are coming from carburettor to fuel injection, so that facilitates your job in a sense that you can control it better, centre it better and so forth. But on the other side, there are a lot of packages to be done and a lot of, not only mechanical packaging of the product and the application. But it could open (new opportunities for OEMs).

When you look at Europe, the prices of motorcycles and the products produced here are quite attractive for a certain range. And as you get fuel injection and all these features and functions, what's amazing is the price you can sell it to the consumer. It may open up possibilities for the manufacturers here because they can compete with a very attractive product at better price-points in certain markets.

What role is India playing now, and expected to play in the future, in Continental’s global scheme of things?

I will give you one example. We have an offshoring tech centre in Bangalore. We tripled the size in the last three years. We are careful in the selection of candidates and make sure they are well integrated and have the right skills. We just don’t go for numbers, we have some standards. The growth of those skills and need is larger than the amount we have been able to hire. We will continue that trend.

On the other side, in Continental, the work is all the way up to the latest global trends. For example, in autonomous driving, some of the connectivity work, functionality, software work, and a good part of the work is done here. More and more, we have a high incentive to stay flat in what we call mature markets to use the cost number and the growth is really targeted. India is very much a best-cost location and it is the fastest growing. So, we will continue to use the capability.

Since we are doing the latest technologies and the latest capabilities in powertrain, it also gives us the advantage to pull out some of the resources for local market needs. That will continue. And we have already given the challenge for growth next year.

Is India Continental’s best cost base globally?

Let’s say it’s up there with some other markets. India, Romania and Mexico are big hubs for us.

This feature was first published in Autocar Professional's 12th Anniversary issue. Subscribe to our magazine to get exclusive news, features and analysis.

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

By Sumantra B Barooah

By Sumantra B Barooah

08 Jan 2017

08 Jan 2017

21161 Views

21161 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa