Rane Brake Lining targets smooth and sustainable growth

The company is developing newer R&D capabilities, focusing on its export business through technical collaboration with its global technology partners Nisshinbo of Japan and TMD Friction of Germany, building new capacities to support new and existing OEMs in the domestic market, and launching innovative, cost-competitive new products in the aftermarket.

While its strategy to shift gear from the commercial vehicle business to the passenger vehicle sector is already paying dividends, future growth for Rane Brake Lining will come when ABS fitment becomes mandatory on 125cc and higher-powered two-wheelers.

Chennai-based Rane Brake Lining (RBL), part of the diversified Rane Group, is adopting multi-pronged strategies to ensure sustainable growth. The company is developing newer R&D capabilities, focusing on its export business through technical collaboration with its global technology partners Nisshinbo of Japan and TMD Friction of Germany, building new capacities to support new and existing OEMs in the domestic market, and launching innovative, cost-competitive new products in the aftermarket.

RBL contributes nearly 12 percent to the diversified Rane Group’s total revenue of Rs 4,000 crore. In FY2016- 17, the company recorded total sales of Rs 486 crore, a year-on-year growth of over 8 percent driven by strong demand from the passenger car and two-wheeler segment. It now aims to maintain its share of business with key OEMs to maintain a growth rate of 7-8 percent over the near term, more so in view of the many new vehicle launches in the next few years.

In the domestic passenger car segment, RBL products are used by every OEM with the exception of Hyundai Motor India, which sources its braking products from a Korean supplier. RBL, being a Tier 2 supplier, caters to Tier 1 suppliers like Brakes India, Foundation Brakes and Brembo which plan to integrate braking systems for OEMs.

Established in 1964, RBL’s core friction products portfolio includes brake lining, disc pads, clutch facing, sintered brake pads and railway brake blocks.

With India being one of the fastest growing automotive markets globally, almost all the major global friction suppliers have set up shop in India, heralding fierce competition. Nevertheless, RBL remains positive about higher growth backed by superior quality products and technologies from its global partners Nisshinbo and TMD Friction.

Speaking exclusively to Autocar Professional, Vinay Lakshman, the youngest member of the family who has taken over the company as managing director two years ago, says: “The overall OEM industry is on a positive track and the industry outlook is optimistic. The trend of people upgrading from two-wheelers to small cars will continue and the small car segment will continue to grow in the foreseeable future in India.”

An early friction products manufacturer in India, RBL started off with technology from the UK. Its initial business grew with Ashok Leyland and Tata Motors as it was the primary commercial vehicle lining supplier in those years. “In the late 1980s, Maruti was set up in India and we signed a licensing technology pact with Japanese company Nisshinbo. The relationship grew stronger over the years from just a licensing technology partner for Maruti to becoming an equity partner,” says Vinay. Nisshinbo holds a 23 percent stake in RBL.

RBL primarily gets technology from Nisshinbo for Japanese OEMs in India. Nisshinbo, which was the third biggest global friction material player, has acquired No. 2 supplier, TMD Friction of Germany. As such, the combined entity has become the leader in the friction material supplier. This partnership has helped RBL to leverage two different technologies for its Indian customers as it has access to the latest technologies from Nisshinbo and has also signed a licensing agreement with TMD for its technology in India for Indian OEMs.

According to Vinay, ‘Technology plays a critical role particularly for Japanese OEMs as they feel comfortable with suppliers from Japan. Earlier, OEMs and Tier 1s were dependent on getting their products validated in Japan and other global locations. These tests were not entirely suitable for Indian conditions and highly expensive too. Over the years, we focused on localising the testing and validation and today we do 80 percent of tests for Maruti in India.’

PV INDUSTRY GROWTH AUGURS WELL FOR RBL

Even though RBL started out as a friction product supplier to commercial vehicles, at present its topline is dominated by demand for its products that cater to passenger cars and utility vehicles (UVs). Maruti Suzuki India, which has a humungous 53 percent share of the domestic PV market, is RBL’s major customer .

PVs and UVs together contributed over 47 percent to its business in FY2016- 17. An uptick in customer demand for A-segment cars including the Maruti Alto and Renault Kwid and the ongoing boom in the UV segment augur well for RBL. In comparison, the CV and two-wheeler segments contribute 36 and five percent respectively to the company’s topline.

“A few years ago, CVs dominated our business with close to 90 percent but have come down significantly. This is because we have expanded in other segments like passenger cars and two-wheelers rapidly,” reveals Vinay.

This strategic shift in demand saw RBL lose some market share in the CV business, primarily from market leader Tata Motors. It was also due to increasing competition and the resultant cost pressure. “About a decade ago, there were only four friction product manufacturers in the country but today there are 15 with every big global name being present in the country,” explains Vinay. Nevertheless, RBL continues supplying to all the key CV makers in the country including Ashok Leyland, Tata Motors, Mahindra & Mahindra and Daimler India CV across the LCV and M&HCV segments.

Unlike passenger cars, the CV market is different when it comes to friction products as the market prefers the same material for diverse applications. However, customers are now getting knowledgeable from the NVH standpoint and braking efficiency and are open to working with different material formulations depending upon the application.

Ashok Leyland and Tata Motors use different grades for their exports to markets like the Middle- East, primarily because the acceptance levels in those markets is higher. Given the fact that friction materials are a safety critical product, RBL says it is committed to using quality materials. The company believes in selling technology and even pulls out of business where the cost becomes too competitive.

“We believe in high-end quality and technology and won’t play the cost game. As a result, we are losing market share but we are fine with this. We stick to our core competencies and value because we believe eventually the customer will understand the difference of quality and value the product,” says Vinay.

The company’s immediate focus area is to win back its share of business from Tata Motors over the next 12-18 months while also maintaining growth from Ashok Leyland which gives it a sizeable chunk of the business. RBL is also eyeing opportunities for export products from Daimler and Volvo.

NEW TECH AND THE PROMISE OF TWO-WHEELERS

Like the PV-related business, RBL is also bullish on demand coming its way from the two-wheeler sector. Once a small contributor to overall revenues, two-wheelers are set to drive a new dynamic in business demand for the company. RBL views this vehicle segment to be at an inflection point due to the technological shift in the Indian market. Drum brake technology, once de rigueur in the Indian two-wheeler industry, is slowly seeing the penetration of superior technology in the form of disc brakes.

With anti-lock braking system (ABS) becoming mandatory for above 125cc two-wheelers in India from April 2018, there will be a massive technological shift in the market which will compel OEMs to fit superior and safer disc brakes. Clearly, this will translate into a huge opportunity for RBL and other suppliers considering 17,589,511 two-wheelers were sold in FY2017. “I am bullish on the adoption of disc brake technology in two-wheelers, which offers us an opportunity. We are investing a lot of time, energy and resources and our engagement in this segment is much higher than it was earlier with new investments,” says Vinay.

GOING AFTER THE AFTERMARKET

The automotive aftermarket is one of RBL’s key growth drivers and contributed in excess of 40 percent of the total business last year. The aftermarket is a profitable business and the company has been focusing on the segment with a strategic growth plan. Over the last 3-4 years, it has undertaken new investment and product development for this business division.

If there are challenges in the aftermarket, then it is OEMs who have high growth aspirations and are getting aggressive. However, RBL sees this as an opportunity to scale up in the aftermarket. It has a separate distribution network with four wholesale distributors – two in the South, and one each in the North and West – who then sell to retail customers.

RBL says it is very strong in commercial vehicle linings with a higher market share in the aftermarket. Over the past three years, in the passenger car aftermarket, the company has been able to record higher business levels. “In the aftermarket, we have OE quality products and don’t believe in having a separate quality or budget brand,” admits Vinay.

Exports constitute a small business for RBL and the focus has been very limited. Due to its technology partner, it has a geographical restriction and exports to only SAARC markets. However, RBL is working on some export strategies to leverage its core competencies and get the benefit which is likely to materialise only in the next 3-4 years.

EMERGING TRENDS

Speaking on emerging trends in friction materials, Vinay says, “Globally everybody is talking about going copper-free; at present there is copper content in the formulations. Globally, everybody is trying to move to copper-free largely because the regulations have come into force in the USA for copper less by January 1, 2020, and copper-free by January 2025.”

While such norms will take a while to be introduced in India, OEMs today work on global platforms and source new materials globally. Therefore, RBL stands to benefit, thanks to ready access to these materials from its partner Nishinbo.

RBL has four manufacturing plants in India at Chennai, Hyderabad, Puducherry and Trichy with substantial capacities and currently running at 80 percent. As such, it does not have any plan to invest in any new production facility.

AUTOMATION TO UP QUALITY, CUT COSTS

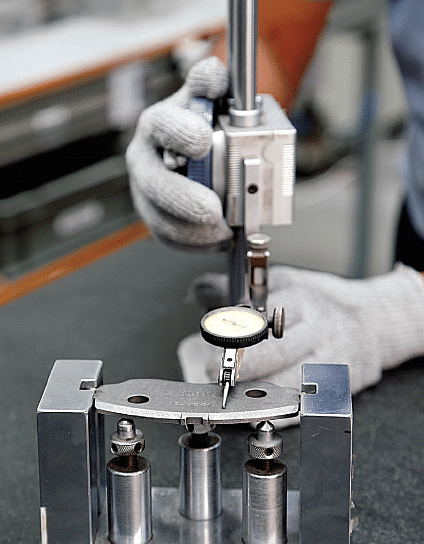

Being a legacy player with an old manufacturing setup and highly manpower intensive line, the company is increasingly working on a high level of automation to improve quality and bring down costs. Thus, all the new investment is being done in automation. Last year the company invested Rs 15 crore in imported dynamometers and today has 11 dynamometers across plants. It has also invested Rs 16 crore in at its Chennai solar power plant with more than 3MW capacity. RBL has a dedicated R&D team of 40 people working on new material and technologies in friction materials. Furthermore, in a bid to service its customers better, the company has set up a techno-marketing division comprising technical people to address technical issues which ensures speedy and accurate redressal of customer enquiries and complaints.

In the final analysis, this braking equipment manufacturer looks well set to remain the supplier of choice for OEMs. While its strategy to shift gear from the CV business to the passenger vehicle sector has already paid dividends, future growth will be accelerated from next year onwards when two-wheeler OEMs will be compelled to fit ABS on their 125cc and higher-powered products. If there is a continuing concern, then it is about hiring and attracting the right talent to the company. But then, RBL is not the sole company to face this challenge – all of India Auto Inc has the same worry.

(This article was first published in the August 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

27 Aug 2017

27 Aug 2017

25106 Views

25106 Views

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo