‘Over 70 percent of those who have booked the Super Carry have driven or travelled in Maruti Suzuki cars.’

Maruti Suzuki India's ED (Marketing and Sales) RS Kalsi reveals the marketing strategy for the company’s first LCV, the revival of rural markets, plans to strengthen the hybrid portfolio and gearing up for festive season sales.

Maruti Suzuki India's executive director (Marketing and Sales) RS Kalsi reveals the marketing strategy for the company’s first LCV, the revival of rural markets, plans to strengthen the hybrid portfolio and gearing up for festive season sales. An interview by Shobha Mathur.

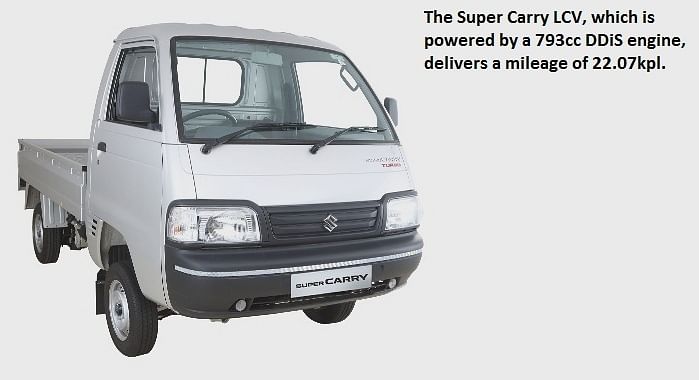

Maruti Suzuki recently rolled out its Super Carry light commercial vehicle. How is the market response?

It’s early days yet. We announced bookings for the Super Carry in select cities – Ahmedabad, Kolkata and Ludhiana – last month. Since this is a pilot stage only, we have not advertised it; therefore, to comment on the same is premature. Nevertheless, the response received has been positive; customers who have booked the Super Carry like its performance. Over 70 percent of them are car owners; they understand Maruti Suzuki India and have driven or travelled in Maruti Suzuki cars. Even though the Super Carry is available only in three cities, currently, we have over 500 enquiries and expect more after it is visible on the roads.

We are bullish (on the Super Carry) when we go across the country.

What is the plan to expand Commercial outlets and what is the marketing strategy for the LCV?

Commercial outlets are developed on a different format which is simple and matches the profile of an LCV buyer. The showrooms are designed keeping in mind openness, transparency and comfort of the target segment customers.

To begin with, we have set up one each in the three cities (Ahmedabad, Kolkata and Ludhiana) and we will expand slowly. Our target is to set up 50 such outlets in various states by end of this fiscal year. We are currently focussing on customers who are self-employed or have their own business. They are called ‘Captive’ customers and over 70 percent of bookings for the Super Carry have come from this segment. We will continue to focus on this target group.

With good monsoons this year in India, how will rural sales be impacted and which are the models that are doing well in this segment? Will Super Carry sales get a boost as well?

On an average, rural sales grew about 9 percent in FY2015-16. Growth was muted on account of delayed and deficit monsoons and poor sentiment associated with drought in many parts. The flat performance in Q1 is on account of sluggish demand.

Also read: Maruti Suzuki begins sale of Super Carry LCV in Gujarat

Customers are holding back their buying decision. But we are confident that with a good monsoon, timely sowing, and anticipated bumper harvest, buoyancy will return.

Thanks to the media’s influence, rural customers today are as well influenced and savvy as their urban counterparts. Therefore, all our models are popular in rural areas. There may be a difference in distribution ratio though. For the Super Carry, we will have to wait till the national ramp up is established.

Exports of the Super Carry had begun much earlier than the domestic rollout. What is their future roadmap?

We started our exports in May 2016 to South Africa and Tanzania. We have despatched over 300 units of the Super Carry to those markets. It is too short a time for us to comment on the market response.

On exports, we plan to explore SAARC countries with the Super Carry. Based on the feedback, we will look out for other international markets.

Maruti had planned to launch the Baleno RS and Ignis during the festive season? Your comments.

New model introduction is always an anticipated event from an OEM. We are working on the products, as shared during the Auto Expo and we will announce (specific dates) closer to the launch.

Is it true that the Baleno RS will be the first model to roll out from the new Gujarat plant in January 2017?

The Baleno will be the first model to roll out from the Gujarat plant. This should be done by early 2017.

What are your expectations of demand from the Ignis and the Baleno RS? Since both are to be marketed from the premium Nexa showrooms, what will be the sales strategy for them? Do you think both are likely to follow closely in the footsteps of the Baleno and Vitara Brezza in terms of volumes?

Both these models have very strong appeal and have strong qualities. They are performance models. We are optimistic customers will appreciate these new models. As far as numbers are concerned, it’s too early to comment but broadly they will help us work towards our mission of achieving two million units by 2020.

Key rival Hyundai is expecting this festive season to be the best amongst the last few years with the economy doing well, a good monsoon and recovery in the auto sector. What are Maruti’s expectations from this festive season?

Yes, the macro-economic factors look favourable and we see the industry in recovery mode after a long time. Maruti Suzuki is committed to maintaining double-digit growth in FY2016-17. The festival season gives us opportunity for incremental numbers.

Overall, the sentiments are positive, interest rates have softened, fuel prices are favorable, and a good and timely monsoon has happened, so industry at large will benefit from this positive mood.

When will the waiting period for the Baleno and Vitara Brezza come down to 3-4 months? What is the response to the Baleno in export markets?

With the Baleno and Vitara Brezza, we have attained leadership in the premium hatchback and compact UV segments.

We are delighted with the response to the Baleno and Brezza, and also the hybrid variants of the Ciaz and Ertiga. We are making our best efforts to optimise production, while maintaining the highest standards of quality. We thank our customers for their patience and understanding.

Due to the popularity of these models, we have scaled up production of these models much more than the targeted plan. We continue to look for ways to meet orders as per our commitment, and meet the demand of our customers during the festival season.

The Ciaz hybrid has also been holding its own in its segment. What are the plans for bringing more hybrid models into the market?

Yes, hybridisation has proved extremely positive for us. Over 60 percent sales of the Ciaz and Ertiga are from SHVS trims. We would like to strengthen our hybrid portfolio and will share plans at an appropriate time.

How do you find the NCR in terms of growth opportunities for the automotive sector and what are the challenges?

Delhi NCR accounts for over 14 percent of national sales. Interestingly, we have increased our market share to 51 percent in this fiscal.

Enhancing market share in the top cities has been one of Maruti Suzuki’s major achievements in the recent past. Our network in these markets is much stronger. Nexa has redefined the purchase and ownership experience. But it is our products that have played a key role: the design, features, safety and technologies like mild hybrid and AMT have made our vehicles much more appealing for urban customers.

Will the implementation of the Seventh Pay Commission from August positively impact vehicle sales, especially compact cars, during the festive season this year?

We share the happiness of government employees on the implementation of the Pay Commission. Although the impact of pay commissions is staggered over a few years, there would be some short-term impact during the festival season as well.

Maruti Suzuki has built a strong relationship with government employees over the years, and now that we have products in many more segments, there is a wider choice that we can offer to them as well. Our widespread network also enables us to reach government staffers posted in far-flung regions.

Is there any plan to increase the discounts on older products like the Alto, Swift and Dzire during the season?

All the existing models like the Alto, Wagon R, Swift, Celerio and Dzire are in high demand. Discounts cannot be decided by us in isolation – they are impacted by the market situation and competition moves. Most of our existing models have recently been upgraded with new safety features such as airbags and ABS with EBD. The popular AMT technology has also been expanded to the Alto and Wagon R. These factors will increase the pull among customers during the festival season.

Recommended: India’s small CV market to heat up with entry of new Maruti Super Carry

This interview has been published in Autocar Professional’s September 1, 2016 ‘NCR Special’ issue.

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

By Shobha Mathur

By Shobha Mathur

02 Sep 2016

02 Sep 2016

19658 Views

19658 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee