India’s CV industry records second straight year in the red

Dampened by a slowed-down economy and Covid-induced lack of demand, the beleaguered commercial vehicle sector takes a hit for the second year in a row.

While the mojo is back in the passenger vehicle and two-wheeler segments in India, the critical commercial vehicle segment, the barometer of the economy, continues to weather the brunt of the slowed-down business environment. As per data collated from company sales numbers, it is apparent that FY2021 marks the second year of a sizeable sales decline for the CV industry.

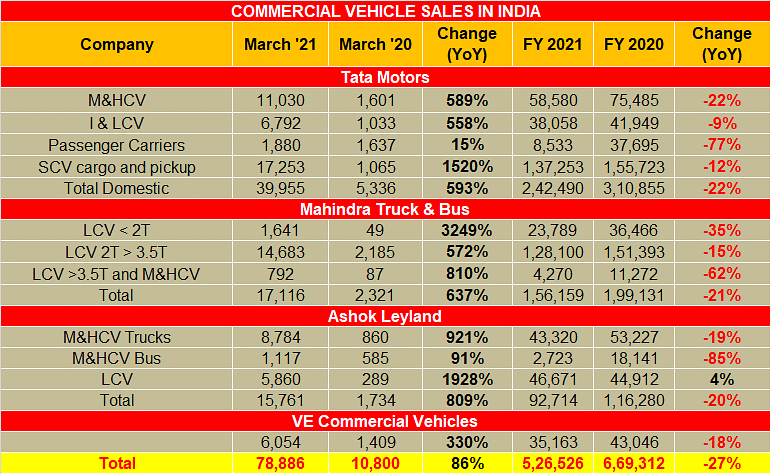

While it did not help that FY2021 took the full brunt of the Covid-19 pandemic, the beleaguered CV sector took a hit due to dampened industry investment in new projects. For FY2021, the cumulative domestic CV sales of the four key OEMs (Tata Motors, Ashok Leyland, Mahindra & Mahindra and VE Commercial Vehicles) was 526,526 units, down -27% YoY (FY2020: 669,312). In FY2019, the overall Indian CV industry had sold a total of 10,07,319 units, posting YoY growth of 17.55 percent.

How the OEMs fared in FY2021

Tata Motors, the country’s largest CV player and market leader, reported sales of 39,955 units in March 2021 (593% YoY), compared to 5,336 units a year ago, which is essentially due to a very low year-ago base. In FY2021, it sold 242,490 units, 22 percent lower year-on-year (FY2020: 310,855).

Girish Wagh, president – Commercial Vehicles Business Unit, Tata Motors said, “Domestic CV sales in Q4 FY2021 at 98,966 units was 20% higher than the previous quarter, continuing its sequential growth. It was also higher by 59% over Q4 FY2020. M&HCVs and ILCVs continued to lead the recovery growing by 48% and 34% respectively over the previous quarter on back of improved consumer sentiments, firming freight rates and higher infrastructure demand including road construction and mining. International business grew by 19% over Q3 FY2021 and 25% over Q4 FY2020, as the key markets started returning to normalcy. We continue to monitor and work on the supply chain to improve availability, especially of electronic components. We are also reviewing our business continuity plans in view of the rising cases of Covid-19 in the country.”

Mahindra & Mahindra reported similar growth last month due to a very low year-ago base, with sales of 17,116 CVs in March 2021 (637% YoY), compared to 2,321 units in March 2020. For FY2021, the company reported a sales decline of 21 percent, selling 156,159 units (FY2020: 199,131 units).

Chennai-headquartered Ashok Leyland reported sales of 15,761 units in March 2021 (809%) compared to 1,734 units in March 2020. In FY2021, the company sold a total of 92,714 units, which was 20 percent lower (FY2020: 116,280 units). Interestingly, the company reported positive year-on-year growth in its LCV segment business, selling 46,671 units (4%) in FY2021 compared to 44,912 units in FY2020.

For Volvo Eicher Commercial Vehicles (VECV), the month of March saw sales at 6,054 units (330%) compared to 1,409 units in March 2020. In FY2021, the company reported an 18 percent sales decline with 35,163 CVs (FY2020: 43,046).

Growth outlook

As is known, CV sales are cyclic in nature and with two straight years of sales slowdown and decline, the outlook remains cautiously optimistic. Demand for CVs is a combination of headwinds and tailwinds. While the tailwinds are enabling improved demand in the tipper and haulage segment especially in the M&HCV segment, there is pressure from the increase in tyre and fuel prices. A positive sentiment is that with the Reserve Bank of India (RBI) and the Central government expecting economic activity to pick up and India’s GDP expected to grow in double-digits, there could be light at the end of the CV tunnel. Only if the second wave of the pandemic doesn’t play spoilsport.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

02 Apr 2021

02 Apr 2021

43949 Views

43949 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal