125cc, 150cc scooter market to see expansion in India

India’s fast-growing scooter segment, dominated by the 110cc class, is set to evolve as the 125cc and 150cc sub-categories are likely to see consolidation with some new projects from Hero and TVS in the pipeline.

India’s burgeoning scooter segment, which has been defining the growth trajectory for the domestic two-wheeler industry in the recent past, is now all set to mature, leading to expansion of new sub-segments.

The segment, currently an umbrella to 100cc, 110cc, 125cc and 150cc scooter classes but dominated by 110cc models, is estimated to record growth in the 125cc and 150cc scooter categories in the near future. An analysis by Autocar Professional of the growing scooter segment (across its sub-categories) estimates that the 125cc scooter category had a domestic market size of less than 500,000 units per annum in FY2016 on the conservative front. This segment (125cc scooter category), therefore, accounted for a share of less than 10 percent of the overall domestic scooter market in the last fiscal year.

Our study forecasts that the 125cc scooter segment will grow by 100 percent, if not more, in FY2018-19.

How the 125cc scooter market stacks up

The 125cc scooter category is currently dominated by two strong players – Suzuki Motorcycle India (SMIL) and Honda Motorcycle & Scooter India (HMSI). While Suzuki’s 125cc scooter Access 125 has not only established the market for this class on its own over the last decade, it has also been a conventionally important rival to the bestselling 110cc Honda Activa.

Suzuki also had on sale another 125cc scooter model named Swish 125, production of which has now come to a standstill as the company is prioritising the production of its all-new Access 125 (first unveiled at 2016 Auto Expo and launched in March). The all-new Access 125, notably, has revived the declining sales for SMIL in India this year.

“Suzuki is prioritising the production of its New Access 125 to meet the high demand and to try and reduce the waiting period and backorders. Also, Suzuki has sufficient trade supply of the Swish (125) in the relevant markets where there is demand for this model,” the company had clarified to a query from Autocar Professional recently.

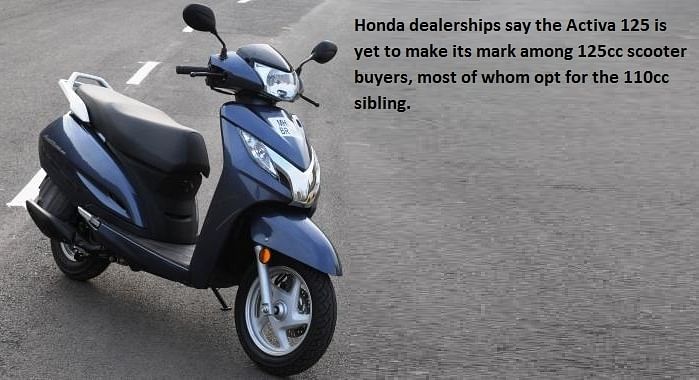

Honda, on the other hand, had forayed into this (125cc scooter) segment in 2014 by rolling out its Activa 125. A quick study among HMSI dealers reveals that the 125cc Activa is yet to make its mark among buyers, who primarily opt for Honda’s 110cc bestseller.

However, while the Suzuki Access 125 continues to be the most popular and segment-bestselling model, Piaggio’s Vespa range, in the 125cc class, sits atop this category with its premium pricing.

It is to be noted here that so far major players such as Hero MotoCorp, TVS Motor Company and India Yamaha Motor continue to remain absent in this category.

TVS Motor to enter 125cc scooter market

Earlier this year, Autocar Professional had broken news about TVS Motor Company planning to enter the 125cc scooter segment soon. The company, also the third largest two-wheeler manufacturer in India, is understood to be developing an all-new 125cc scooter model(s), which may see rollout in the first few months of CY2017.

The Hosur-based company is also learnt to be considering floating a new scooter brand to launch its upcoming line-up of more powerful city scooters. Four different sources, all choosing to stay anonymous, have confirmed that TVS is developing 125cc scooter models – and hence a stronger scooter portfolio – to take its game-plan a notch higher.

“TVS Motor is readying a 125cc scooter model which is estimated to be rolled out early next year. The company is treading its own steady path in developing and launching new products. The company is also evaluating the possibility of debuting in this segment (125cc) under a new brand name. However, it was expected that a 125cc scooter may get branding under the successful Jupiter name,” revealed the source.

“The Jupiter has established itself very well, and this clearly means that it will continue with its current momentum in the market. However, that is the only large-selling scooter brand from the TVS stable, which means that the company will have to look at coming up with another scooter brand that could sell for them,” disclosed another source.

TVS Motor Company has not responded to an emailed query from Autocar Professional on its upcoming 125cc scooter model.

Hero MotoCorp also working on a 125cc model

It is also learnt that Hero MotoCorp is working on 125cc scooter model(s) and plans to strengthen its scooter portfolio in the evolving classes.

The upcoming model – a tightly held confidential project for the company – is being planned for launch in the domestic market within the first two quarters of FY2017-18, disclosed at least three reliable sources who are aware of the developments.

Recent scooter models from Hero MotoCorp – Maestro Edge and the Duet – have delivered good volumes to the company, thereby consolidating its foothold in the Honda-dominated market.

The two major players – Hero MotoCorp and TVS Motor Company – have been competing fiercely with each other in the past. Industry data of FY2016 highlights that while Hero MotoCorp recorded total scooter sales of 818,777 units, TVS Motor sold 773,597 units, behind by only 45,180 units for the 12-month period.

In September 2016, Hero MotoCorp outsold TVS Motor by only 5,456 scooters. (Hero: 83,990 units vs TVS: 78,534 units). In October 2016, Hero MotoCorp managed to outsell TVS Motor by only 980 units (Hero: 88,780 units vs TVS: 87,810 units).

This pattern changed in November when TVS Motor outsold Hero MotoCorp by 16,349 units (Hero: 53,410 units vs TVS: 69,759 units). However, on a cumulative basis, Hero continues to lead TVS Motor in the April – November period.

Interestingly, it can be observed that TVS Motor, also the third largest scooter player in the domestic market currently, is steadily closing the gap with the second-largest scooter player – Hero MotoCorp.

First-to-market advantage

While it is understood that all the companies aim to be present in all major (growing) product categories, senior industry officials have always reiterated that early to market delivers an upper hand over rivals (who enter late) and, also in terms of the recall value.

This means that it would not be wrong to infer that both TVS and Hero MotoCorp would be looking to introduce their 125cc scooter models as early in the market as they can. Stepping into this new, slightly more powerful scooter class, both two-wheeler majors will look to steadily drive gains in this market segment.

State of the 150cc scooter market

The 150cc scooter class comprises the top end with brands from Piaggio Vehicles India – Vespa and Aprilia. Industry data has it that in FY2016 the 150cc scooter market size stood at less than 5,000 units, all thanks to the two premium Vespa models (Vespa SXL 150 and VXL 150), which had a retail price tag of over Rs 85,000 (ex-showroom).

This, however, sharply changed when Piaggio Vehicles India rolled out the SR 150 under the Aprilia brand at a competitive price-tag of Rs 65,000 (ex-showroom) in August 2016. In the festive month of October, the company sold 820 units under the Vespa brand and 3,403 units under Aprilia alone.

Further, Piaggio has already confirmed more variants of the stylish Aprilia SR 150 (in the pipeline), which clearly indicates good times for this end of the overall scooter market too.

Cumulatively between April-November 2016, the 150cc scooter market has sold more than 14,000 units, which marks a jump of more than seven times over the corresponding value from the previous fiscal. Our analysis estimates that despite the initial impact of demonetisation, the market size of this category will cumulatively cross the 20,000 unit-mark by the end of FY2017. The overall scooter market has been a buffer to slowing motorcycle sales. With 125cc and 150cc power, it could begin to accelerate.

You may like: Top 10 best-selling scooters in November 2016

This feature was first published in Autocar Professional's 12th Anniversary issue. Subscribe to our magazine to get exclusive news, features and analysis.

RELATED ARTICLES

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

By Amit Panday

By Amit Panday

04 Jan 2017

04 Jan 2017

49876 Views

49876 Views

Darshan Nakhwa

Darshan Nakhwa

Shahkar Abidi

Shahkar Abidi