In what would be good news for passenger carmakers in India, particularly the ones who have either launched or about to launch new models, July 2015 sales numbers point to sustained growth through the coming year.

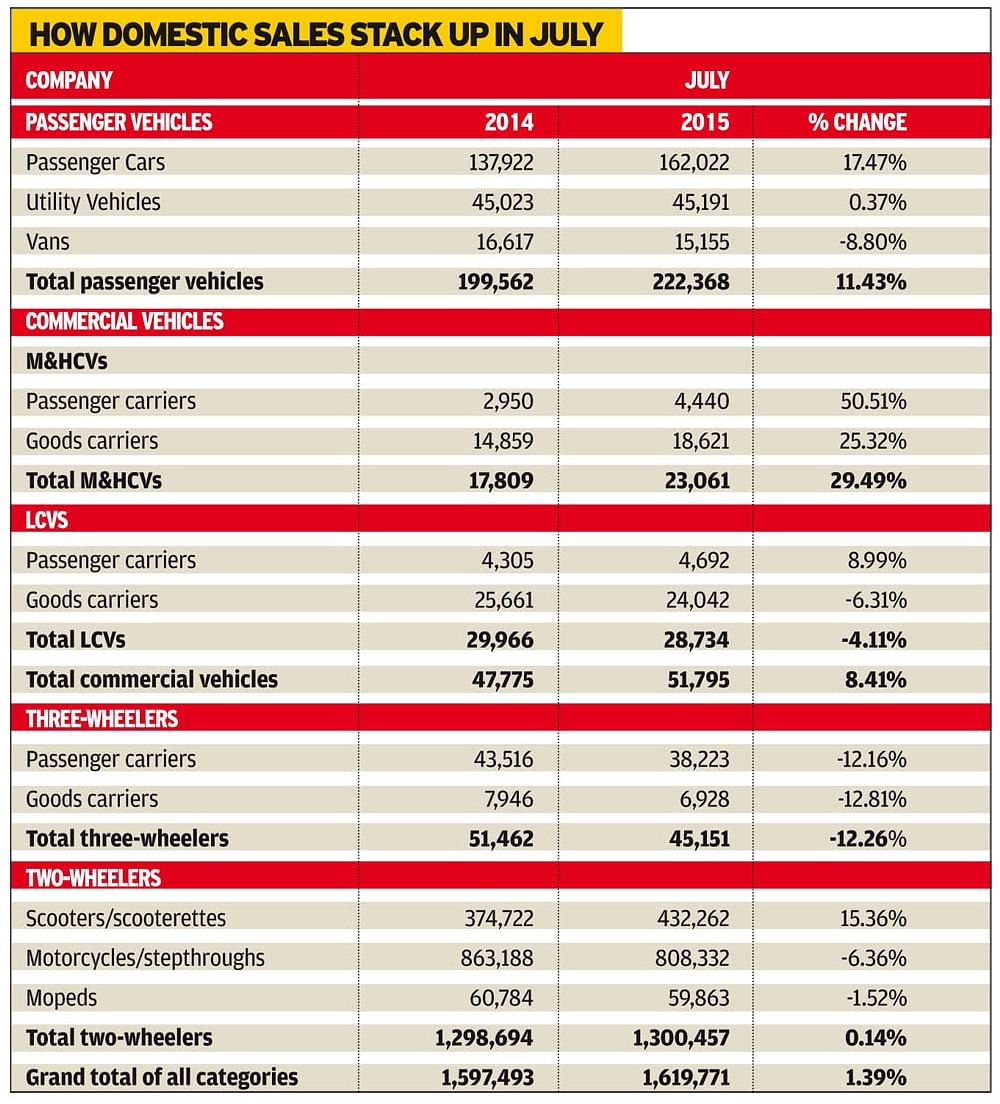

As per industry sales numbers revealed today by the Society of Indian Automobile Manufacturers (SIAM) today, at 162,022 units sold last month, growth in July 2015 is a good 17.47% above July 2014 (127,922 units). The July 2015 numbers are the ninth month of continued growth for passenger cars; the last month for negative sales was October 2014 (-2.55%).

Utility vehicles, however, continue to plod – 45,191 units sold in July are a flat 0.37% year on year growth, indicative of the slowdown in the rural markets. UV market leader Mahindra & Mahindra with its stable of UVs has borne the brunt with sales down 14,456 (-12.75% YoY).

The strong growth in car sales aided overall domestic sales of passenger vehicles, as they rose 11.4 % YoY to 222,368 units.

Sales of medium and heavy commercial vehicles, which are considered to be the barometer of the economy, continued their upward trend and grew 29.5% in the month to 23,061 units. However, sales of light commercial vehicles continued to be a drag and fell 4.1% in July to 28,734 units. As a result, total commercial vehicle sales grew by only 8.4% in the month to 51,795 units.

The two-wheeler industry suffered due to falling motorcycle sales, which declined 6.4 % during July to 808,332 units. The sales of scooters, however, rose 15.4 % in the month to 432,262 units. As a result, total two-wheeler sales rose marginally to 1,300,457 units in July.

April-July 2015 industry performance

A slew of fresh launches and falling fuel prices have reignited the demand for passenger cars in India as is evident from car sales in the first four months starting April 2015. According to SIAM data, car sales have risen 10.7% YoY to 644,354 units in April-July 2015.

Meanwhile, deficient rainfall and falling rural income have hit demand for utility vehicles in the country, as sales fell 0.3% in the first four months of the current financial year to 173,255 units. The narrowing gap between petrol and diesel prices has also lured some buyers away from the largely diesel-dominated UV segment and back to petrol-engined passenger cars. The overall passenger vehicle sales in April-July grew 7.4% to 875,670 units.

Replacement demand and growing demand for buses has augured well for the medium and heavy commercial vehicles segment. In April-July, M&HCV sales rose 24.9% to 875,670 units, with both passenger carrier and goods carrier sales growing around 25% each.

However, small and light commercial vehicle sales continued to struggle owing to the falling need for last mile connectivity and lack of easily available finance. Light commercial vehicle sales fell 5.2% in April-July. As a result total commercial vehicle sales grew by a meager 5.6% in the first four months of the financial year to 199,552 units.

Falling rural incomes and increasing popularity of scooters continued to dent motorcycle sales in the country, as they declined by 3% to 3,521,101 units in April-July. Scooter sales continued to rise and grew 9.5% to 1,511,797 units. Rising scooter sales compensated for falling motorcycle sales in the period and total two-wheeler sales grew 0.5% to 5,276,181 units in April-July.