New business models to drive aftermarket in India

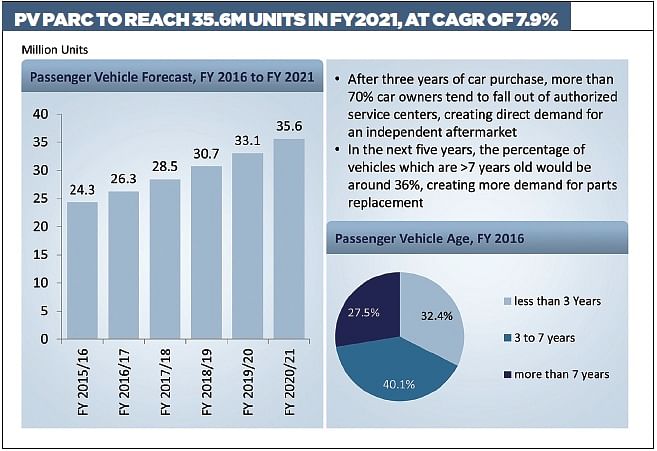

In an increasingly digital India, which has a vehicle parc of 24 million and growing, organised service chains and parts e-commerce are billed to be the new growth drivers of the Rs 44,200 crore aftermarket.

Sometimes it takes an event for one to realise the potential of an industry. AutoServe, the biennial automotive aftermarket event organised by the Confederation of Indian Industry (CII) between November 18-20 in Chennai, reflected the huge potential of the domestic market and also revealed future business trends in this dynamic sector.

The seventh edition of the expo, which focuses on vehicle care, maintenance, service, parts and garage equipment, brought together around 110 exhibitors. Coming just 10 days after the government’s demonetisation move, aftermarket industry stakeholders were of the opinion that despite some short-term distress, the longer-term impact of this decision will be positive on the sector as it will encourage cashless transition and drive a digital payments system in the unorganised sector.

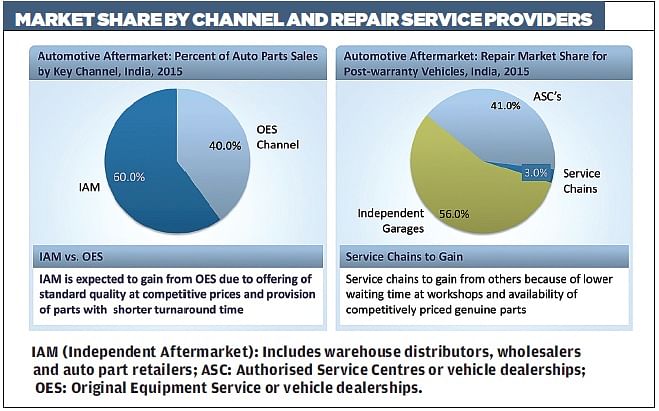

India being one of the leading markets, the size of the aftermarket is estimated to be $7 billion with 30 percent passenger cars and 40 percent commercial vehicles. Given the humoungous car parc in the country and the need to service vehicles, the aftermarket sector is expected to see rapid growth over the next decade.

Talking about the aftermarket sector, R Dinesh, chairman, Auto Serve 2016 and joint managing director, TVS & Sons, said, “The domestic aftermarket has seen rapid expansion from commercial vehicles to passenger cars and the usage pattern has changed dramatically over the past few years. This has led to a tremendous increase in service requirements. Autoserve focuses on the independent aftermarket to understand what OEMs and component suppliers need to do to support this eco-system.”

According to Dinesh, the Indian automotive market is likely to grow 10-12 percent over the next 2-3 years, provided the new passenger vehicle market continues to maintain its 7-8 percent annual growth.

In India, the auto aftermarket is critical to drive a vibrant automotive industry as the sector is probably the largest employer in the country. Reports have it that nearly one manufacturing job out of four jobs is created in the aftermarket and services sector. Therefore, the aftermarket is crucial for the profitability and sustainability of Tier 1 suppliers.

For sustainable longer-term growth, the sector needs to make a tangible impact on transport operators, service mechanics and retailers to improve their profitability. This is necessary not for its survival but the resurgence of the sector. To achieve this, all stakeholders need to have a taskforce for the aftermarket and should collaborate with component and vehicle manufacturers to create value for consumers.

Regulatory changes and adoption of technology are also introducing new challenges to the aftermarket industry. Upcoming BS IV emission norms for commercial vehicles from April 1, 2017 will see a significant impact on the repair side of the vehicles as engine electronics will have increased substantially. To counter this, roadside mechanics have to tie up either with component manufacturers or knowledge service providers to obtain the technical know-how.

Bringing an international perspective, Gael Escribe, CEO of Nexus International, spoke about how the aftermarket has evolved globally and the drivers of change in the sector. According to him, there are four broad trends that are driving the aftermarket globally. Firstly, it’s the consolidation underway in key markets including the US, Europe and Asia Pacific. Then, there’s the level of electronics content in cars which resultantly has brought about a lot of complexities and cost when it comes to servicing cars, the increasing influence of digital tools and OEMs’ interest in the aftermarket. “The Indian automotive market is growing extremely fast and is crucial for OE manufacture,” he added.

AutoServe saw Japanese companies participate for the first time in the form of a Japan pavilion. The 16 Japanese exhibitors comprised manufacturers and marketers of sealants, tools, adhesives, seat fabric and metal-plastic components. While some were first-timers, a few are already present in India. Commenting on the participation of Japanese firms and eyeing business opportunities in the Indian automotive aftermarket, Hidehiro Ishiura, director-general, JETRO Chennai, said: “To flush away counterfeit and low quality products, there is a need to develop more branded products to retain the customer trust. Higher quality products from Japan will contribute to growth of the aftermarket sector in India.”

Some of the exhibitors Autocar Professional – the official media partner to AutoServe 2016 – spoke to said there’s huge potential for the aftermarket business in India on the back of service requirements for the huge vehicle parc. Making their presence felt were garage equipment supplier Madhus Garage which represents a number of global brands through imports; TVS Automobile Solutions, TVS Tyres, Brakes India, Mahindra First Choice, Lucas-TVS, Roots Industries, Sundaram Fasteners and Bosch’s aftermarket division.

Business models for the future

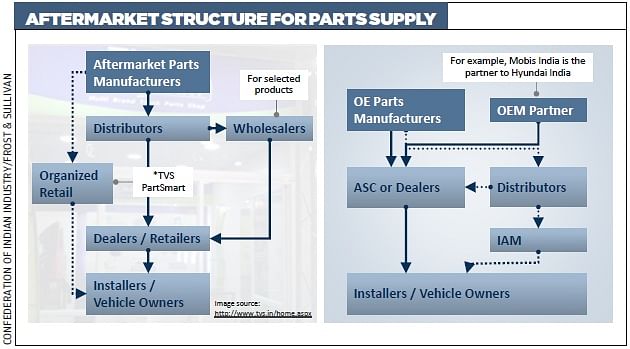

CII commissioned Frost & Sullivan to prepare a report on the automotive aftermarket in India. The in-depth study reveals how new business models are driving this sector at a time when connected devices and e-retailing are making their presence felt across the country.

The Indian economy, which is currently the world’s seventh largest and growing at 7.5 percent, could drive past the UK and France in the near future. For a country with the youngest population in the world, connectivity has become the growth mantra and by 2025 it is estimated that there will be 4 billion connected devices in India.

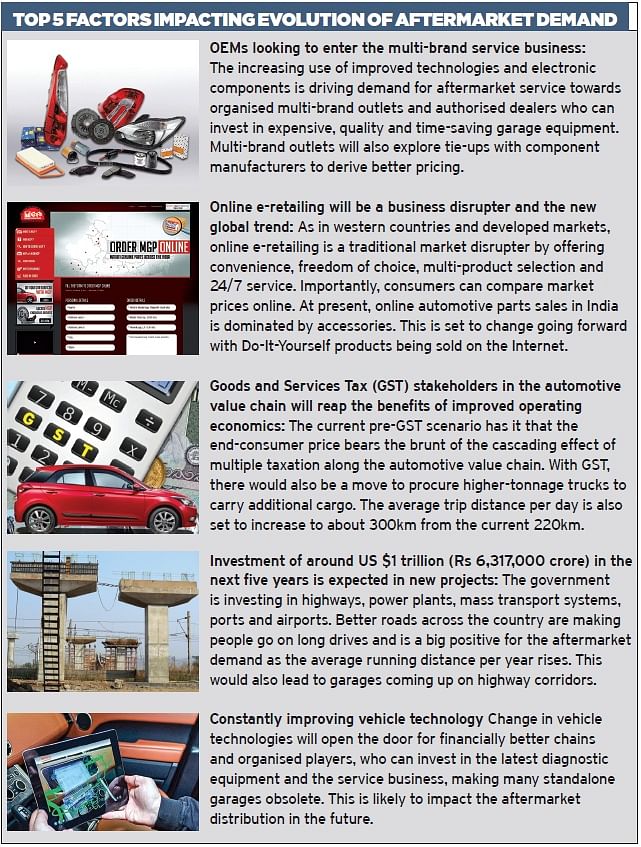

The coming years will see new market trends that are likely to impact the aftermarket. Vehicle manufacturers will explore entry into the business of multi-brand services through organised multi-brand outlets and authorised dealers who can invest in expensive garage equipment. Mahindra First Choice is one such company which has done this successfully. Online e-retailing, which is the new global trend, will emerge in India and enable consumers to compare market prices and shop online. The coming of the Goods and Services Tax will also impact stakeholders in the automotive value chain, helping them reap the benefits of improved operating economics. This is as opposed to the current scenario where the end-consumer price bears the brunt of the cascading effect of multiple taxes along the value chain.

The Frost & Sullivan study says auto parts e-commerce in India is still at a nascent stage due to the limited presence of major players, small product portfolio and lower customer awareness levels. There are also trust issues associated with buying parts online.

In 2014, the online auto aftermarket in India was estimated at around $20 million (less than one percent of the overall parts aftermarket at a retail level) and is expected to increase at a CAGR of 7 percent to $150 million by 2020. There are huge opportunities to be had in the B2B space due to speedy growth of organised and independent workshops and customers being positively disposed towards them.

The key market challenge to auto parts e-commerce is the widespread menace of fake parts. Also, no major vehicle manufacturer is currently very active online in the selling of pure parts and services. If at all, some of them focus on car care and accessories which is a booming segment. There is also the challenge of logistics and many companies struggle to supply parts to different parts of the country due to the high cost of doing so.

New market-impacting trends

There are five major trends likely to impact the aftermarket components market in the next five years.

Scrappage of old vehicles: The government is planning to provide customers with incentives to promote scrappage of vehicles more than 10 years old; it will have a negative impact on aftermarket components.

GST: Fewer regional hubs will be required and no price arbitrage will be available for buying from low tax states.

Online retail: While there is negligible online presence of parts sellers, expect a number of start-ups to enter the online spares retail space apart from traditional e-retailers like Snapdeal, Flipkart and Amazon. With investor funding online, e-retailers are offering aggressive discounts compared to market prices.

Smart cities: The government’s plan to develop 100 smart cities will provide impetus to the growth in these urban centres, which will be major drivers of growth, urbanisation, and consumption in their respective states.

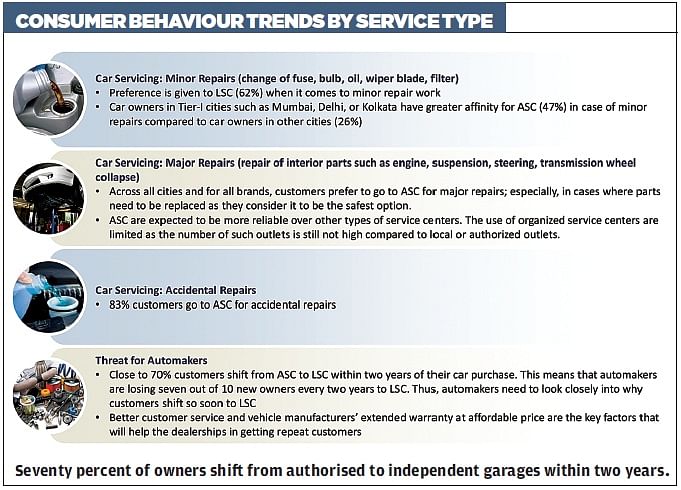

Organised service chains: Organised service garages like Carnation, MyTVS, and Mahindra First Choice are gaining ground and will become big influencers in the vehicle maintenance space. These players are aggressively planning to enter Tier-1 and Tier-2 cities in the near future.

Future industry growth drivers

The growth in the vehicle parc and aging vehicles will boost the independent aftermarket in India. Some of the key growth drivers in the future will be:

Poor condition of roads: Poor road conditions in different parts of the country resulting from the use of substandard raw materials, overloading, and weather conditions cause great damage to parts, resulting in faster replacement which in turn translates into higher demand for parts in the aftermarket.

Regular scheduled vehicle maintenance: Of vehicle owners, 90 percent carry out regular maintenance to improve performance and life of the vehicle. This would drive the aftermarket. However, 22 percent of the owners report that they do not follow the manufacturer’s recommended schedule for maintenance, as they find it to be too expensive and frequent.

Increasing vehicle age / kilometres driven: Indian consumers tend to use their vehicles longer and so the number of vehicles older than seven years will grow. As the road infrastructure improves (currently, only 50 percent paved roads), consumers will drive more. Both these factors will drive the aftermarket.

Steady increase in the car parc: Vehicle sales have been robust until 2012. They dipped in 2013 but have shown shown strong growth since then. This will result in an increased car parc, which is forecast to grow by 13.4 percent until 2021. This will drive demand for parts in the aftermarket.

Given this scenario, the automotive aftermarket in India seems headed for good times. With a growing number of vehicle owners focusing on keeping their cars well maintained and carmakers bullish on launching their own multi-brand service outlets, it won't be long before the sector shifts into a higher gear. Greater digital connect for industry players will be mandatory as a young vehicle-owning populace prefers to log on to be informed purchasers.

This article was first published in Autocar Professional's December 1, 2016, issue.

You may like: ACMA says demonetisation will help stem menace of fake parts

RELATED ARTICLES

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

By Kiran Bajad

By Kiran Bajad

08 Dec 2016

08 Dec 2016

66574 Views

66574 Views

Shahkar Abidi

Shahkar Abidi