Maruti’s Super Carry takes 5 percent market share in India’s mini-truck market

Launched in July 2016, Maruti Suzuki India’s first commercial vehicle has sold a total of 4,257 units till end-September 2017.

Fifteen months since its launch in the domestic market, the Super Carry, which is Maruti Suzuki India’s entry product into the small commercial vehicle (SCV) market, is making news.

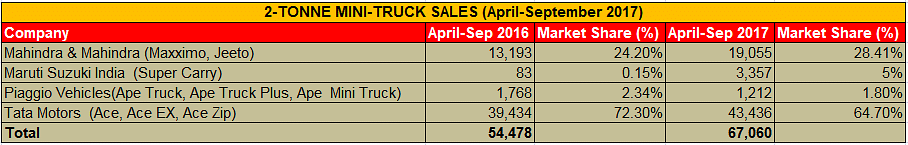

As per the latest sales numbers from apex industry body SIAM, the 793cc, diesel-engined vehicle has helped the company grab a 5 percent market share in the 2-tonne mini-truck segment in H1, 2017 and in the process has become the third largest player in the segment which is dominated by Tata Motors’ Ace and Mahindra & Mahindra’s Jeeto range of SCVs.

As per Autocar Professional’s estimates, a total of 4,257 Super Carrys have been retailed from July 2016 through to end-September 2017, which works out to a monthly average of 283 units. Much lower than what probably Maruti – and the industry – expected from a product that bears the Maruti badge.

In an initial soft market introduction across a few markets, Maruti Suzuki launched the Super Carry in July last year in Ahmedabad, Kolkata and Ludhiana at a starting price of Rs 401,000, gradually expanded to a few other territories. In the first six months of FY2018 (April-September 2017), the company has sold 3,357 units in the domestic market and also exported 794 units to largely African countries. The rapid uptick in the Super Carry’s sales indicates the company has been able to carve out its own identity in the segment, despite the presence of established players. Tata Motors, the market leader in the SCV segment, sold 43,436 units in H1 FY2018 to have a market share of 65 percent. M&M, with total sale of 19,055 units, has a market share of 28 percent.

In an interview to Autocar Professional last year, RS Kalsi, executive director (Marketing & Sales), Maruti Suzuki India, said: “The response to the Super Carry has been positive. Customers who have booked the Super Carry like its performance. Over 70 percent of them are car owners; they understand Maruti Suzuki India and have driven or travelled in Maruti Suzuki cars. We are bullish (on the Super Carry) when we go across the country.”

Focus on driver comfort paying off

Driver comfort is the USP of the Super Carry. The spacious driver’s cabin gets ergonomically designed features like flat and extended co-passenger seat with thick glass fibre heat shield for better heat insulation and NVH, well-positioned gear lever and ergonomically placed pedals.

On the features front, it gets a mobile charging socket, dual assist grip, odometer, trip meter, fuel meter, and digital clock, besides provision for a stereo. There is also an integrated rain guard, sliding back window glass, and conveniently located spare wheel carrier for ease of replacement.

Maruti Suzuki says it has invested about Rs 300 crore in the Super Carry project. The LCV is powered by a 793cc lightweight and compact two-cylinder diesel engine, which develops peak power of 32bhp at 3500rpm and max torque of 75 NM at 2000rpm. The vehicle, which has a five-speed manual transmission, delivers fuel efficiency of 22.07 kilometres per litre and has a maximum speed of 80kph. Its payload is 740kg in all terrain. Other product highlights are a 2110mm wheelbase, a lower loading bay and wider deck that offers ample loading space to carry higher loads in a single trip. The Super Carry is offered with a warranty of 2 years / 72,000km.

Competition in the 2T mini-truck segment has increased also because overall numbers are reducing with buyers favoring higher-tonnage vehicles of up to 3.5T to meet the boom in last-mile delivery.

Tata Motors and M&M in dogged fight

Tata Motors, which saw M&M up the ante in SCVs to wrest away considerable market share in the recent past, in now taking rearguard action. In a bid to maintain leadership in the segment, Tata has recently expanded its Ace range with three new XL range vehicles – Ace Mega XL, Ace Zip XL and Ace XL – all with a starting price of Rs 308,000 (ex-Mumbai).

M&M, having tasted blood in the SCV segment, is expanding aggressively. Since the rollout of Jeeto in 2015, the company has consistently gained double-digit market share. The company, which has sold nearly 60,000 Jeetos till now, claims the Jeeto offers superior product performance, lower maintenance, best-in-class mileage and the promise of a 30 percent higher earning potential.

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

12 Oct 2017

12 Oct 2017

25433 Views

25433 Views

Ajit Dalvi

Ajit Dalvi