Pricol turns a new page

Coimbatore-based Tier 1 supplier embarks on a new phase of growth with a new set of strategies for the domestic and global markets.

Vikram Mohan, the 41-year-old managing director of Pricol Ltd, sees himself as a serial entrepreneur. When this second-generation entrepreneur took over the current role in the family’s automotive components business in 2011, the condition of the company was far from being ideal.

New to the automotive business, Vikram had the tough challenge of steering Pricol, a well-established brand, back on track.

The company had industrial relationship (IR) issues, lost business of crucial new vehicle programmes and, as a result, faced a double whammy of “huge losses” and high debts. “There were multiple setbacks from 2007 to 2011 which set us back by 6-7 years. Those were the high growth years of the auto industry. Though our peers grew, we de-grew or remained flat during that time,” says Vikram in a candid interview with Autocar Professional.

Fast forward to 2016, the company, with a redesigned brand identity, now has a robust growth outlook and healthy order book stretching till 2020, after going through an intense period of business restructuring.

The company, which closed FY2015-16 at revenues of nearly Rs 1,500 crore and “almost” debt- free (Rs 100 crore), is aiming at a healthy 20 percent growth YoY for the next 4-5 years with a target of Rs 3,000 crore in top-line.

This target is expected to be achieved through both organic and inorganic steps. The strong demand from the domestic market, growth in exports, a few new acquisitions in Europe and USA and a couple of greenfield plants will keep Vikram and his team quite busy. This is in contrast to the 2011 period, when the company’s debt level stood at Rs 340 crore, almost half of the company’s turnover.

Past forward

However, the return to profitability and growth of the present day was not a cakewalk as the company had to take a complete re-look at its business. As part of the restructuring, Pricol found that it has been highly Coimbatore-centric despite the absence of any big customer or vendor base there. Therefore, it decided to expand into other auto clusters in the country. Pricol shut down one plant in Coimbatore, scaled down operations in another and let go of nearly 1,800 employees. The overall employee base has come down from 7,000 to 5,000 now. Automation was introduced, end-of-testing, upgrades labs and development capabilities were scaled up. It has sold a die-cast plant in Coimbatore, shut down one plant in Pantnagar and expanded the other and also closed a plant in Pune which was not in a suitable location, and faced IR issues.

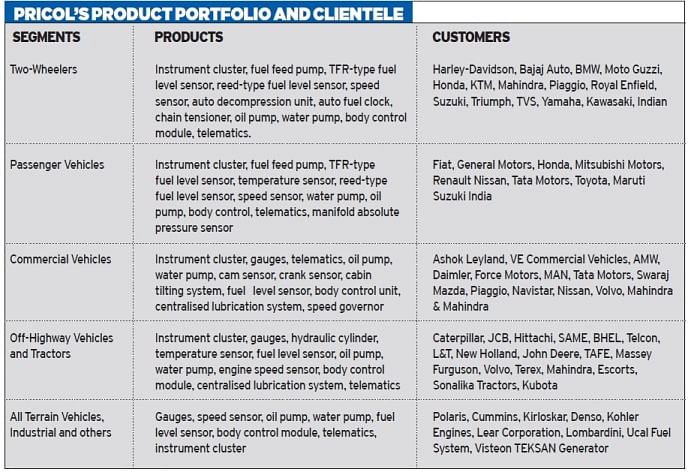

The company decided to focus on its strengths and do away with non-core business. It has divided its business largely into three key areas – instrument cluster and sensors, pumps and mechanical products, and asset management solutions. “We looked at product by product, our cost structure and our leadership position. Whatever is not fitting in these three verticals is either sold or shut down,” says Vikram.

In order to strengthen its product offerings and achieve leadership in its chosen business areas, the business strategy has been tweaked to suit the changing market dynamics. “We strategised internally about the future of the instrument cluster in a car. In 2020, the instrument cluster will cease to exist in large automobiles. It will be a driver information system and not instrumentations, combined with entertainment or infotainment, navigation, climate control everything with one-touch screen panel and a lot of software,” elaborates Vikram.

Though Pricol had a strong presence in the domestic passenger vehicle instrument cluster market earlier, it exited that business by selling it off to Visteon and Denso because it knew that with the changing dynamics in that segment, it wouldn’t be able to match the development investments by MNCs which have an advantage of spreading big investments across the globe.

Pricol has enhanced its focus on the two-wheeler instrument cluster business, where it is the world’s second largest by volume and value terms. It supplies all the key two-wheeler manufacturers. As part of its new strategy, the company wants to be present in the top five global two-wheeler markets.

It also plans to focus on instrument clusters for commercial vehicles, tractors and the off-road segment. These segments, despite being lower in volume terms, offer greater business opportunity and growth. “Our strategy is to be among the top three players in any geography and product that we operate in. If there is no roadmap to get there organically or inorganically or we lack the technology, let us not step into that space. Our inorganic strategy is based on this,” elaborates Vikram.

Winning back the business

As a result of the massive restructuring of the business, Pricol is winning orders and regaining customer confidence. Over the years, its market share has grown significantly in key market segments including two-wheelers, tractors, CVs and off-highway.

“We have been growing and this year we are expecting 20 percent growth. We are confident we can sustain this growth till 2020 and perhaps a little higher as many projects are in the pipeline,” avers Vikram.

Pricol supplies water pumps to passenger cars, commercial vehicles and two-wheelers. It is one of the largest suppliers of pumps to two-wheelers. Besides instrument clusters and pumps, the company is highly bullish on the telematics and asset management solutions business. It has won some big global orders from JCB and is “on the verge of” becoming a global partner for half-a-dozen other companies. While this vertical does not offer huge scale, the margins are quite healthy with sustainable long-term business.

One of the key developments in this vertical is a centralised lubrication system which it supplies to truck-maker Daimler and a few other companies. “In asset management, we have developed various products and are moving forward. All of this is done in Coimbatore as we shifted production and substituted it with these products as we have plants and permanent labour,” informs Vikram.

The way forward

According to Vikram, the key for future growth is not just being an Indian company but become a global company as increasingly vehicle platforms are being developed globally. One of the major steps in this direction was to expand its footprint to Indonesia six years ago when a number of Indian two-wheeler makers ventured into that country. Although Indian companies failed to make inroads in the second largest two-wheeler market in Asia, Pricol managed to gain some business there.

The Indonesian plant has ramped up quickly, bagging orders from prominent players like Honda, Yamaha and Suzuki. Pricol has a near-18 percent market share in the two-wheeler instrument cluster market and hopes to grow it to a healthy 30 percent. It has recently introduced its range of pumps for two-wheelers. Today Indonesia is not just catering to the local market but has become a hub for the ASEAN region including Thailand, Vietnam and the Philippines.

Similarly, Latin America was added to Pricol’s manufacturing network when it acquired a company in Brazil a year and half ago. More than the manufacturing, the company’s technology prowess in pumps is what made Vikram invest in it. Today, it has become the global technical centre for Pricol’s pumps vertical, which is expected to be the company’s largest revenue generator in the next two years or so. Currently, driver information systems are the biggest with a 40 percent share of the company’s total revenue. Brazil’s economic fall may have disturbed Pricol’s business plans but Vikram is hopeful of a recovery in that market in 2-3 years.

Acquisitions ahead

As part of its aspirations to go global and fuel its future growth, the company is aggressively looking at 2-3 acquisitions in Europe and the US. The acquisitions would be made to plug the gaps in Pricol’s product portfolio. To fill in those gaps and gain entry into the larger European market, the company is eyeing two acquisitions in Europe (one each for pumps and sensors for CVs, tractors, off-road instrument clusters) and one instrument cluster company in USA. While acquiring any company, Vikram has set very clear criteria. “The criteria to buy a company are based on five scales including financial health, customer base, local management expertise, technology roadmap and quality of manufacturing asset. Unless three of them are complete, we won’t buy the company. It took us 2-3 years to identify the right assets. We have a focused strategy,” he says.

After the acquisitions, all the three companies are likely to add anywhere between Rs 750-1,000 crore to Pricol’s top-line, taking the company close to its aspiration of reaching the Rs 3,000 crore revenue mark by 2020. To fund these acquisitions, the company has earmarked a capex of Rs 400 crore for the next four years by leveraging its strong balance sheet and profit from the existing business. It could also raise some funds for the same.

New plants in India

At the home front, Pricol is set to open a greenfield plant in Pune next month. Moving away from the practice of buying land for a new plant, the company has adopted an asset-light model. Instead of buying land for a plant which is 50-60 of the total cost, it is collaborating with an industrial park operator on a build-to-suit basis. Besides insulating itself from huge investment in real estate, this model offers flexibility to take faster decisions on shifting production if industry dynamics change.

The company looks to leverage this model for having constraints with a geographical presence. As the Pune plant is ready to go live, Pricol is looking to set up another greenfield plant in the next 24 months to fuel domestic growth. “The greenfield plant will be either in Gujarat or outside of Chennai in Andhra Pradesh as there are some good policies and power availability is not a problem,” says Vikram.

Currently, Pricol is sitting pretty on its healthy export business. It gets Rs 100 crore revenue from the Indonesia plant, Rs 120 crore from the Brazil plant and nearly Rs 120 crore from exports from India. Exports from Brazil or India are expected to touch Rs 400 crore by 2020.

Thanks to the robust business outlook and armed with a healthy order book, Pricol is aiming high by targeting ambitious goals with a new-found aggression. It is currently the fifth largest global cluster supplier in the off-highway segment and wants to become one of the top three. Clearly, after the early setback, this Coimbatore-based Tier 1 supplier is poised for a better journey. Many challenges have been overcome but the company, like many other suppliers, will have to find a way to tackle a common challenge. “We have robust growth ahead but disparity in wages between OEMs and suppliers is going to be a huge challenge for auto component companies going forward,” says Vikram.

Having overcome a series of challenges, including IR issues, Vikram and his team would be in a much better position now to tackle such a challenge successfully.

Photography: Omkar Dhas

RELATED ARTICLES

BKT, the ‘Off-Road King,’ Chases the Consumer Market

The company has unveiled a broad range of tyres for the Indian two-wheeler and CV markets.

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

20 Aug 2016

20 Aug 2016

21643 Views

21643 Views

Shahkar Abidi

Shahkar Abidi

Darshan Nakhwa

Darshan Nakhwa