Can India position itself as a component production alternative to China?

Given China’s dynamic role in global supply chains and as a primary source of many an automotive component, the impact of current production stoppage in China is being immediately felt worldwide. Can India step in?

The outbreak of Coronavirus (Covid-19), which originated in China over two months ago and is now having a major impact on countries worldwide, could have a silver lining from a Make-in-India automotive perspective.

China, the largest automotive market in the world and also one of the world’s biggest manufacturers and suppliers of components particularly electronics, has been badly hit and scores of its factories remain shuttered. The resultant impact is being felt on automotive supply chains at OEMs and suppliers across the world, including India. If production does not commence, even in a small manner, in China within a month or so, it is likely that manufacturing operations at some OEMs in some countries could come to a grinding halt.

Given China’s dynamic and robust role in global supply chains and as a primary source of products particularly automotive, the impact of current production stoppage in China is being immediately felt worldwide. While most companies are temporarily taking care of supply disruptions through their inventories, the renowned Just-In-Time practice and methodology of shipping parts to harried vehicle assembly lines seems to have met its match in Covid-19. OEMs cannot easily make sudden shifts in supply chains nor source from alternative suppliers, whose products have to be certified on quality and other critical parameters. Importantly, a prolonged Covid-19-driven disruption and delay in Chinese factories coming back to life will have a ripple effect on the logistics chain and the time it takes to ship components to India and elsewhere. This is clearly a crisis, which has many learnings for Global Auto Inc.

Given the huge reliance on China as a sourcing base, captains of industry across Global Automotive Inc would be considering developing alternative sources of importing components. Can India position itself as one? In recent years, Indian component suppliers have made a name for themselves by driving up the quality curve, a fair number winning the coveted Deming Prize too. Not only that, they have actively assisted automakers in successfully leapfrogging to BS VI emission norms in a scant three-year period.

Gravest threat to global economy, says OECD

As the coronavirus spreads, the global economy faces the gravest threat since the financial crisis of 2008. According to OECD’s latest Interim Economic Outlook, output contractions in China are being felt around the world, reflecting the key and rising role China has in global supply chains. Subsequent outbreaks in other economies are having similar effects, albeit on a smaller scale.

OECD’s report says, “Annual global GDP growth is projected to drop to 2.4% in 2020 as a whole, from an already weak 2.9% in 2019, with growth possibly even being negative in the first quarter of 2020. Prospects for China have been revised markedly, with growth slipping below 5% this year, before recovering to over 6% in 2021, as output returns gradually to the levels projected before the outbreak. The adverse impact on confidence, financial markets, the travel sector and disruption to supply chains contributes to the downward revisions in all G20 economies in 2020, particularly ones strongly interconnected to China, such as Japan, Korea and Australia.”

Sum of all parts: Sharper focus on localisation for all types of components will help Indian industry reduce its reliance on substantial imports from China and thereby de-risk itself.

For India’s component industry to accelerate its growth, a joint ACMA-McKinsey study released in September 2019 had called upon key stakeholders such as the government, industry bodies and OEMs co-create and collaborate. Among the actions these stakeholders could consider to help the industry prepare for its next phase of growth is facilitating a cooperative supply chain in high-potential export markets. The study said that increasingly, companies across industries are seeing merit in developing a collaborative supply chain by partnering with peers. This reduces risks and costs and makes it easier to expand into newer markets. Industry bodies in India could work with multiple automotive component manufacturers to enable cooperative supply chains, especially in the area of warehouse management. Such guidance could help these players enter and flourish in high-potential export markets like China.

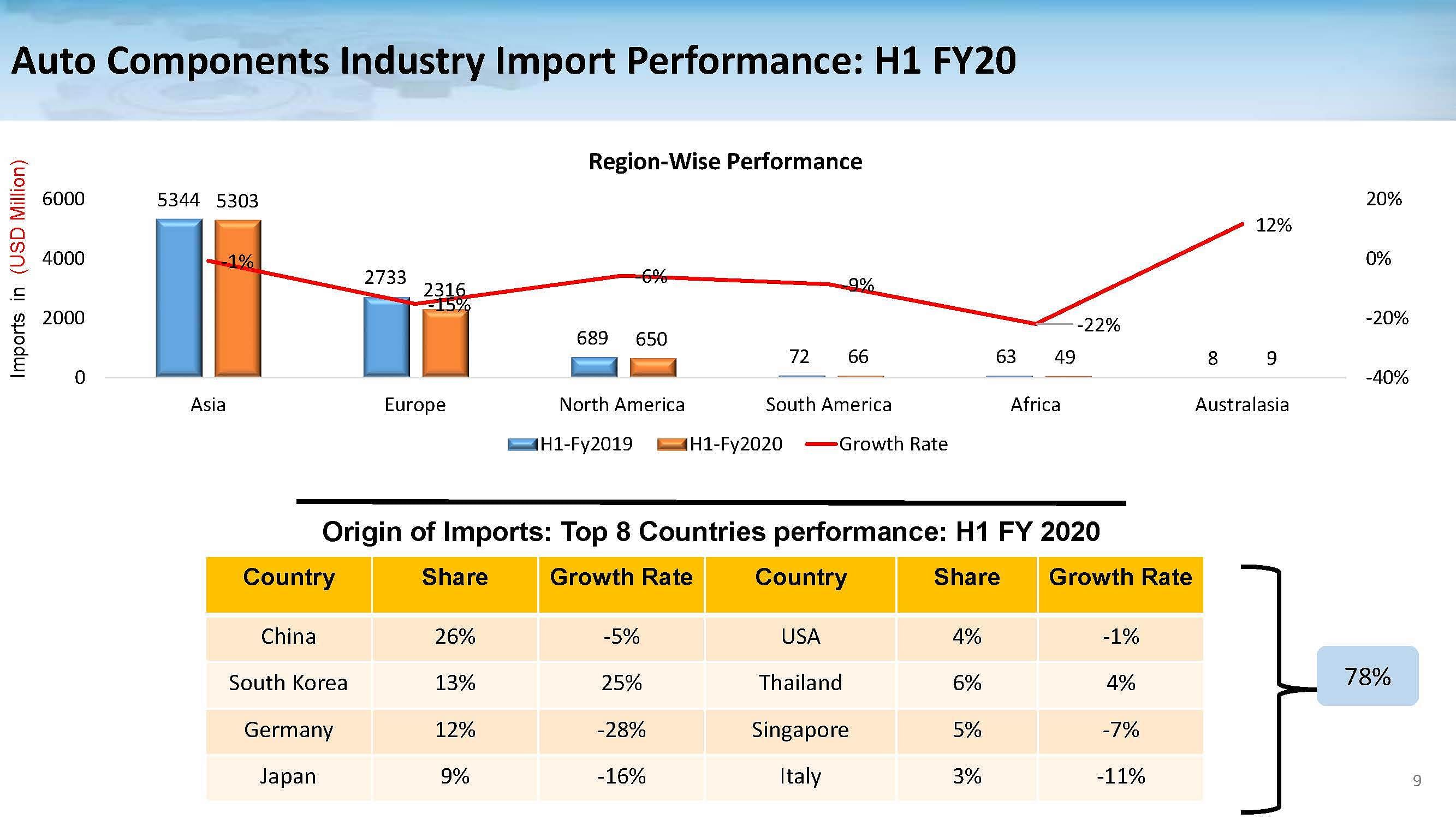

China has biggest share of India’s components imports: 26%

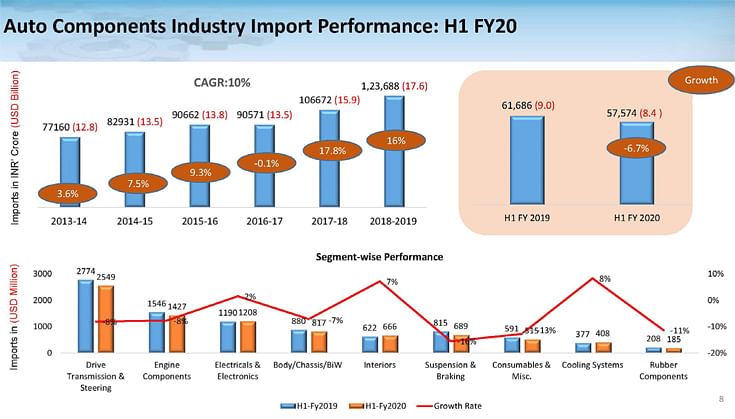

Of the top 8 countries that India imports automotive components, China has the largest share – 26%, followed by South Korea (13%), Germany (12%), Japan (9%), USA (4%), Thailand (6%), Singapore (5%) and Italy (3%). In FY2019, the value of imports of components from China was US$ 4.5 billion of the overall US$ 17 billion dollars of imports China 4.5 billion. India imports a varied range of parts from China covering drive, transmission and steering; engine parts; electricals and electronics; suspension and braking; cooling systems and vehicle interiors.

ACMA president urges de-risking strategy and increased localisation

Speaking to Autocar Professional, Vinnie Mehta, director general, ACMA said: “India Auto Inc imports all types of components from China. In FY2019, of the total imports of US$ 17 billion, China accounted for US$ 4.5 billion. The import of these components depends upon pricing, an OEM's global sourcing strategy and whether Indian suppliers have competence in that specific component / technology.

“De-risking and localisation are clearly the writing on the wall. We (Indian industry) did not act in time to capitalise on the opportunities that came about when the USA-China trade war began. Now, one of the de-risking strategies has to be to increase localisation in India, at a rapid pace. This essentially has to be a mid- to long-term strategy and I think the industry and the government need to have a focused campaign.”

As regards the present situation in the industry, Mehta said: “There is concern in the industry but no panic.”

Indian component suppliers too are increasingly thinking on the same lines. Commenting on the subject, Anjali Singh, executive chairperson, Anand Group, said: "I think through this latest hit of Coronavirus, there will be a real push on localisation; besides, the government is already encouraging Make in India. The OEMs are also very clear that localisation to another level is a must."

"I don't think anybody can survive without traveling the localisation journey. Yes, they all have but now it will be accelerated even further. There will be more sites producing smaller numbers. Industry per se, be it automotive, telecom, electrical or electronics, will no longer have mega production hubs, because they can basically be threatened by any kind of calamity or natural disaster and cause a worldwide crunch as we have seen with the Coronavirus.

"So, I think this will change the way the manufacturing footprint happens. And many countries will benefit, whether it is India, Bangladesh or Sri Lanka."

"Currently, everybody just wants to stay afloat for the March-April period. They are concerned about part numbers and where things are coming from, so that production lines keep running smooth. Obviously, there is a major slowdown in overall numbers. So everybody is coping with the present day, but I am sure future planning will start very soon."

Ulrich Schrickel, CEO of the mechatronics major Brose Group, who was in India recently for the inauguration of a new facility in Pune, believes that shifting manufacturing operations for many products is not very easy and it is not just a management decision to bring a product from another market. He said, shifting manufacturing from one location to another location for many products "requires the helping hand of our customers who are willing to do that. We cannot do it ourselves."

In an interaction with Autocar Professional, Carsten Breitfeld, CEO of Faraday Future, the electric vehicle manufacturer in the USA, when queried whether India can look at this opportunity to support the global automotive sector as an alternative to China, said: “I think an even more diverse global network of suppliers would be beneficial for companies in terms of sourcing diversity and cost efficiencies.”

Collateral impact on vehicle buying behaviour in China

The coronavirus outbreak is also having a collateral impact on vehicle buying behaviour in China. According to Balaji Pandiaraj, executive director, Clinics & Mobile Labs, Ipsos India, “Ipsos recently conducted a survey in China in the aftermath of the COVID-19 outbreak. The survey shows how people are re-evaluating their car purchase behaviour in the face of adversity, especially for a high involvement and high value category, like automobiles. Contagion fears are driving people towards private mobility as opposed to choosing public transportation, leading to increased car purchase intention, even amongst first- time buyers.

“Health monitoring as a feature is gaining significant traction owing to the growing number of infections. People are now seeking features unheard of before such as ‘in-built mechanisms to monitor the health of car members’ and ‘outbreak area reminder’ besides the already existing novel features such as ‘AC with germ filter”. Interestingly, these features are also being requested from entry level cars.”

‘Health configuration’ is suddenly becoming the new norm now. How will the automotive industry respond to this? Will we see health tracking sensors incorporated in cars? Frequency of digital touchpoints has increased significantly, to unprecedented levels, with the sole intention of avoiding any tertiary contact. Online and door-to-door dealership services, are now the preferred mode of engagement, for customers, both in sales and aftersales.”

(With inputs from Mayank Dhingra & Nilesh Wadhwa)

RELATED ARTICLES

Beyond Cars: VinFast's Full-spectrum EV Push in India

With $2 billion committed, VinFast is constructing an integrated play spanning cars, scooters, buses, ride-hailing and c...

A Breather for Hero

A combination of policy tailwinds, new products and Honda’s cautious approach on EVs put a stop to the constant encroach...

Renault India's Quiet Fixer

As the head of Renault India, Francisco Hidalgo Marques faces his biggest challenge yet.

04 Mar 2020

04 Mar 2020

9545 Views

9545 Views

Kiran Murali

Kiran Murali