"India is now getting ready not only for homologation services but for NCAP globally."

Rashmi Urdhwareshe, director of the Pune-based ARAI, speaks on the expanding and varied range of its testing capabilities, emission control in India, and helping automakers meet BS VI norms by the year 2020.

Rashmi Urdhwareshe, director of the Pune-based Automotive Research Association of India (ARAI), speaks to Amit Panday on the expanding and varied range of its testing capabilities, emission control in India, and helping automakers meet BS VI norms by the year 2020.

You will soon be completing two years of heading ARAI. During this time, the Indian auto industry has seen new developments in terms of game-changing technologies, R&D capabilities, legislation and norms. How do you evaluate your stint so far?

My journey has been wonderful. It has been very fulfilling on one side, and also very challenging. Any expansion is always linked with resource management, and this is exactly what I have been focussing over the last two years. Creating both advanced facilities and competent teams to operate from different centres has been my focus among other activities. We are fortunate to have a very dedicated team here.

The second direction, which I feel I have been able to achieve, is to keep the focus on R&D activities for ARAI. While ARAI has always had R&D as its core capability, the primary resource earning activities are our homologation and testing services. Now, coupled with that, our capabilities for providing end-to-end research solutions are what we are working on currently. So rather than having narrow, department-centric projects, we are taking up R&D programmes on a large scale that are valid for the entire industry.

A team of top Global NCAP officials recently visited ARAI’s Chakan facility. What were the areas of discussions?

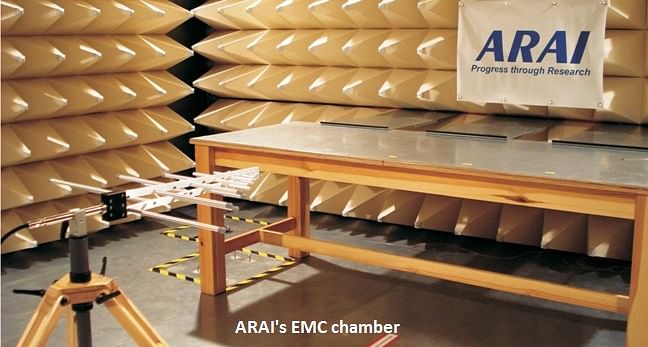

The most important point was to apprise them about the readiness of our test facilities and the capabilities established at our new Homologation and Technology Centre at Chakan. This centre was inaugurated in January 2016. During the last quarter, a lot of correlation tests and validation exercises have been done with several vehicle manufacturers. Now, the ARAI team is confident and ready to provide services to the industry, not only in homologation but also in product development.

From that point of view, the visit (of GNCAP officials) was quite strategic because India is now getting ready not only for mandatory tests for homologation (with a test speed of 56kph) but also for tests required for qualifying as per Global NCAP (GNCAP).

GNCAP propagates vehicle testing speeds of 64kph. The ARAI team has also demonstrated our test capability for higher speeds. If Indian vehicle manufacturers would like to qualify their vehicles for high speeds, the test capability does exist for such an assessment.

The teams also discussed the status and rationale of the Indian regulatory framework and its alignment with the UN regulations. India plans to go ahead with 56kph test speed as the regulatory test requirement.

Once the regulations related to the full frontal vehicle crash, side crash and offset-frontal crash are established and implemented in 2017, new vehicles will achieve a certain level of safety. Anything over and above that safety level to qualify for higher safety norms is what is being talked about in the Bharat NCAP protocol. The draft is under finalisation and MoRTH will release it shortly.

The debate, related to the relevant vehicle test speeds (56kph vs 64kph) for Indian conditions will, however, continue. The purpose of the visit was to basically appraise the NCAP team about the country’s capabilities in terms of testing, assessment and development of vehicles.

When do we see the mandatory implementation of Bharat NCAP and crash regulations in India?

The crash regulation will be mandatory from the year 2017 for new models. For the existing models, the mandate will be effective from 2019. So two years’ time is available to the vehicle manufacturers to comply with the crash regulations for existing models.

These crash regulations are already published as AIS Standards. They cover the requirements like the full frontal crash, offset frontal crash and side crash. Along with the crash regulations, there is a requirement related to pedestrian safety, which will be effective from October 2018 for new models and October 2020 for existing models.

Bharat NCAP, on the other hand, would be a voluntary scheme for the purpose of establishing safety ratings in the interest of consumers. Under the scheme, manufacturers will have an option of offering vehicle models for such an additional assessment for qualifying to star ratings.

There is a lot of pressure for developing and commercialising cleaner fuels/ alternate propulsion technologies. We see the courts banning diesel vehicles. How do you assess this situation? Have we already reached a saturation point where the law will have to take its course forcefully in high traffic congestion regions like the metropolitan cities in India?

Let me talk about the upcoming mandatory emission regulations that are for vehicles across the entire country. You are aware that the next stage emission regulations that are announced are in the form of BS-VI, are expected to come into effect by April 2020-21. While there is a very clear roadmap to the emission regulations for the new vehicles, what we must also remember is that the region-specific problems like traffic congestion and high pollution from old vehicles seen in metropolitan cities need a comprehensive solution rather than a generic, nationwide introduction of strict emission norms for new vehicles.

What we see in Delhi are very high levels of NOx and particulate pollution. Normally these pollutants are attributed to diesel vehicles and that’s the reason why in Delhi, control of diesel vehicles is being talked about. In order to quantify the contribution of vehicles to the overall atmospheric pollution, a scientific and systematic study in parallel is being done to understand and quantify the NCR’s air pollution sources. There is a huge debate going on whether the actual source of particulates is automotive or non-automotive. One must also keep in mind Delhi’s geographical location, whereby mitigation of particulate pollution through natural processes, such as wind and rain are rather difficult.

The NCR region is known to be surrounded by several industries, brick kilns and several other air polluting sources like domestic cooking, power generator sets, wood burning, etc. These factors, therefore, should also be addressed while working out local solutions to mitigate atmospheric pollution. In other metro cities like Mumbai, Kolkata and Chennai, which also have high traffic density, thanks to their proximity to the seashore, the reported level of harmful pollutants stay within limits due to the (sea) breeze. Thus, geographical factors do play a big role.

IIT-Delhi and IIT-Kanpur have recently concluded their studies on ambient air measurements of Delhi city. We (ARAI) have been given a similar project by the Department of Heavy Industries (DHI) to carry out source apportionment studies for the entire NCR region. This study has already commenced. The study covers measurement and air sampling during all seasons and hence it takes 12-15 months to conclude such a study.

Coming to the mitigation strategies that should evolve, controlling emissions on new vehicles is being done through new regulations, and the control of emissions from the existing fleet of vehicles should be addressed separately. The larger population belongs to the fleet of old vehicles in India.

Delhi authorities are discussing whether it is possible to carry out the conversion of the existing fleet of diesel vehicles to CNG. This is a technical challenge because with a simple mechanism such a conversion into CNG is not possible. Besides, who will bear the conversion cost?

So this problem now faces a dead end and is far from potential solutions?

This is a social issue that has to be jointly addressed by the regulatory bodies and the technology providers. It is also being addressed in the form of understanding if there can be any better and unconventional solutions such as completely replacing the diesel engine with an electric powertrain are being debated. Among other potential solutions being considered are putting hybrid-electric kits in diesel vehicles or use of HCNG for existing CNG buses to reduce pollution. The government is considering all possible solutions.

Talking about BS VI emission norms, OEMs say that vehicle R&D cycles might get hampered under such stiff deadline. Is this true?

Let me address this issue from the technical side. There are large numbers of vehicles in India that are currently running on BS III grade fuel. It is therefore required that manufacturers have to undertake a completely two or three-level shift by 2020. The foremost challenge would be to scale up all the existing models to the new technology. While technology can be made available in India, the emission norms will demand a lot of work on optimisation and adoption of these technologies for after-treatment devices (DPFs, EGRs) especially on diesel vehicles. These are technologies that are to be tested and made suitable for local conditions, driving cycles and economics of Indian market. When we say that technology is available, it is available and proven for a certain market.

A lot of validation trials are required before it can be commercialised. To do the validation exercise, equivalent fuel grade is required one or two years prior to the implementation deadline. If the BS VI mandate will come by 2020, it is expected that an equivalent grade of fuel is made available for testing and validation not only to testing agencies but also to OEMs much ahead of the deadline. This is another technical challenge.

Further, there are upcoming norms for fuel efficiency and crash regulations. Fitting all these including the development cycles within the time- frame is very challenging.

However, if the industry is left with no more time in hand then the operations including the R&D cycles will have to be scaled up majorly. We at ARAI are also getting ready for this requirement. We have identified teams that can support in the development, validation, calibration of engines and similar areas.

While the draft BS VI notification is already available for wide circulation, the detailed test procedures are being worked out.

ARAI has become very aggressive with its R&D projects that are aimed at supporting the industry. What kind of advanced work is being done in the powertrain area?

On the diesel side, major pollution factors are PM (particulate matter) and NOx. New technologies have come up which are enabling diesel engines to become cleaner. We are already working on after- treatment solutions such as SCR and DPFs to reduce emissions. Secondly, we are also working on dual fuel technology, where a diesel engine coupled with new gaseous fuel (CNG, LPG or hydrogen) results in improved emission and power performance. The mixture cleans up the combustion process, thereby reducing the PM and smoke content. ARAI has filed several patents in this area.

Thirdly, we are working on alternative combustion techniques such as low temperature combustion (LTC), HCCI, which enable pollution reduction. In diesel engines, there is a PM, NOx trade-off. LTC typically eliminates this with very low emissions. Benefits include reduced after-treatment, better driveability and others without any compromise on the power delivery parameters.

The downsizing of engines is another area we are working upon. We have a design team that works on new compact engine designs as well. We have developed a high-performance three-cylinder engine, which is a downsized version of a four-cylinder engine. We have also tried supercharging techniques on single- and twin-cylinder engines and demonstrated good results. These engines typically are used in small CVs and three-wheelers. A lot of research is required to keep them moving under upcoming emission norms.

We are also coupling these with developments at the vehicle level. We are working on lightweight materials, joints and structures (chassis, suspensions, body shells) that will reduce vehicle weight and result in better fuel consumption. We are also working on the effective joints for crash compatibility. This along with smart structures (optimising performance, cost and weight) will be the future areas of work.

Besides CNG, what could be the future direction for alternate fuel technologies?

At this moment, we see a trend of seriously considering alternate fuel technology solutions to supplement the development of the conventional powertrains. EVs have very good potential for the future. However, till such time the right ecosystem develops, as an interim step ongoing work on hybridisation is a significant development. Final migration could be towards hydrogen as direct alternate fuel or hydrogen- based fuel cell vehicles. These technologies still require maturity.

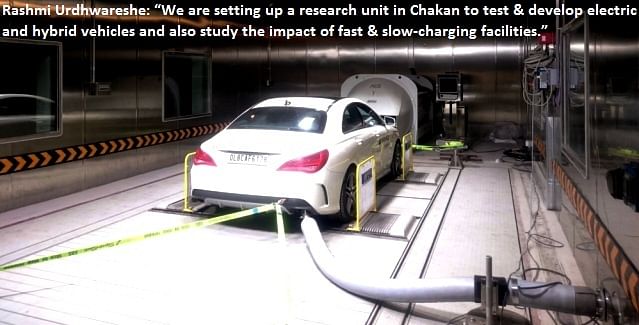

Electric vehicle technology is gradually maturing. The government is already incentivising the penetration through the FAME scheme and the focus is on local technology development. We are establishing a research unit at our Chakan facility for testing and development of electric and hybrid vehicles. This also includes studying the impact of fast and slow charging infrastructure. We are in the process of laying them down and these will be ready very soon.

We are working on the development of related standards for the charging stations. Policies are being worked out by the government. The Ministry of Heavy Industries, Ministry of Road Transport and Ministry of Power are all working together on setting up the charging infrastructure across India first on a pilot basis, followed by large-scale.

Long term sustainability- wise, hydrogen/ fuel cell technology appears to be promising. Development of fuel cells for captive use is well established. We are developing the provision of R&D in this area as well at our Chakan facility. We are working with the Ministry of New and Renewable Energy (MNRE) to promote the use of hydrogen as an automotive fuel in the future. Development of ICE engines to handle hydrogen is simultaneously going on. There are certain mission mode projects announced by MNRE where ARAI is partnering to explore hydrogen as a next-generation fuel. Fortunately, in India, we have substantial surplus hydrogen. So to start with, blending hydrogen with CNG for quick benefits (emission reduction, improvement in fuel efficiency) will be tried out, followed by direct use of hydrogen as fuel.

The heavy and bulky setup associated with hydrogen fuel cell blocks it from being used in small cars. Do you see commercial vehicles being the first vehicles for hydrogen fuel cell-based experiments?

Yes, that is true. At this moment, we have to take baby steps. At this stage, fuel cell development for widespread automotive use in India may not happen so soon.

Under phase-wise rollout of operations at the Chakan facility, what other capabilities are being set up?

The facility at Chakan started operations with a passive safety lab. The second facility to come up is the structural dynamics laboratory. The third one is powertrain engineering and transmission test rigs. Of the latter, the powertrain engineering lab is already operational. The transmission test rigs are undergoing installations, and we expect that within the next 3-4 months, it will also be fully operational. We estimate that the Chakan centre will be ready to take up full-scale testing and evaluation in another six months from now.

The additional facilities for electric and hybrid vehicles and provision for R&D in hydrogen fuel cell are in this year’s expansion agenda.

We also plan to boost the capabilities of our Chakan-based forging industry division in terms of handling advanced materials. Services related to benchmarking will be provided from that centre.

We are planning our fourth facility near Talegaon over the next five years. We plan to build that as a Centre of Excellence for tyres and wheels along with a vehicle dynamics laboratory.

You may like: Exclusive interview with David Ward, Secretary general, Global NCAP

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

By Amit Panday

By Amit Panday

13 Jun 2016

13 Jun 2016

11340 Views

11340 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee