Marquardt India plans R&D centre expansion, new plant in Pune too

Marquardt lays down strategy to not only expand its existing Pune-based R&D centre but is also aggressively looking to set up an all-new production plant in the outskirts of the city.

Marquardt India, the local arm of the Germany-based 1.23 billion euro (Rs 10,294 crore) Tier 1 supplier of electro-mechanical and electronic switches to the automotive industry, has laid down aggressive expansion plans to tap the fast-evolving opportunities in India’s growing passenger car market.

The company, which already has a production plant in Mumbai and a development centre in Pune, now plans to further expand its R&D centre and also set up an all-new manufacturing facility in the outskirts of Pune. The senior management at Marquardt India has drawn up a two-plus-two-year expansion plan, wherein the expansion within the first two years appears to be highly critical for future growth.

In the run-up to CY2020, the company aims to commence manufacturing operations at its upcoming plant in Pune and is also looking to double the current R&D staffing headcount from 250 people to 500 people. To accommodate a larger engineering headcount, Marquardt India will relocate from its existing R&D set up to a brand-new facility in Pune.

L-R: Peter Driessen, team manager – Functional Safety Architectures, Marquardt; Johannes Mattes, associate general manager, Marquardt India; and Debasish Tripathy, head – System Engineering, Marquardt India.

Speaking to Autocar Professional in this regard, Johannes Mattes, associate general manager, Marquardt India, said: “We are looking at rapidly expanding our operations in Pune over the next two years. There is a lot of innovation and development work happening out of our R&D centre in Pune. We plan to move into a bigger development facility, which will also have multiple laboratories such as battery lab, validation lab, an innovation centre, a competency centre and others. It will also have a facility for making prototypes for our customers. We have already bought the land for this. On the engineering headcount, we plan to expand to 500 engineers by 2020 and up to 1,000 engineers by 2022.”

Notably, Marquardt India’s Pune-based development centre, which is currently located in Hinjewadi – an IT and manufacturing hub – is not only catering to the local market but about 80 percent of its engineering work is for the company’s global projects.

Adding further, Mattes disclosed, “We are also planning to set up an all-new production plant in Pune for which we are evaluating possible sites in the Chakan and Hinjewadi area. We aim to finalise the location within CY2018 and commence operations in CY2020. The manufacturing is aimed at localising our products completely in India for our customers. Our Mumbai-based facility will soon have capacity constraints.”

It is to be noted that although the design and development work on its products based on the demands from the OEMs in India happens locally; Marquardt’s products thus far were made in and supplied from China.

Nevertheless, with increasing demand and to benefit from being in close proximity to its customers in India, the company now plans to manufacture complete systems locally within two years. The senior company official refrained from disclosing the total investment earmarked for expansion in the near- and mid-term.

Growth drivers

For Marquardt, which continues to be a family owned company since its inception in 1925, automotive is a major source of global turnover every year. According to Mattes, the company’s automotive business contributes to about 80 percent of its overall turnover globally.

Marquardt’s global focus areas are clearly defined into three categories that also sum up its portfolio. The company, which is credited with innovating the first fully electronic car key in 1997 for Mercedes-Benz and electronic gear shifter – called the shift-by-wire system – for BMW in 2007, categorises its product portfolio under drive authorisation systems, human machine interface (HMI systems) and battery management system (BMS).

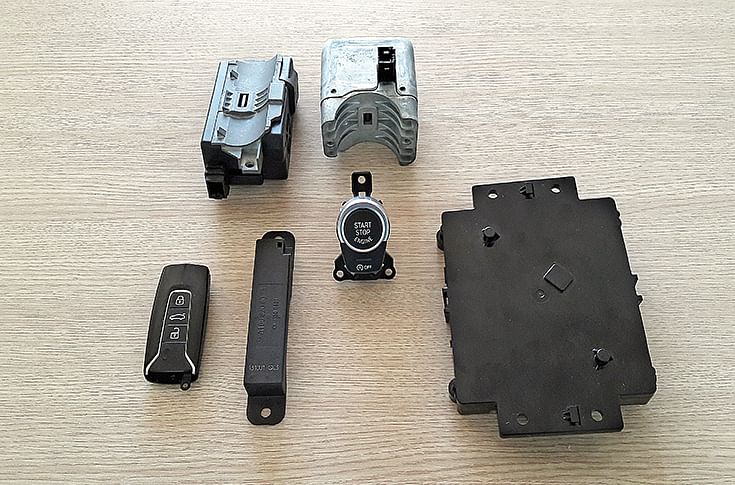

The products under drive authorisation system include all components that help in accessing the car securely and safely. This includes electronic keys, door handle sensors, antennas, control devices, ignition switches, electronic steering column locks (ESCL), start-stop systems and the mechanism around that.

Products manufactured under drive authorisation systems include electronic car key(s), sensors, electronic steering column lock, ECU and other components.

On the other hand, while the HMI systems include switches, modules and the electronic architecture for car interiors, the BMS is a relatively new product vertical for the company. It is lately gaining traction due to the rapid development of electric vehicles (EVs) around the world.

Marquardt foresees a bagful of opportunities with the advent of EVs, all thanks to the burgeoning role of electronics and ECUs in electric vehicles.

Giving his outlook on the rising electronic content in passenger cars, Peter Driessen, team manager – Functional Safety Architectures at Marquardt said, “The innovations in the area of mechatronics are clearly driven by the legislative changes that are coming in across countries. This turns around in the form of new demands from the vehicle manufacturers.”

The growing electronic content in vehicles can be looked at under two heads – in the conventional petrol- / diesel-powered cars and in electric vehicles.

For Marquardt too, the EV business opportunity is understood to be a major growth driver in the coming years. According to the senior management, anticipating the EV era in the future, company engineers worked on the BMS as early as CY2013. “Pre-development of the BMS happened in 2013, which is when it became a completely new product vertical for us dedicated to the EVs. We received SOP (for BMS) in 2017 by an OEM in Europe. It is a big and substantial vertical for us today as we are working on a lot of projects under electric mobility already. These will fuel major growth for the company in the coming years,” affirmed Debasish Tripathy, head – System Engineering, Marquardt India.

According to the company, its BMS business is expected to contribute more than a quarter of its total turnover globally by 2023. What this underlines is how cleverly Marquardt’s leadership in Germany and elsewhere has aligned the company with the fast growing EV development in Europe and in China, where it has a substantial footprint already.

Adding to that, Mattes said, “We want to be the technology leader just like how we are the market leaders and trendsetters in the drive authorisation systems globally.”

Connectivity

Connectivity as a megatrend in automotive is yet another identified growth driver for the company. Commenting on why connectivity is so important in the future, Mattes said, “There is no chance one can ignore the trend of connectivity in cars. This is important not only from the convenience point of view but also for safety. Just like how smart homes will need smart connectivity, a similar connectivity trend will come in passenger cars.”

According to him, there could be several possibilities on the connectivity front such as extending the range of the electronic car keys.

Quoting examples, he explained, “We can add new features to our electronic car keys around security, safety and connectivity. Let’s assume you lose your car key in a European scenario. You may still access your car by calling your service provider, who could send you a passcode to open and drive your car. Secondly, there is another surging trend in Europe, which is car sharing. So you can book a car, which your phone can locate is close to your house. Using Bluetooth or some other wireless technology you can access the car and drive it. We are working on several possibilities related to connectivity under drive authorisation systems.”

According to Driessen, a smartphone can always become an add-on device supporting the functionality of the key system. “The best solution, however, in the future would be to have the high-tech electronic car key and as an add-on, you can have an app in your smartphone to access your car,” said Driessen.

Safety vs security

Safety and security are often confused with similar meaning when it comes to the functionalities across different systems and technologies inside a car. The same, however, are very different, suggested Driessen.

According to him, an engineer must understand the balance between robustness (secure system) and safety to design an effective solution.

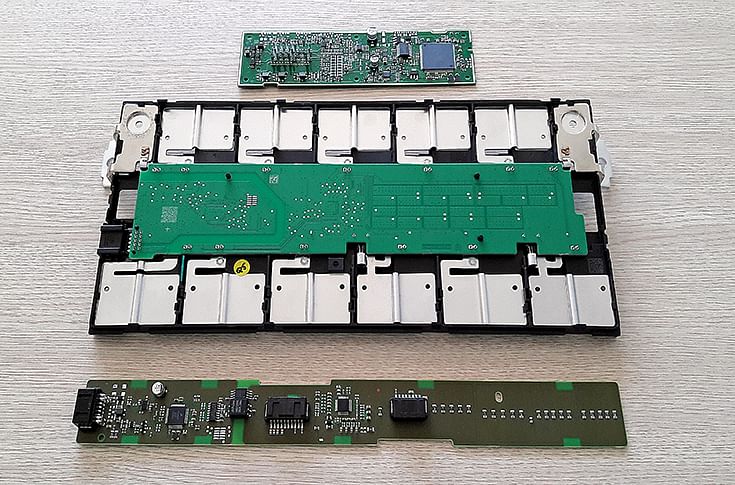

Battery management systems for lithium-ion cells and battery packs. BMS, which is needed to safely and efficiently use lithium cells, continuously monitors the lithium cells and confirms charging status.

Explaining the difference between the two aspects while designing and developing new innovations at Marquardt, Driessen elaborated, “We can distinguish between safety and security like this – everything that is person-related is safety and everything that is product-related is security. So, if a product device puts the human environment in danger, the functionality has to define safety. For example, if a steering column lock locks itself for some reason while the car is being driven. While the steering column lock is meant for security purpose, this scenario has a safety connotation as it puts a human life in danger. So while developing electronic control units (ECUs), we define the safety and security roles accordingly.”

He goes on to add, “A nuclear power plant can have, say, four redundant systems but the accident can still happen. You cannot assume that they did not follow the safety rules. Similarly, it does not make any sense to add 10-time redundancy to an electronic car key because that will only increase the costs, which can go up to 2,000 euros (Rs 167,380) or 5,000 euros (Rs 418,450). Developing balanced technology means that a key must be robust and it must be safe. It is critical to find a balance between robustness and safety in the kind of products that we make.”

Adding his views on similar lines, Tripathy remarked, “We have a lot of products today that provide both the security and safety features. We are growing in both domains with our product portfolio. How secure is the system is something that an OEM can discuss. However, it can never request for an inferior safe system. While, on one hand, highly secure systems are expensive and we can have multiple levels of security attached to a system, safety, on the other hand, is always non-negotiable.”

Human Machine Interface

Automotive interiors are fast transitioning from switch-based systems to capacitive touch systems. Tesla is already known to have deployed 17-inch screens as the central console in its pure electric cars. Does this pose a threat to Marquardt, which has electro-mechanical and electronic switches as one of its core product lines?

“I strongly believe that despite the fast-evolving HMI, switching systems will remain in the interior environment of the car in the future. Not all switch-based control systems will get phased out,” said Mattes. Steering-mounted, switch-based power controls can be a good example of what he was referring to.

“We have a specific strategy for next-generation power switches. The company is already in the first phase of launching its latest technologies around switches and control systems globally. We also have products under development, which are closer to the screen-controls and come under the purview of human-machine interface. These will be touchpad-based or screen-based control systems,” said Tripathy.

According to Tripathy, the capacitive touch systems are not new to Marquardt as the company had already developed these and supplied to Cadillac about a decade ago. “We are prepared to handle products in the capacitive-touch systems domain. There are other touch-based technologies too that we are capable of,” he added.

Focus on R&D

It is interesting to note that about 70 percent products currently offered by Marquardt to its customers are less than five years old. This clearly underlines the inherent drive within the company for new product development and constant innovation.

According to Mattes, about 10 percent of the company’s total turnover is re-invested into R&D and in new programs every year. This is against the average of less than one percent of total turnover invested in R&D by most Indian automotive component suppliers.

“We are a mechatronics specialist company. We invest a lot in the young talent. Marquardt has more than 100 students interning (globally) at any given point in time. They are trained for fundamental engineering jobs such as making stamping parts or moulding parts and others,” highlighted Mattes.

Among several locally designed and developed products is an HMI-based multimedia switch, which is supplied to the Jeep Compass SUV. Another example of a locally engineered product is the electronic key system supplied for Tata Motors’ popular Nexon compact SUV.

Giving an update on the product localisation plan, Mattes added, “Our plan is to localise at least 50 percent of the products (under drive authorisation systems) that we supply to our customers in India in CY2018. Initial production can begin in our Mumbai plant until the Pune plant comes up by 2020.”

(This article was first published in the 1 July 2018 issue of Autocar Professional)

RELATED ARTICLES

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

10 Sep 2018

10 Sep 2018

60489 Views

60489 Views

Darshan Nakhwa

Darshan Nakhwa

Shahkar Abidi

Shahkar Abidi