TVS, Suzuki and Bajaj scooters shine in April but Honda, Yamaha, Hero struggle

Despite hitting record sales in FY2025, FY2026 has opened on a tepid note for the scooter industry with April 2025’s 548,370 units down 6% YoY, essentially dragged down by a poor performance by market leader Honda, along with Yamaha and Hero MotoCorp. TVS Motor’s stellar performance sees its market share jump to 30% while Suzuki and Bajaj Auto also achieved strong gains.

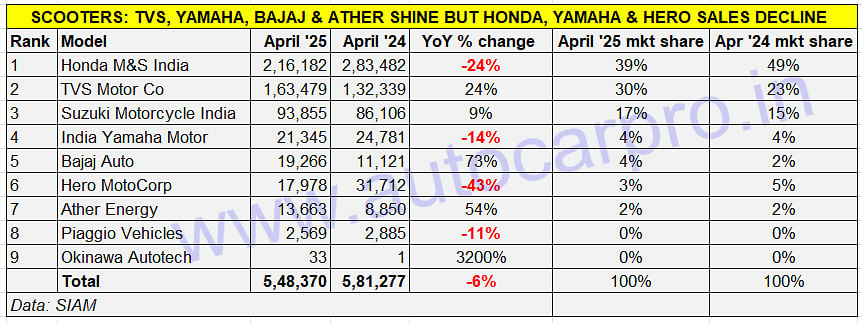

After achieving record sales of 6.85 million units (68,53,214 units) in FY2025, up 17% year-on-year (FY2024: 58,39,325 units), the Indian scooter industry has opened FY2026 on a dour note. The wholesales of 548,370 scooters by nine OEMs in April 2025 are down 5.67% YoY (April 2024: 581,277 units) – a difference of 32,907 units. As the SIAM-sourced data table below reveals, with four of the nine scooter makers registering YoY sales declines, overall industry sales being in negative territory can only be expected. And Honda Motorcycle & Scooter India (HMSI) – the bellwether of the scooter industry – took the biggest hit.

April 2025's 548,370 units were 32,907 units fewer than a year ago. While Honda's April market share has fallen to 39%, TVS' has risen to 39 percent.

April 2025's 548,370 units were 32,907 units fewer than a year ago. While Honda's April market share has fallen to 39%, TVS' has risen to 39 percent.

Honda dispatched a total of 216,182 scooters in April 2025, which is 67,300 fewer scooters than a year ago (April 2024: 283,482 units) and a sharp decrease of 24% YoY. This sees HMSI’s market share for the month reduce to 39% from 49% in April 2024. These comprised 215,342 units of the 110cc and 125cc Activa and Dio (down 24% YoY) and 840 units of the all-electric Honda Activa E and QC1.

In comparison, TVS Motor Co’s wholesales of 163,479 ICE scooters comprising the Jupiter, NTorq and Zest (up 18% YoY) and 27,604 iQube electric scooters (up 65% YoY) saw it achieve 24% YoY growth last month (April 2024: 132,339 units). This translates into an additional 31,140 units YoY and TVS’s scooter market share jumping to 30% form 23% in April 2024.

Suzuki Motorcycle India, which sold 93,855 scooters last month, clocked 9% YoY growth (April 2024: 86,106 units) and a resultant increase in market share to 17% from 15% a year ago. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

India Yamaha Motor is ranked fourth among the nine OEMs with 21,345 scooters sold in April 2025, down 14% YoY (April 2024: 24,781 units). While combined sales of the 125cc-engined Fascino and Ray ZR at 19,861 units were down 13%, demand for the 155cc Aerox scooter (1,484 units) was down 22% year on year.

Bajaj Auto, whose scooter portfolio consists of only the all-electric Chetak and Yulu e-bikes, had a good month – the 19,266 units are a strong 73% YoY increase (April 2024: 11,121 units). This sees Bajaj’s scooter market share double to 4 percent.

Hero MotoCorp is ranked sixth on the scooter market scale with sales of 17,978 units, down 43% YoY (April 2024: 31,712 units). Hero’s scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. Their combined sales of 10,862 units last month are down 62% on April 2024’s 28,832 units. Hero though achieved strong sales with its V2 electric scooter – 7,116 units, up 147% on the year-ago sales of 2,880 units.

Ather Energy, the other only electric scooter maker in this group, sold 13,663 units to register strong 54% growth (April 2024: 8,850 units). The company, which currently has a four-model portfolio comprising the Rizta family scooter, 450S, 450X and 450 Apex, is upping the ante on the network front to expand its reach across the country. According to the company’s recent investor presentation, it had 351 Experience Centres at the end of March 2025 including 86 new ones it set up in Q4 FY2025 alone. With a strong market share in the southern part of India, Ather is now concentrating on achieving gains in other regions.

Legacy player Piaggio Vehicles registered sales of 2,569 scooters in April 2025, down 11% YoY.

One month doesn't a year make and April 2025's dampened scooter market wholesales could be a case of some OEMs having higher inventories at their dealers across their country. With the forecast of a good monsoon and harvesting season along with more money in the wallets of vehicle buyers as a result of increased personal income tax outlay in the Union Budget FY2026, the coming months could just see demand for scooters rise again.

ALSO READ:

Bajaj Auto goes ahead of TVS in electric two-wheeler sales in FY2025

Two-wheeler share of EV sales grows to 58% in FY2025

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

16 May 2025

16 May 2025

10585 Views

10585 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal