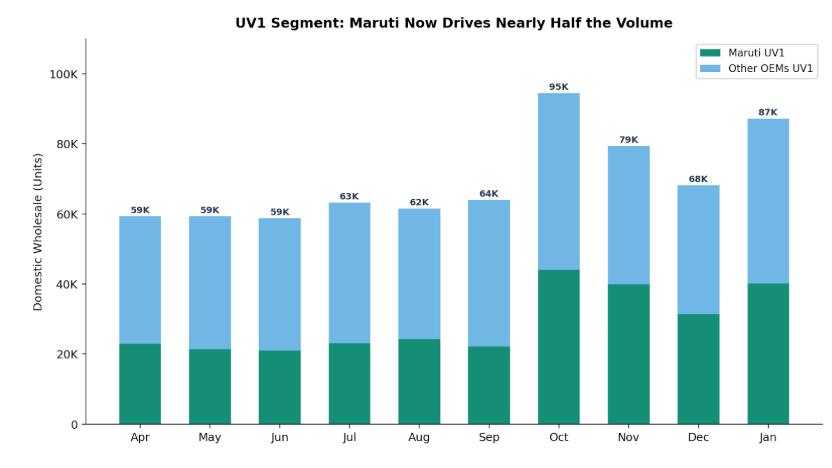

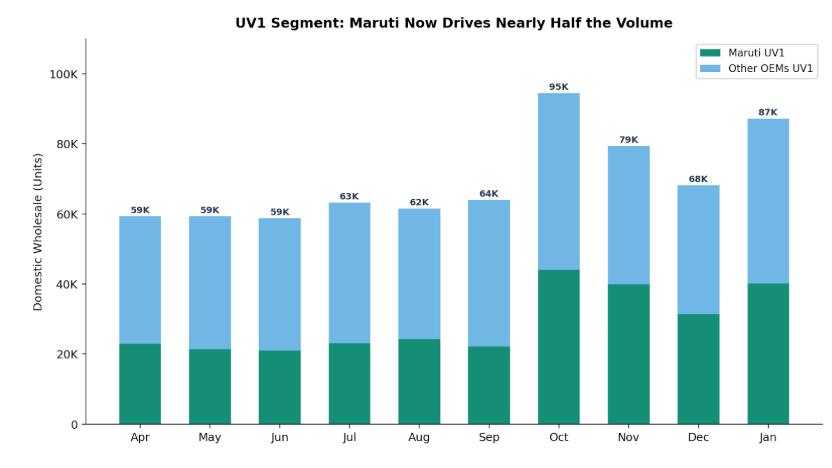

Among the most striking numbers in the October–January data is Maruti Suzuki’s UV1 segment performance. The company’s wholesale volumes in this segment jumped from an average of 22,415 units per month (April through September) to 38,846 units (October through January) — a 73 per cent increase. At first glance, this looks like it could be a GST-related story. It is not.

UV1, by definition, covers vehicles in the 4.0–4.4 metre range. These models sit above the four-metre threshold and did not benefit from the GST rate reduction. The explanation for Maruti’s UV1 surge lies in something more straightforward: the company went from having two models in this segment to four, within the span of two months.

The Product Timeline

For the first four months of the financial year (April through July), Maruti’s UV1 portfolio consisted of two models: the Ertiga, a long-established MPV that has maintained steady volumes in the 10,000–12,000 monthly range, and the Grand Vitara, a mid-size SUV that Maruti launched in late 2022 and which had settled into a monthly rhythm of around 10,000–12,000 units.

In August, the e Vitara — Maruti’s first electric SUV, positioned in the same length class as the Grand Vitara — entered the UV1 numbers. In September, the Victoris, a body-on-frame SUV positioned as a more rugged offering, was added. By October, all four models were contributing to the UV1 wholesale figures, and the combined effect was immediate: volumes jumped from 22,074 in September (a transitional month) to 43,992 in October.

The subsequent months confirm that this was not a one-time channel fill. November recorded 39,836 units, December dipped to 31,393 (in line with broader seasonal patterns), and January recovered to 40,162. The new four-model portfolio appears to have stabilised at roughly 35,000–40,000 units per month, with dips and peaks following the normal seasonal cadence.

Impact on UV1 Landscape

Maruti’s expansion has reshaped the UV1 segment’s competitive dynamics. In the first half of the year, Maruti accounted for approximately 37–39 per cent of total UV1 wholesales. By October, that share had risen to roughly 47 per cent. In a segment where Hyundai’s Creta, Kia’s Seltos, and Tata’s Curvv have been the other principal competitors, Maruti’s sudden capacity to dispatch 40,000 units per month is a significant development.

Maruti’s expansion has reshaped the UV1 segment’s competitive dynamics. In the first half of the year, Maruti accounted for approximately 37–39 per cent of total UV1 wholesales. By October, that share had risen to roughly 47 per cent. In a segment where Hyundai’s Creta, Kia’s Seltos, and Tata’s Curvv have been the other principal competitors, Maruti’s sudden capacity to dispatch 40,000 units per month is a significant development.

The overall UV1 segment grew from an average of 61,042 units pre-GST to 82,351 post-GST. Of that roughly 21,300-unit increase, Maruti alone accounts for about 16,400 units, or 77 per cent of the growth. This means other UV1 players — Hyundai, Kia, Tata, Honda, Mahindra (Electric Origin SUV) — collectively grew their UV1 volumes by only around 5,000 units per month, a modest increase that could reflect normal festive-season effects rather than structural expansion.

At the same time, January 2026’s production data presents an interesting puzzle. Maruti recorded only 18,172 units of UV1 production in January against 40,162 units of domestic sales. This implies the company dispatched roughly 22,000 units more to its dealers than it produced in the month. Whatever the reason, the sales-to-production divergence is a data point to monitor in the coming months. If Maruti sustains 35,000–40,000 UV1 dispatches, its own production capacity will need to keep pace.