Managing change in an era of disruption

Business heads representing India's commercial vehicle market leader and three carmakers reveal how they plan to transform and reinvent in an era of disruption.

L-R: Girish Wagh, president, Tata Motors Commercial Vehicle Business Unit; Sumit Sawhney, managing director and CEO, Renault India; N Raja, deputy managing director, Toyota Kirloskar Motor; and Rajesh Goel, senior vice-president and director (Marketing and Sales), Honda Cars India, participated in the roundtable discussion.

As the automotive industry grapples with enormous and unprecedented shifts brought about by global megatrends, automakers are actively engaged in change management to ensure they remain relevant in a disruptive world. Business heads representing India's commercial vehicle market leader and three carmakers reveal how they plan to transform and reinvent in an era of disruption. A report on a recent roundtable meeting in New Delhi.

The automotive industry, like most industries, has been impacted by the surge of new technologies, global sustainability issues and changing consumer opinion about vehicle ownership. Add to this the march of Industry 4.0, digitisation and new business models with far shorter timeframes than even a decade ago and what you get is an industry witnessing disruption across its value chain.

As industry the world over comes to grips with rapid transformation as well as new megatrends like vehicle electrification, in-vehicle connectivity, shared mobility and autonomous driving, it is imperative for vehicle manufacturers across segments to evolve their businesses – products, performance and sales panache – if they are to remain relevant in an era of cut-throat competition and sustain themselves in a disruptive world where change is the only constant.

Digitisation, Industry 4.0 and megatrends like connectivity, electrification, shared mobility and autonomous driving mean the automotive industry is facing huge disruption across the value chain.

What’s keeping OEMs and their large teams actively engaged is the increasingly demanding customer, who not only is not displaying the loyalty of the past but is also wanting his/her vehicle to be a comfortable yet connected cocoon, given the increased amount of time spent on gridlocked roads. That’s not all. India Auto Inc has also to contend with the government’s aggressive push towards electric mobility despite the absence of requisite infrastructure, the speedy upgrade to Bharat Stage VI emission norms by April 2020 and meeting improved safety norms.

Globally as well as in India, which is billed to be among the Top 3 passenger vehicle markets in the near future, captains of the auto industry and their teams are burning the midnight oil to devise sustainable long-term strategies to smoothly transition into a new era. While the passenger vehicle (PV) sector, which has 15 OEMs fighting for a slice of the market, is seeing action aplenty, the commercial vehicle (CV) space too with 10 OEMs is bustling with activity, with a number of regulatory changes set to impact growth.

The Indian auto sector, which is in good nick, clocked overall sales of 24,972,788 units in FY2018 to register brawny double-digit growth of 14.22 percent. And in the first quarter of FY2019, overall industry sales across segments were a tad short of the seven-million units mark, posting 18 percent YoY growth. Making their presence felt in that total are the PV (873,501 units +19.91%) and CV (230,095 / +51.55%) sectors. The industry, which contributes around seven percent to the total GDP, is currently well-placed on growth road but the challenges remain.

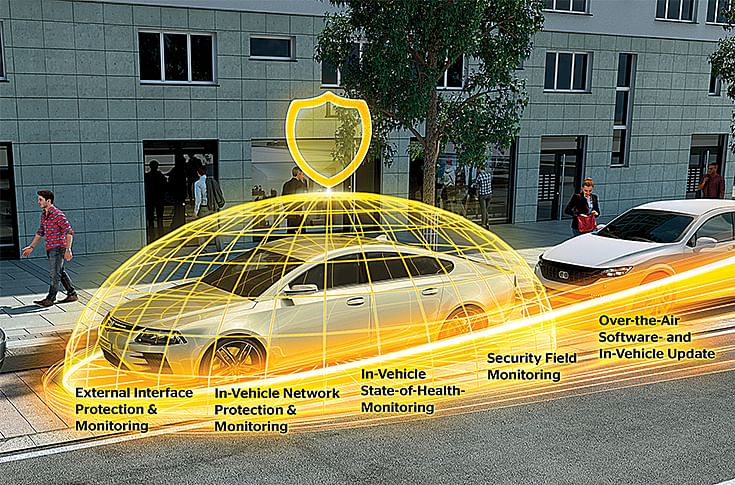

With customers demanding a high level of in-vehicle connectivity, OEMs will have to, in sync with technology suppliers, develop end-to-end solutions with the aim of ensuring the highest possible degree of cyber security at all times.

All this and more was the subject of a lively discussion between four industry heads held in June in New Delhi. Moderated by Hormazd Sorabjee, editor, Autocar India, the panelists comprised Girish Wagh, president, Tata Motors Commercial Vehicle Business Unit; Sumit Sawhney, managing director and CEO, Renault India; N Raja, deputy managing director, Toyota Kirloskar Motor; and Rajesh Goel, senior vice-president and director (Marketing and Sales), Honda Cars India.

Assessing the disruptive forces

Setting the tone for the panel discussion from a macro perspective was the commercial vehicle industry which is seen as the barometer of the country’s economy. “The CV space is not completely isolated from the upcoming changes. Rather, the sector is being pushed by a lot of regulatory reforms. While BS IV emission norms were the stepping stones in 2017, BS VI norms – with their Phase I and Phase II coming in – are going to bring another slew of changes, forcing us to change very quickly. Also, with bus- and truck-body load norms, safety is another crucial area that is going to be a key driver for the CV segment,” said Tata Motors’ Girish Wagh.

Tata Motors is already seeing success with its ‘Turnaround 2.0’ strategy aimed at winning back 5 percent market share in both its CV and PV businesses. Its 50.23 percent CV market share in FY2014 had dropped to 42.79 percent over the next three years. It was only in mid-2017 that sales began rising, when the new, aggressive strategy focusing on newer products and customer-centricity kicked in and now it aims to win decisively in the CV segment. And the company is taking a closer look at trends.

“One of the key trends we see emerging for the future is that of ‘Value Trucking’ where there is a need for a futuristic and advanced truck at a lower price point. Moreover, with an increasing e-commerce ecosystem in India, there is a lot of demand for ‘Urban Trucking’ for last-mile delivery and for local dispatches as well,” added Wagh.

In April, Tata Motors launched the Ultra intermediate CV to make the most of hub-and-spoke model, boom in e-commerce and restrictions on overloading.

“To some extent, megatrends have also started impacting the CV sector, and a very evident example of that is that we, at Tata Motors, have been able to win seven out of the 10 tender pitches for supplying electric buses to various states in the country,” he pointed out.

The hugely competitive PV segment too has its own challenges and with a young customer profile, OEMs are having a tough time keeping the excitement levels for a product consistently high. According to Renault India’s Sumit Sawhney, “Clearly, one has to look forward to entering a new segment altogether, or create a sub-segment within a segment. Hence, we would be looking at products with such potential in the coming future because there has to be a novelty factor in products.”

The Renault Kwid, which had its global launch, back in mid-2015, had disrupted the entry-level hatchback space in the country, with its unique SUV-styling and broader proportions, breaking away from the conventional mould. “Even when we had launched the Duster, it had created a completely new segment, while the Kwid, which also had 98 percent localisation levels at launch, went on to create a sub-segment within the entry-level space,” said Sawhney.

After disruptive models like the Duster and Kwid, Renault India introduced the Captur SUV in the domestic market. After disruptive models like the Duster and Kwid, Renault India introduced the Captur SUV in the domestic market.

While Renault’s approach to new models has been refreshingly fresh, Japanese carmaker Toyota has been a little too conservative with its strategy for the Indian market. While its established models like the Innova and Fortuner have been faring well on the sales front, new car launches are too few and far between.

To Sorabjee’s pointed query on how the global No. 1 carmaker, which is known to be risk-averse, plans to tackle future challenges, Toyota Kirloskar Motor’s N Raja replied, “We’ve been seen as going slow, but things have progressed. The impending changes are major and are going to be the changes of a century; we are preparing ourselves for all types of technologies. We have been working on improving the internal combustion (IC) engine cars with strong hybrids and, at the same time, we are working on electric technology as well as fuel cells.”

“We see hybrids as a transition from IC engines to full electrics. The Camry Hybrid’s emission is one-tenth of that of a BS VI vehicle today. Moreover, its fuel efficiency is also 50 percent better than its regular petrol-only sibling,” said Raja. He added, “We understand the needs of the country, what it is going through and we need to be a part of providing the solutions. So, we are looking at how to move in this journey of supporting India on two important factors – oil bills and pollution.”

The Camry Hybrid’s emission is a tenth of that of a BS VI vehicle and its fuel efficiency 50 percent better than its regular petrol-only sibling.The Camry Hybrid’s emission is a tenth of that of a BS VI vehicle and its fuel efficiency 50 percent better than its regular petrol-only sibling.

“We are not closing any options for that matter and as per the projection of 10 million PV sales in the country over the next decade, 60 percent will still continue to be internal combustion-based. Hence, improving efficiency on IC engines is going to be the first priority for us, and we are going to address that with hybrids and only later, the remaining 40 percent of the pure electric vehicle volumes will come in,” Raja added.

Big tech, bigger investments

With such paradigm shifts in technology, prodigious investments are also bound to see cash reserves being employed in model development and technological research. Will that put a lot of pressure on an OE’s profitability, asked Sorabjee? “Yes, it would have been the case if we were to start today. But the work has already been initiated years ago. Rather than monetary resources, it is the right set of human resources which would be a challenge, going forward,” Raja remarked, enumerating the looming issue of shortage of worker skills in the near future.

Honda Cars India, which is seeing its recently launched new Amaze sedan gain strong traction in the domestic market, is gingerly exploring bringing in breakthrough solutions from its home market in the form of the FCX Clarity fuel-cell vehicle or some of its electrified cars like the Accord Hybrid, which is already on sale at our shores. In India, Honda has had difficult moments when it bet big on diesel, at a time when the market started to skew towards petrol again. Is it difficult to predict the future then?

Recently launched new Amaze sedan has given Honda a new sales charge. In July, it was the carmaker's best-seller. Recently launched new Amaze sedan has given Honda a new sales charge. In July, it was the carmaker's best-seller.

“Diesel was not difficult to predict. It was just a question of how the equation in terms of the differential between the fuel prices and car prices on one side, fared with the customer’s usage pattern. Diesel had picked up some three years ago. Now, with the price gap between the two fuels narrowing, it is again on a decline,” said Rajesh Goel, who has recently taken charge of the company’s marketing and sales functions. “We are at a cusp where in terms of powertrain technologies, certainly the future is all about electrics. But whether to go there directly or through hybrids is something that needs to be dwelled upon.”

“Also, pushing huge investments in such cases is not just valid for the carmakers, but for the government as well. With BS VI, there is also RDE which comes into the picture, where even oil companies are investing alongside vehicle OEMs. So, if we were to move directly to EVs, then what happens to those investments? Therefore, by bringing in hybrids, we have to keep drawing a balance between electrified vehicles and pure electrics until we reach a firmer ground with regard to fully electric vehicles,” added Goel.

On the CV front though, more than electrification it is fuel cell technology that seems promising for long-haul trucking, where hydrogen offers the benefit of a relatively longer range as well as shorter vehicle downtime. Nonetheless, Tata Motors’ current agenda lies in enhancing the fuel efficiency of its IC engine-based vehicles by hybridisation, as well as by upgrading for BS VI norms.

“We are working on hybrid powertrains and have also been working on full electric buses from the last 6-7 years. However, we are also looking at hydrogen and fuel-cell vehicles but in a small manner, at our Advanced Engineering domain,” disclosed Wagh.

Connectivity and disruption in services

As the buzz around connected vehicle technologies and IoT grows, automakers are increasingly tying up with technology giants to make connected vehicle platforms a reality of the future. While Honda, with its ‘Honda Connect’, offers information on vehicle health, usage statistics, as well as aftersales support via a mobile application, almost all OEs, are certain to be entering the space. The power of data holds huge potential for companies to monetise it and leverage it towards customer satisfaction and overall brand sentiment.

L-R: Tata Motors' Girish Wagh, Renault India's Sumit Sawhney, Toyota Kirloskar Motor's N Raja and Honda Cars India's Rajesh Goel, with Hormazd Sorabjee, editor, Autocar India, who moderated the discussion. L-R: Tata Motors' Girish Wagh, Renault India's Sumit Sawhney, Toyota Kirloskar Motor's N Raja and Honda Cars India's Rajesh Goel, with Hormazd Sorabjee, editor, Autocar India, who moderated the discussion.

In the CV space, Tata Motors is working on some innovations in the services front and slicing the market on multiple dimensions at the micro-level. “In the CV industry, there is a lot of scope to innovate in services as well, until gradually the product itself becomes the service. Owning a CV is all about earning money with the vehicle over a period of time and to have comfort and peace of mind. We are offering a breakdown support service to our customers with the promise of getting the vehicle back on the road within 24 hours. We have also reduced the total cost of ownership by cutting down on the prices of consumables like oil, where we have brought in a significant 35 percent reduction as it is a major consumable during servicing,” said Wagh.

“Customers today are not just looking at total cost of ownership, but at the total revenue generated from a similar asset base as well. It is good to see them improving their bottom as well as top line profits, which makes us to get into action to improve both our product, as well as services.”

“There are quite a few start-ups in the metros, which have come up with technology platforms, trying to connect customers to CV owners. This is bringing in a good amount of disruption in the space, offering better vehicle utilisation as well as transparency for the customers,” he added.

With the CV industry in mind, Sorabjee spoke about the current crisis of shortage of good drivers as also the low respect accorded to the driving profession in India. Tata Motors is taking steps on both fronts," said Wagh. “Globally, in the CV industry, driver availability is a concern and more so in India because the dignity of the profession is quite low. We are working at improving the comfort of the driver, where some of the regulations are helping to accelerate that. Also, we have created rest zones at our 2,000-odd workshops across the country, where drivers can relax and recuperate as the vehicle gets serviced.”

The company has also collaborated with over 60 driver training schools in the country, along with offering transferable driver medical insurance with every new truck, as well as providing scholarships to drivers’ children.

An opportunity in shared mobility

Shared mobility is a reality today, at least in the metros and Tier 1 cities, a fact which is also reflected in the slowing sales of cars in once-strong markets like Mumbai and Bangalore. Does this new paradigm of mobility bring anything lucrative to the table for automotive players? Is it worth their while to develop tailor-made products for shared mobility?

Shared mobility is growing in metro cities which are increasingly witnessing traffic gridlocks. Shared mobility is growing in metro cities which are increasingly witnessing traffic gridlocks.

“Looking at the specific needs of the entrepreneurs who are driving these cars, long-term durability is one of the key parameters while making a vehicle choice. Hence, a low total cost of ownership is what matters and we are working at various levels to bring out some solutions for their needs,” said Raja, where Toyota’s models, especially its Innova MPV, has a strong fan following among fleet operators in India.

“Good drivers are scant today and ride-hailing companies like Ola and Uber are also looking for good skill sets to give their leased-out cars for drivers to operate. We are utilising driver training schools and also venturing into Tier 2 and Tier 3 markets to train such people and generate employment,” added Raja.

Sorabjee was quick to redirect the question to the Renault and Honda representatives: “Is it something that one sees as an opportunity or does plying in the commercial segment hamper the brand?”

“With a per thousand penetration of merely 20 cars, as compared to over 500 for Europe, India clearly has enough potential in the personal car space itself. Today, India is getting to where China was around 10 years ago. However, while shared mobility will grow in the larger metros, it is probably not likely to impact car manufacturers in a big way,” said Sawhney.

“The key reasons for people opting for these services are that there is a lot of traffic congestion in big cities, and the larger motive is also that these rides are highly subsidised at the moment. The cash-burn of these companies cannot be forever and as the cost to customer goes up over a period of time, these services will see a rationalisation happening, in turn moving demand back to personal car ownership.”

“I do not see developing tailor-made products for ridesharing as an opportunity as future regulatory changes for ridesharing in India could see personal cars being allowed to ply as ride shares, akin to the West,” added Sawhney.

With India being an extremely cost-conscious market, the country needs and demands cost-efficient solutions for its mobility problems. While EVs have evolved considerably, there are currently very few takers for them due to their high pricing. What’s more, the government in the upcoming FAME 2 scheme has proposed to cut down the subsidy for EVs for private owners.

“The current cost of electrics is a hindrance to adoption of the technology, which is why there are not many takers. Infrastructure too is a concern; it develops over time while also requiring a lot of investment. There is a debate between the government and industry as to who would invest. The government may expect the industry to invest, but the industry cannot plunge at this level,” said Raja.

“There is going to be disruption on the product side. However, another disruption which is needed today is in terms of clarity of the roadmap from the government’s side. The BS IV to BS VI switch in itself is a major disruption, with the industry standing firm with the government on that front. But, there has to be stability in policy and clear timelines,” said Sawhney.

While the debate over full vehicle electrification will remain for the long term, all four panelists were of the consensus that the road to full electrification seems achievable, albeit by employing a more pragmatic approach of going hybrid, with the government setting a clear mandate on emission targets and remaining technology agnostic. At a macro level, they felt that the country's infrastructure will gradually develop and lithium-ion battery costs would reduce over time.

So, just as in every other business, where the customer is king and there is always a push-and-pull effect of trends, technology and time to market, the Indian automotive industry looks set to tread the challenging path of sustainability, even as it tackles an era of transformation of the entire mobility ecosystem.

(This feature was first published in the 15 August 2018 issue of Autocar Professional)

RELATED ARTICLES

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

30 Aug 2018

30 Aug 2018

6729 Views

6729 Views

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo