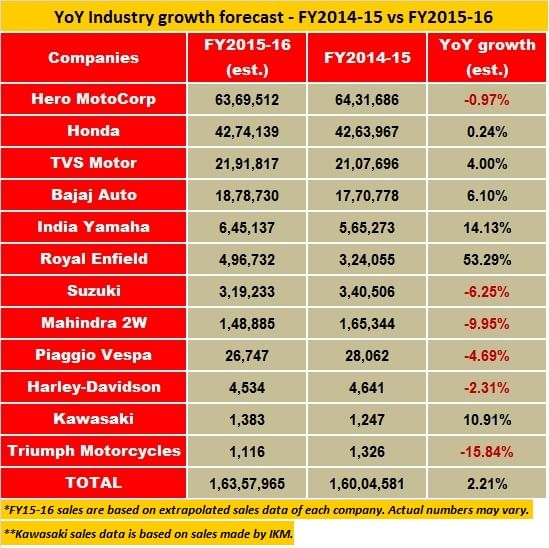

The Indian two-wheeler industry, covering motorcycles, scooters and mopeds, is expected to record a flat year-on-year growth rate of close to 2 percent for FY2015-16.

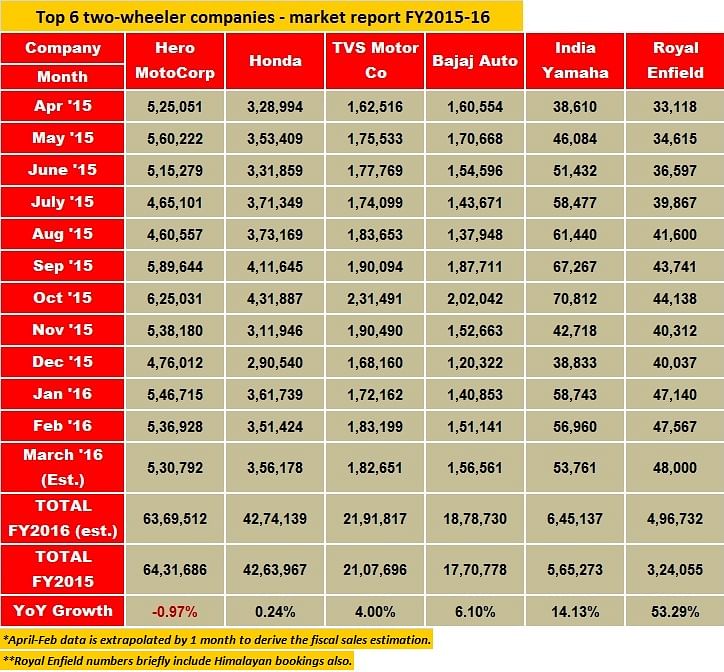

A quick sales forecast based on the 11-month market performance as registered by each individual two-wheeler OEM in India underlines that Hero MotoCorp, the largest two wheeler manufacturer, may record a slight decline for the year ending March 31, 2016. This is estimated if the company records sales of around 53 lakh units, a monthly sales average for the April 2015-February 2016 period. However, the growing popularity of its scooter models (Duet and Maestro, Edge) may help the company push its sales for March even further.

On the other hand, rivals such as Honda Motorcycle & Scooter India (HMSI), TVS Motor Company, Bajaj Auto, India Yamaha Motor and Royal Enfield are estimated to record positive YoY growth rates respectively.

The growing popularity of scooter models, primarily the Activa (Honda), Jupiter (TVS) and Fascino (Yamaha), have powered YoY growth for HMSI, TVS Motor and India Yamaha.

Meanwhile the sales of new Pulsars and Bajaj Auto’s most affordable mass commuter, the 100cc CT100, have helped Bajaj gain momentum in the market and push its growth curve in the positive territory. Charging down its own growth trajectory, Royal Enfield, the only company to have recorded a linear month-on-month growth during FY2015-16, is expected to be the showstopper of all the two wheeler OEMs.

We estimate that the company may register total March sales in the range of 48,000-50,000 units, which would be its highest ever monthly performance. According to the company, while it is going slow on its recently launched adventure model, the 411cc Himalayan, in terms of retail sales, it has reported that the response to the new adventure tourer model has been promising.

While the financial year 2015-16 may not be a good year in terms of sales performance for the big bike OEMs such as Harley-Davidson and Triumph Motorcycles, India Kawasaki Motors (IKM) is estimated to record improved numbers. This can be attributed to its aggressive product strategy, which includes bringing in new models to its CKD (completely knocked down) and CBU (completely built unit) line-up and pan-India network expansion.

However, 2015-16 has seen a number of large displacement motorcycles make their way into the market, which is good news for the maturing segment. Among this, the midsized motorcycle category is the most anticipated class in terms of customer demand and association.

With new launches including the Yamaha YZF-R3, Triumph’s Classics (Bonneville and Thruxton), UM Motorcycles and the incoming models from Bajaj-KTM, TVS Motor and other OEMs only hint at growth in FY2016-17.

While the scooter segment will continue to grow, commuter motorcycle sales could also pick up depending upon a surge in rural demand and new technological advancements boosting fuel efficiency. Hero MotoCorp’s first in-house developed 110cc Splendor iSmart 110 could be understood as one such example.