AFFORDABILITY: How GST Cuts Reshaped India's Sub-4m Market

Taken together, Mini, Compact, and sub-4m SUV segments have moved to a materially higher demand level — and the shift appears to be holding.

The Mini segment’s doubling, as dramatic as it is, represents a relatively small volume in absolute terms. The more consequential question is whether the GST cut had a measurable impact across the broader universe of sub-4m vehicles, which collectively form the majority of India’s passenger vehicle market. The data indicates that it did.

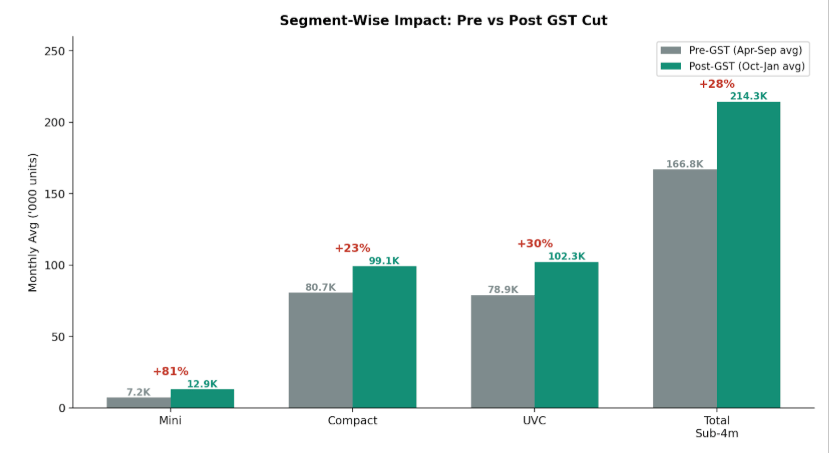

When Mini cars, Compact cars (Swift, Baleno, WagonR, Dzire) and UVC SUVs (Brezza, Venue, Nexon, XUV 3XO) are combined, the pre-GST monthly average was 1.67 lakh units/month.

The post-GST average, on the other hand, is 2.14 lakh units — an increase of 28.5 per cent. Moreover, this is not a figure inflated by a single good month. October was the highest at 2.20 lakh, but November (2.06 lakh), December (2.19 lakh) and January (2.13 lakh) all remain in the 2.05-2.20 lakh band, well above the pre-GST ceiling of 1.75 lakh.

At the same time, there are subtle differences in how the three sub-4m segments responded, each reflecting distinct competitive dynamics and buyer profiles.

Mini (+80.6 per cent): This one showed the strongest response. This segment was most price-constrained and had the most latent demand waiting for a trigger.

UVC (+29.6 per cent): Sub-4m SUVs recovered from the mid-year weakness that had seen them drop to 71,000–79,000 units, climbing back to a sustained 97,000–109,000 range. The GST cut helped, but as the next story explores, the segment’s issues were partly structural.

Compact (+22.8 per cent): The workhorse segment of the Indian market stepped up from an 80,700 average to 99,130. With Maruti’s Swift, Baleno, WagonR, and Dzire forming the core, the Compact segment settled at a consistent floor just below 100,000 — a level it had rarely touched in the pre-GST period.

Above-4m Segments: The Control

Above-4m Segments: The Control

The data offers a natural control group in the form of UV1 and UV2 — SUV segments that sit above 4 metres and were not directly affected by the GST rate change. UV2 (4.4–4.7m: Scorpio, XUV700, and Thar Roxx) moved from an average of 39,569 to 41,422 — a 4.7 per cent increase that is well within normal seasonal variation and cannot be attributed to the tax change.

UV1 (4.0–4.4m) shows a larger increase of 34.9 per cent, but this is driven almost entirely by Maruti’s product expansion — the addition of e Vitara and Victoris to its UV1 portfolio, which nearly doubled Maruti’s UV1 volumes. Strip out the Maruti effect, and the remaining UV1 players show modest movements.

This contrast between GST-affected and non-affected segments strengthens the case that the sub-4m growth is genuinely policy-driven rather than a coincidence of seasonal or macroeconomic factors. The festive season (September–October) would have lifted all segments, but it does not explain why sub-4m vehicles rose 28.5 per cent while UV2 moved just 4.7 per cent.

The Share Shift

Sub-4m vehicles accounted for 55–58 per cent of total PV wholesales in the pre-GST period. This share has remained in a broadly similar range post-GST (55–63 per cent), reaching a peak of 62.7 per cent in December, a month when above-4m volumes were seasonally depressed. The fact that the share has not expanded permanently suggests that the GST cut raised the absolute volume of the sub-4m market without necessarily cannibalising the larger vehicle segments. In other words, the policy appears to have expanded the overall pie rather than merely redistributing it.

Total PV wholesales averaged 2,96,232 units per month before the GST cut and 3,70,784 after — a 25.2 per cent increase. Not all of this is attributable to the tax change (festive season effects and new product launches play a role), but the sub-4m segments clearly account for the bulk of the step-up.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

By Angitha Suresh

By Angitha Suresh

18 Feb 2026

18 Feb 2026

134 Views

134 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi