Coming of age

Honda’s journey in India since 1998 has seen a lot of action, ups and downs and milestone moments. Autocar Professional takes a deep-dive tour into the Japanese automotive brand's story in India.

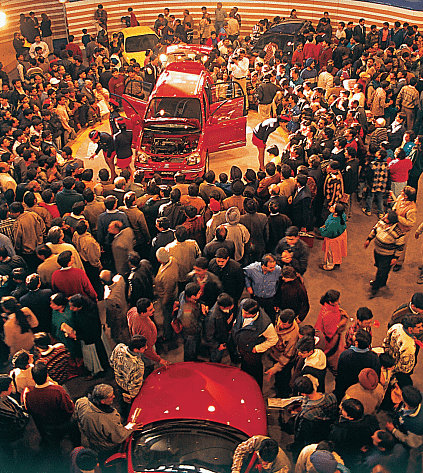

The late 90s was the begining of a new era for the Indian automotive industry. In hindsight, one would think that participation in the 1998 Auto Expo was a guarantee for success for a new automotive brand or products. That landmark Expo saw Hyundai Motor announce its India entry, Tata Motors unveil the historic Indica and Honda officially entered the Indian market with the City sedan.

It’s no secret that each one of these storied names went on to achieve greatness in the Indian market. Honda had a stellar start and the City has never looked back since. In fact, the City is the longest running mass market model in the country and is a brand that’s as old and possibly as big in India as Honda itself. The City sedan has been the backbone of the company ever since and has seen the company through the jittery ride it has had over the last decade.

The first-generation City sedan which was an Asia specific model was an outcome of Honda’s consolidation efforts, and its strategy of focusing on the simple formula of the Honda magic, which lay in its engines and the way it drove. The City’s driving attributes made people even overlook the interiors which were not considered to be premium for the time. The fact that the Honda City could command a higher price than its rival Mitsubishi’s Lancer, which was more expensive in ASEAN countries, already made a statement about brand Honda’s equity in India.

With a focus on cutting-edge technology, with its iVTEC petrol engines and smooth automatic transmissions, it did not take much time for Honda to become an aspirational brand in India's growing PV market, which was then opening up to foreign players, including those from Korea, America and Europe.

With the invincible City, Honda was able to successfully create a solid foundation in India in the fast growing and lucrative sub-Rs 10-lakh-price segment while further enhancing its brand with the introduction of halo, global models like the CR-V SUV and the flagship Accord sedan. The introduction of the futuristic Honda Civic sedan in India in 2006, bowled over buyers and at its peak, this revolutionary car even sold 1,800 units a month, a figure no executive sedan has ever come close to achieving.

The Indian car buyer's trust in Honda gave the company the confidence to gradually eye more volumes, and prepare for capacity expansion. Its maiden plant in Uttar Pradesh's Greater Noida which started off with 50,000 units of annual capacity, saw more capital infusion and by 2008, the capacity was doubled to 1,00,000 cars after a cumulative investment of Rs 1,620 crore since the company’s inception in 1997. The capacity was further beefed up to 120,000 units to cater to growing demand.

Honda was now all ready to make a dent in the high volume hatchback segment with the Jazz and was confident that it would receive the same enthusiastic response as the City and priced it at a premium. But, in a segment dominated by Maruti, the Jazz had effectively entered the lion’s den and was badly mauled. Launched in 2009, the Jazz never really took off and its failure came as a rude shock to Honda which until then, cruising on the back of the City, could do no wrong.

"India is a very value conscious market and the Jazz lacked value. The pricing was almost 20-25 percent higher than the internal price targets, and from thereon, it was always going to be a catch up with the defined plans. In fact, after the launch of the Jazz, Hyundai's premium i20 hatchback started selling more," said one of the eight people Autocar Professional spoke with. The Jazz’s high cost, largely due to the high level of imported content (localisation levels were at best 25 percent), priced what was still a large hatchback, in the sedan segment. Consumers rejected the Jazz seeing more value in the status-conscious sedans and cheaper hatchbacks. Honda had to cut its losses and eventually discontinue the Jazz in 2013.

The 1998 Auto Expo held in New Delhi was a turning point for the Indian automotive scene which saw the entry of foreign brands including Honda and Hyundai in the market.

The company, however, did not give up on its mass-market volume ambitions in India and made a second attempt in 2011 with the Brio — an ASEAN region-specific model developed specifically for India, Thailand and Indonesia markets. With its unconventional styling, the Brio too failed to make a noticeable mark in its targeted segment, and could be considered as the tipping point of Honda's slide in India over the next few years. The car was also faced with a major supply chain disruption with a Tsunami striking Japan impacting its production right after the launch.

While all this was going on at the product side, Honda's business structure was simultaneously going through a massive transformation, with the Japanese parent moving towards acquiring the entire stake in its JV entity — Honda Siel Cars India, a joint venture with India's Usha International, a white goods major, with which it had forayed into the liberalised Indian economy in 1995.

The India journey

- Honda struck a JV with Usha International in 1995 to foray into India's passenger vehicle market.

- The Japanese carmaker launched the ASEAN specific Honda City sedan in the country at Auto Expo 1998.

- Doubled capacity at Greater Noida plant from 50,000 units in 1997 to 100,000 units in 2008.

- Capacity expanded and commissioned second plant in Rajasthan in 2008.

- Honda acquired Usha's entire stake in the JV to become 100 percent subsidiary of Honda Japan in 2012.

- Tapukara, Rajasthan factory rolled out the first car in 2014, total capacity expanded to 300,000 units in 2015.

- Honda shuttered Greater Noida car plant in 2020, consolidated manufacturing operations at Tapukara.

More than a decade and a half later, the acquisition was completed in 2012, and it gave Honda complete management control over its Indian operations, which was now rechristened as Honda Cars India (HCIL). While the change brought full operational autonomy, industry observers believe Honda's car business in India also lost expert guidance on the Indian market with Usha's representation on the Board gone.

Lost time is lost forever

Also, around 2007-2008, India's passenger vehicle market was undergoing a massive shift towards diesel powertrains, as the fuel, which was the backbone of agricultural and logistics industries, was being heavily subsidised by the government. The difference between the retail prices of petrol and diesel was as much as 70 percent, and diesel cars were increasingly becoming the defacto choice for a large set of Indians.

Several OEMs had seen this market opportunity, and in order to save time in development, many were adopting a collaborative approach to make the most of the existential demand. Diesel car sales peaked in India around 2012, with over 54 percent of all new car sales coming from this relatively dirtier fuel option.

However, with a global legacy rich in highly-efficient and technologically-advanced petrol powertrains, Honda was caught off-guard in this mega transition of the Indian passenger vehicle market towards the diesel fuel. While the Civic was discontinued in 2012 due to a slump in sales of D-segment cars in India, the company was also scrambling for a diesel engine to sustain sales momentum in the country.

With a global philosophy and core ethos of sustainability, which was amply pronounced by its tag line — Blue Skies for Our Children — a diesel engine would be against its founder Soichiro Honda's vision of a cleaner world, but the need for one was so critical in India that Honda's R&D in Japan did come up with a solution — an allaluminium 1.5-litre diesel engine that was the lightest in its class in India, and focused on efficiency and low emissions.

Honda's 1.5-litre diesel mill, christened iDTEC, made its global debut in India in 2013, with the carmaker's latest market entrant — a sub-four-metre compact sedan, Amaze, specifically developed to reap the taxation benefits for such cars in the country. With its all-aluminium engine construction, the 1.5-litre diesel was a bit noisy compared to competition, and did not gel with customers who were used to the Japanese carmaker's refined offerings.

The Gen-1 Tata Indica (top) and Mitsubishi Lancer (Cedia) brought in good company for the Honda City in the Indian market.

The Gen-1 Tata Indica (top) and Mitsubishi Lancer (Cedia) brought in good company for the Honda City in the Indian market.

Moreover, the timing of Honda's diesel foray in India was inopportune as the government had reduced subsidies on the fuel in 2013, bringing down the difference between petrol and diesel prices from 79 percent in 2012 to a mere 38 percent in 2013. While Honda's mid-term product plans now heavily banked on diesel, the market started tilting away, with new diesel car penetration reducing to 48 percent by 2014, when the company introduced diesel in its best-selling model — Honda City — and also commenced assembly operations at a second, 120,000-unit annual capacity site in Rajasthan's Tapukara.

While the general negative aura around diesel powertrains in the country, and the advent of BS6 emission norms in April 2020, brought about a drastic reduction in the offtake of diesel cars in India, Honda had to finally retire this relatively underutilised mill in April 2023 with the introduction of RDE norms that made it an expensive affair for OEMs to upgrade their small-capacity diesel engines to these real driving emissions (RDE) regulations.

This delay in tapping into the market opportunity has been a key reason for Honda's slip from being a key player in India's passenger vehicle market, to one that ended up losing its once-held No. 5 position in 2007, to No. 11 in 2011. The company has been caught unawares multiple times, and is often slow to acknowledge and respond to changing market dynamics or market feedback.

For instance, when the Indian passenger vehicle market started showing a liking to mid-size SUVs around 2012, HCIL conducted a feasibility study to assess the possibility of bringing the 4.2-metre-long HR-V or Vezel to the Indian market, but, announced it impossible, for sources say due to the little localisation scope for the SUV, particularly for its unique feature - electronic parking brake (EPB).

Today, when SUVs command over 50 percent share of all new car sales in the country, Honda, which finally realised the trend a couple of years ago, is yet to introduce its first mid-size SUV offering that is likely to be launched in the coming months, and give a fight to the established brands from its Korean and Japanese rivals.

Confused approach

Often in the past decade, Honda has lacked surefootedness in its decision making. Between 2012 and 2022, HCIL saw five different CEOs taking charge, with each one coming with a different approach and background. This led to several projects being called off and strategies undergoing course correction midway. For instance, after observing the Hyundai Creta's success in the Indian market, HCIL, in 2017, had resumed work to bring the HR-V to India, and was targeting roll out by end-2019.

However, despite being on track for the mass production of the model — codenamed: 2XV — the company called off the project around mid-2019, with low localisation (30 percent) and low volumes (around 4,000 units per annum) likely being the key reasons. The Hyundai Creta, meanwhile, has became the undisputed champion of the mid-size SUV segment in India and has set a benchmark with features like panoramic sunroof, premium audio setup, connected car technology, and a multitude of powertrain options. Honda, which now aims to rival the Creta with its newly-developed offering that is likely to make its debut around June 2023, but is still expected to give a panoramic sunroof, and multiple powertrain options amiss on grounds of pricing.

Furthermore, sources say, in 2015, Honda had kicked off a new mass-market R&D project — Indian Small Car Revolution (ISR) — to jointly develop a mass-market car along with Thailand to be positioned below the Brio. Despite work being underway, and in full swing, the model was called off abruptly, with the company citing low volume potential as the key reason to its design teams working diligently across the two countries.

Consolidating business globally

Covid emerged as a major setback for many businesses, forcing them to relook at their strategies, and also go lean to ensure viability and long-term sustenance. For HCIL, whose market share was also under a significant threat with competition offering better value, and more options, including SUVs, took to a major reboot in CY20.

The company started implementing its business consolidation strategy in India by streamlining its workforce and rolling out voluntary retirement schemes (VRS) for employees in January 2020, and eventually ceasing manufacturing operations at its Greater Noida plant in December 2020 to entirely rely on its Tapukara plant for production and exports.

However, in the exercise, Honda had to swallow a bitter pill by discontinuing its Civic and CR-V models which were being assembled by CKD kits at this plant, which had been recently given a expensive overhaul to assemble these models. While the move came as a shock to customers, enthusiasts, and potential Honda buyers who feared the company's exit, but the step was critical for the Japanese carmaker to ensure viability, and profitability of its Indian operations.

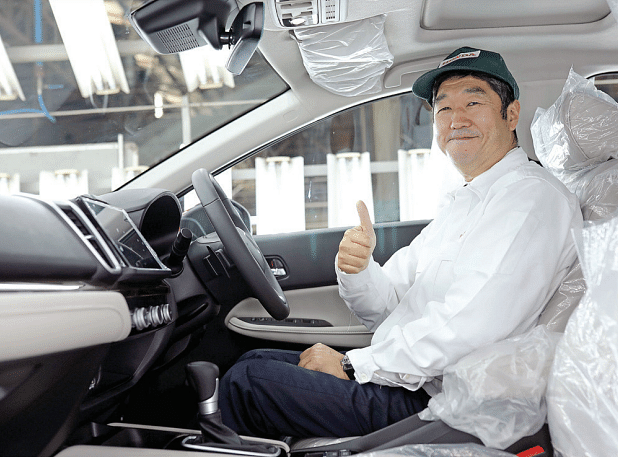

According to the incumbent HCIL President and CEO, Takuya Tsumura, "At one point around 6-7 years ago, Honda used to chase volumes globally, which is when we made significant investments and added a lot of fixed costs. This made Honda's financial situation weaker, including that in India." Tsumura explained that Honda's previous global CEO, Takahiro Hachigo had found the situation unhealthy and it made sense to consolidate the manufacturing footprint. "This led to the decision of closing factories in the UK and Turkey, and consolidating operations in Japan, Thailand and India with one factory each, and focusing on profitability over running behind volumes," he said in an exclusive conversation with Autocar Professional. "Our aim was to make the total constitution stronger, and it was good that we did it before Covid; we took the action. A lot of things were happening around that time, so we could take the call. We successfully transitioned to a stronger cost constitution, and even though it impacted many countries, including India, it was good timing," Tsumura added.

"At one point around 6-7 years ago, Honda used to chase volumes globally, which is when we made significant investments and added a lot of fixed costs. This made Honda's financial situation weaker, including that in India." — Takuya Tsumura, President and CEO, HCIL

"At one point around 6-7 years ago, Honda used to chase volumes globally, which is when we made significant investments and added a lot of fixed costs. This made Honda's financial situation weaker, including that in India." — Takuya Tsumura, President and CEO, HCIL

He recalled that the closure of Honda's factory in Turkey also opened a new opportunity for India and Thailand, which would now export cars from their respective bases to fulfill Turkey's demand for Honda models. "Our exports will build further; we have a bigger export plan from India. While the headquarter tries to utilise India as a base, India has a potential to grow its exports. We do not only export fully-built units, but also engine and transmission parts. We will try to grow our exports in the future," Tsumura revealed.

Tsumura stressed that Honda needs to consolidate and make its constitution stronger to invest into EVs, and future disruptive technologies like rockets and drones, which are poised to transform the mobility ecosystem.

"To make that money, we needed to make our constitution stronger. It is a global story," he said.

Technology roadmap for India

Although enthusiasts have been crying for a turbo-charged Honda petrol engine, or introduction of some of its performance-oriented 'Type R' models in the country, the carmaker has always adopted a safe approach to cater to a wider set of audience in India. While the chances of seeing a turbo-charged VTEC engine in India continue to remain bleak in the foreseeable future, Honda is observing a shift in the market towards premium models, and it would like to tap into that demand. "In India, we would like to serve our stronger areas, like the premium end of the market. Earlier, about 65 percent of the market was sub-Rs 10 lakh; now it is moving up. We are trying to set up our line up in that area. We would introduce one new model every year, starting this year," Tsumura said.

Tsumura further said, "We will try to capture the premium end of the market, not the luxury segment, and our future line up is going to be in that area." This remark also hints towards the company having no immediate plans to introduce its Acura brand that sports a luxury car portfolio, to the Indian market. Honda, which has also started introducing electrified options in the country with the City getting a strong-hybrid option — e:Hybrid — Tsumura says the tax structure on hybrids does not make it a viable business case to localise hybrid powertrains in India. "The tax structure is unfavourable. While petrol vehicles are taxed at 45 percent, hybrids are taxed at 43 percent, and EVs at 5 percent. If this scheme continues, then there is not much benefit for the hybrid powertrain. While we believe that hybridisation is a good solution before the industry switches completely to EVs, the Indian government is emphasising more on EVs, and therefore, we are moving in that direction," Tsumura said. "Globally, Honda has a carbon-neutrality target of 2050, and we are trying to align our Indian operations in that direction. So, we will have both EVs and hybrids in the future," he added. The company also intends to increasingly offer ADAS features in its future models in India.

The way forward

The business consolidation and restructuring exercise did bear fruit, with HCIL posting a net profit of Rs 235 crore in FY2021-22 — all of three years later when it last registered profit of Rs 1,141 crore in FY2018-19. While it is upbeat about the upcoming SUV, there are headwinds that might continue to tame its flight.

Interestingly, Honda's upcoming mid-size SUV (code: 3US) enters the market amid strong macroeconomic headwinds and even fiercer competition in the form of over 50 SUV offerings. "Honda will have to get the new launch spot on. Having downsized its workforce, and shut down factories, the operation is making money, but a mis-fired product at this point in time in terms of positioning, pricing or timing would have a collateral impact on its future roadmap, especially when the entire automotive industry's focus is going to be on electrified vehicles," said a source requesting anonymity. Amid a plethora of choices across price brackets, Honda continues to be seen as a sedan specialist and will have its task cut out to get into the consideration set of buyers with its new SUV.

This feature was first published in Autocar Professional's May 1, 2023 issue.

RELATED ARTICLES

BKT, the ‘Off-Road King,’ Chases the Consumer Market

The company has unveiled a broad range of tyres for the Indian two-wheeler and CV markets.

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

10 May 2023

10 May 2023

13978 Views

13978 Views

Shahkar Abidi

Shahkar Abidi

Darshan Nakhwa

Darshan Nakhwa