INDIA SALES: Top 10 Scooters in May 2016

While the TVS Jupiter seals second spot, the Hero Duet rides in to take No. 3 position in the Top 10 scooters list.The Honda Activa, of course, stands supreme with a humongous lead.

The scooter market is thriving in India and how. Last month, the scooter segment notched 24.97% year-on-year growth and sold a total of 454,992 units. That's less than what the slowing motorcycle sector sold (985,158 units) which translates into 3.34% YoY growth.

Although Honda’s hugely popular Activa brand of scooters continues to outperform the competition by a vast margin, consistency in market demand and sales has led TVS Motor Co’s Jupiter, which recently crossed the million units landmark, to seal the second rank in the top 10 best-selling scooters list for May 2016.

Many months of the last fiscal saw an intense struggle between TVS Motor’s 110cc Jupiter and Hero’s 110cc Maestro models for the second slot. However, the former had emerged as the winner to claim the second spot for FY2015-16, with the Hero Maestro ranking third in the best-selling scooters list for the last fiscal.

Recommended: Indian scooter segment is now a 5 million unit market

In May 2016, while the Activa rules supreme with sales of 237,317 units, the TVS Jupiter has gone home to 43,867 new buyers. The Duet, Hero MotoCorp’s family scooter, which is pitched against the Activa and Jupiter, ranked third in the order with stable sales of 33,304 units. Being positioned as a conventional utility scooter for families, the 110cc Duet was expected to sell more than the pricier Maestro in the near term when it was launched last year.

The Hero Maestro, which has lately seen a drop in its monthly sales volumes, sold 25,589 units during May 2016 to settle as the fourth best-selling scooter in the domestic market.

Gaining ground with improving sales, Suzuki’s 125cc family scooter, the Access 125, ranked fifth with sales of 19,390 units. A correction in the declining sales of this model is the result of an all-new Access 125, which was not just a cosmetic upgrade on the existing model but has substantial mechanical changes including the engine (weight savings of close to 6kg) that now returns more kilometres per litre of fuel. Suzuki had unveiled and launched the all-new Access 125 during the 2016 Auto Expo.

Yamaha’s best-selling scooter model, the Fascino, which breezed into the best-selling scooters list within three months of its launch last year, stands at sixth position with sales of 18,500 units in May 2016. The 113cc Fascino, which shares its engine with other scooters (Ray variants, Alpha), has singlehandedly steered the company’s growing scooter sales over the last 10-12 months, making Yamaha a legitimate rival in the booming segment. The company became the fourth largest scooter player in the domestic market leaving Suzuki Motorcycles India behind for the fifth slot last year.

Honda’s Dio, a consistent performer in the urban markets, ranks seventh with sales of 17,099 units last month. Yamaha’s Ray variants fetched sales of 11,591 units to ride in at eighth position in the elite list.

The 110cc Aviator, Honda’s stylish, urban male scooter, stands ninth with sales of 9,591 units while TVS Motor’s small scooty, the Pep+, occupies the last slot in the Top 10 best-selling scooters’ list for May 2016. TVS sold 9,137 units of the Pep+ last month, which brings much-needed relief to the company as it had registered a sharp YoY decline in the sales of its small scooters (75cc-90cc) during FY2015-16.

Scooter sales accelerate

Scooter sales in India have been on the upswing since the past couple of years and OEMs are doing all they can to capitalise on the sales momentum. In 2015-16, overall scooter sales rose 11.79% to 5,031,678 units (2014-15: 4,500,920).

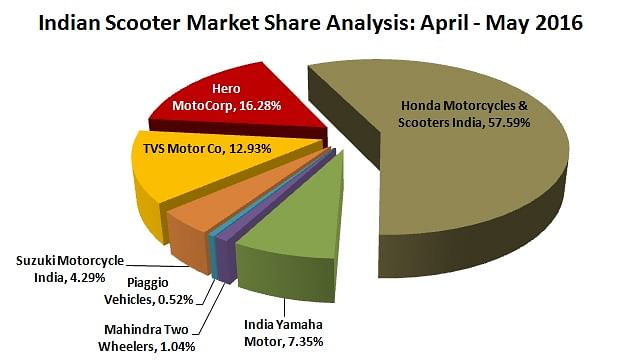

There are essentially seven scooter-making OEMs in the market – HMSI, Hero MotoCorp, India Yamaha Motor, Mahindra Two Wheelers, Piaggio Vehicles, Suzuki Motorcycles India and TVS Motor Co. The top three – HMSI (57.59%), Hero MotoCorp (16.28%) and TVS Motor Co (12.93%) – account for 86.8% of the total scooter market, while the remaining four – India Yamaha Motor (7.35%), Suzuki Motorcycle India (4.29%), Mahindra Two Wheelers (1.04%) and Piaggio Motor (0.52%) – make up the balance.

You may like to read:

- Top 10 Two-wheelers in May 2016

- Top 10 best-selling motorcycles in May 2016

- Honda beats Hero, becomes largest scooter exporter for FY2015-16

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Amit Panday

By Amit Panday

17 Jun 2016

17 Jun 2016

98566 Views

98566 Views

Shahkar Abidi

Shahkar Abidi