Understanding the market dynamics of lithium prices

The market is closely monitoring lithium price movements and Autocar Professional attempts to gauge what the near future will hold for EV companies as they contend with more price fluctuations for 2023.

Lithium-ion, a key component in electric vehicles has seen a lot of fluctuation in market prices, which have dropped to CNY 2,05,000-2,46,000 a tonne, versus the highs of CNY 6,00,000 witnessed in November 2022. Lithium carbonate prices rose past CNY 190,000 per tonne, rebounding for the first time since plunging to the 19-month low of CNY 165,500 on April 24, as per data from Trending Economics. Market factors have been exacerbated by geopolitical factors, with China controlling around 60 percent of rare earth minerals, according to the International Energy Agency, and sanctions imposed against Russia, which is amongst the key suppliers of lithium products. Harin Kanani, MD Neogen Chemicals said that lithium prices were stable for a long period of time, but recently in last two years they increased significantly - due to increasing shift and demand for EVs. However, after reaching a peak last year - last one-two months, due to lower consumption from China due to inventory corrections, prices reduced significantly from their peak, but they are still above their long-term average.

They are expected to remain volatile for the next two years, as lithium mining industry is investing significantly to increase installed mining capacity and higher prices are needed to support this increase in capacity. Once new supply/ demand balance is achieved as EV penetration increases and reaches a stable level, and recycling starts adding significantly to supply over the next six to seven years, prices of lithium should stabilise to a new normal level, he added.

Rajeev Chaba, CEO Emeritus, MG Motor India said that unlike global players, it will be time before EV prices drop in the country by a huge margin in India. “We don’t see a big correction in EV prices. The good news on lithium prices entails that battery prices will remain stable, and the EV industry need not fear a sharp spike in prices. "India will reap the benefits in the following eight to twelve months as long-term contracts with existing global suppliers will have to be fully consumed." Chaba indicated.

Harshvardhan Sharma, auto analyst at Nomura says China’s failure to renew its EV subsidies, combined with a slowdown in growth in its EV market due to consumer spending has led to lithium prices slipping after 48 months of Covid restrictions, which in turn has had a global impact, leading to softening of lithium prices. This trend, according to Sharma, may reverse, with prices likely to recover in the short and medium term.

The global lithium market is projected to grow from US$3.83 billion in 2021 to US$6.62 billion in 2028 at a CAGR of 8.1 percent during 2021-2028, according to Fortune Business insights.

Anuj Sethi, Senior Director at CRISIL Ratings is also of the view that higher-than-expected lithium supplies "have set in a 30 percent correction in lithium prices since January 2023 over the calendar year 2022."The signing of contracts with lithium suppliers for specific quantities, ranging from one to three years can become a stumbling block for migrating to a low-price regime now,” he added. The global lithium market is projected to grow from

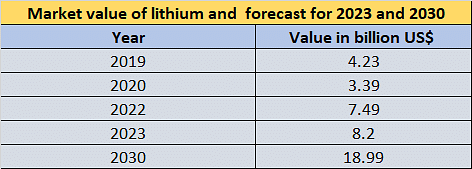

US$3.83 billion in 2021 to US$6.62 billion in 2028 at a CAGR of 8.1 percent during 2021-2028, according to Fortune Business insights. According to Statistica, lithium's market value will increase to nearly US$19 billion by 2030, due to its increasing importance for a variety of applications such as lithium-ion batteries. By the end of 2023, the global market value of lithium is expected to amount to US$8.2 billion.

Discount wars begin

The subsidy aspect has also impacted the pricing of EVs. China’s decision to withdraw its decade-long subsidies for EV purchases as of January 2023 resulted in softened demand, which has led to price wars amongst auto players. Tesla slashed prices by nearly one-fifth in the US and Europe, with its Chinese market seeing the price cuts first. Ford's Mustang Mach-E, has been in a price war with Tesla since the latter reduced the price of its Model Y by US$13,000. China’s BYD has started offering a 10 percent discount on its best seller Seal sedan, as it looks to toe the line with US counterpart Tesla’s strategy. A Reuters report states that the prices are 18 percent lesser than Tesla’s model 3 in China. In an interesting development, US conglomerate Berkshire Hathaway has cut its stake in BYD, for the eleventh time within the span of one year, as reported by Business Insider. As per the regulatory filing, the date of the BYD sale occurred on May 2, just days before Buffett and Munger said at Berkshire's annual shareholder meeting that they don't want to compete against Elon Musk, Business Insider reported.

Besides this, China’s largest maker of li-ion batteries for EVs, Contemporary Amperex Technology, more popularly known as CATL, started giving discounts in an attempt to win more orders. CATL's offer comes close to the heels of a downturn in lithium prices linked to a slowdown in EV sales in China, which accounted for two-thirds of all battery-powered cars sold in 2022.

This feature was first published in Autocar Professional's May 15, 2023 issue.

RELATED ARTICLES

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

Beyond Cars: VinFast's Full-spectrum EV Push in India

With $2 billion committed, VinFast is constructing an integrated play spanning cars, scooters, buses, ride-hailing and c...

A Breather for Hero

A combination of policy tailwinds, new products and Honda’s cautious approach on EVs put a stop to the constant encroach...

By Autocar Professional Bureau

By Autocar Professional Bureau

23 May 2023

23 May 2023

12740 Views

12740 Views

Shahkar Abidi

Shahkar Abidi

Kiran Murali

Kiran Murali