GST-driven stock rationalisation sees June PV numbers dive 11%

June 2017 sees dealers expedite inventory liquidation over purchasing new stock

With predictions of reduced pricing of passenger vehicles (PV) following implementation of GST from July 1, customers in India experienced considerable confusion as regards their purchase decisions in June, in lieu of benefiting from the tax cut on most vehicles effected by the country’s biggest-ever tax reform.

For many vehicle manufacturers, all of June went into stock rationalisation, especially at the dealer end, with most dealers focusing on liquidating their existing inventory so as to not carry it forward into July. The key reasons for this was the upcoming drop in prices and a very grim clause from the government to credit only the excise duty paid on all vehicles procured before July 1, and not the entire tax and associated cesses being subsumed under the GST, which add up to about 6-7 percent in addition of the excise.

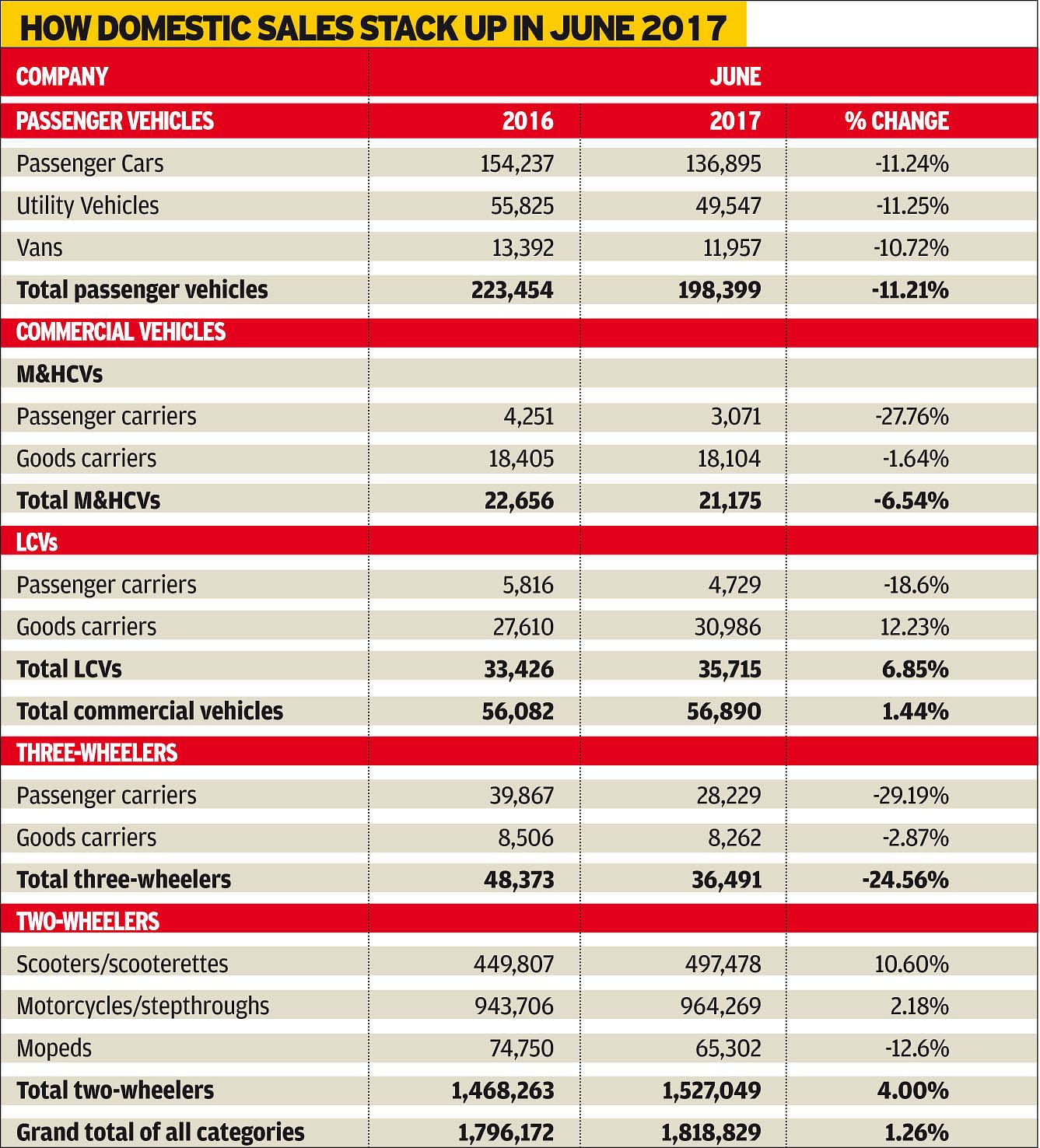

As a result, dealers resorted to not placing a high level of fresh orders to OEs, bringing down the June wholesale numbers to 198,399 units, a substantial 11.21 percent year-on-year drop, making it the slowest month sales since May 2013, when due to the economic slowdown and rising fuel prices, overall PV numbers were down by 11.24 percent. The next biggest decline was, not surprisingly, in December 2016 when the sales speedbreaker in the form of demonetisation saw sales de-grow 8.14 percent. However, retail sales in comparison were substantially better at 15-20 percent higher than in June 2016.

This is because demand still prevailed in the market but customers were only holding back in anticipation of better prices in the coming few weeks as a response to which alluring discounts were passed on, jointly supported by both dealers and OEs, in order to clear off the dealer shelves and also make way for more stock movement from OE stockyards, to now be billed with the new GST rates after June 30.

According to Dr Pawan Goenka, managing director, Mahindra & Mahindra, in a GST-related media conference on July 6, "With maximum stocks being liquidated in June, dealers are right now sitting on an inventory lower than the industry average of 4-6 weeks. There is a shortage of around a week’s inventory at the dealership level. There should be an inventory refill in the short term, going up to the month of August, after which the stock situation will be back to normal," he added.

How the PV makers fared in June

A closer look at the individual company stats reveals red ink on 13 of the 16 passenger vehicle manufacturers. The three OEMs to stand out in the black are Maruti Suzuki India (93,057 / +1%), Honda Cars India (12,804 / 12.25%) and Skoda Auto India (1,018 / 1.60%).

Even Hyundai Motor India, the No. 2 player after Maruti, sees its sales drop by 5.64 percent to 37,562 units while Mahindra & Mahindra saw its June numbers drop 5.27 percent to 16,169 units. And Tata Motors saw its June numbers drop 12.19 percent to 13,148 units. Of the 16 automakers, only five logged sales of over 10,000 units last month and two over 5,000 units.

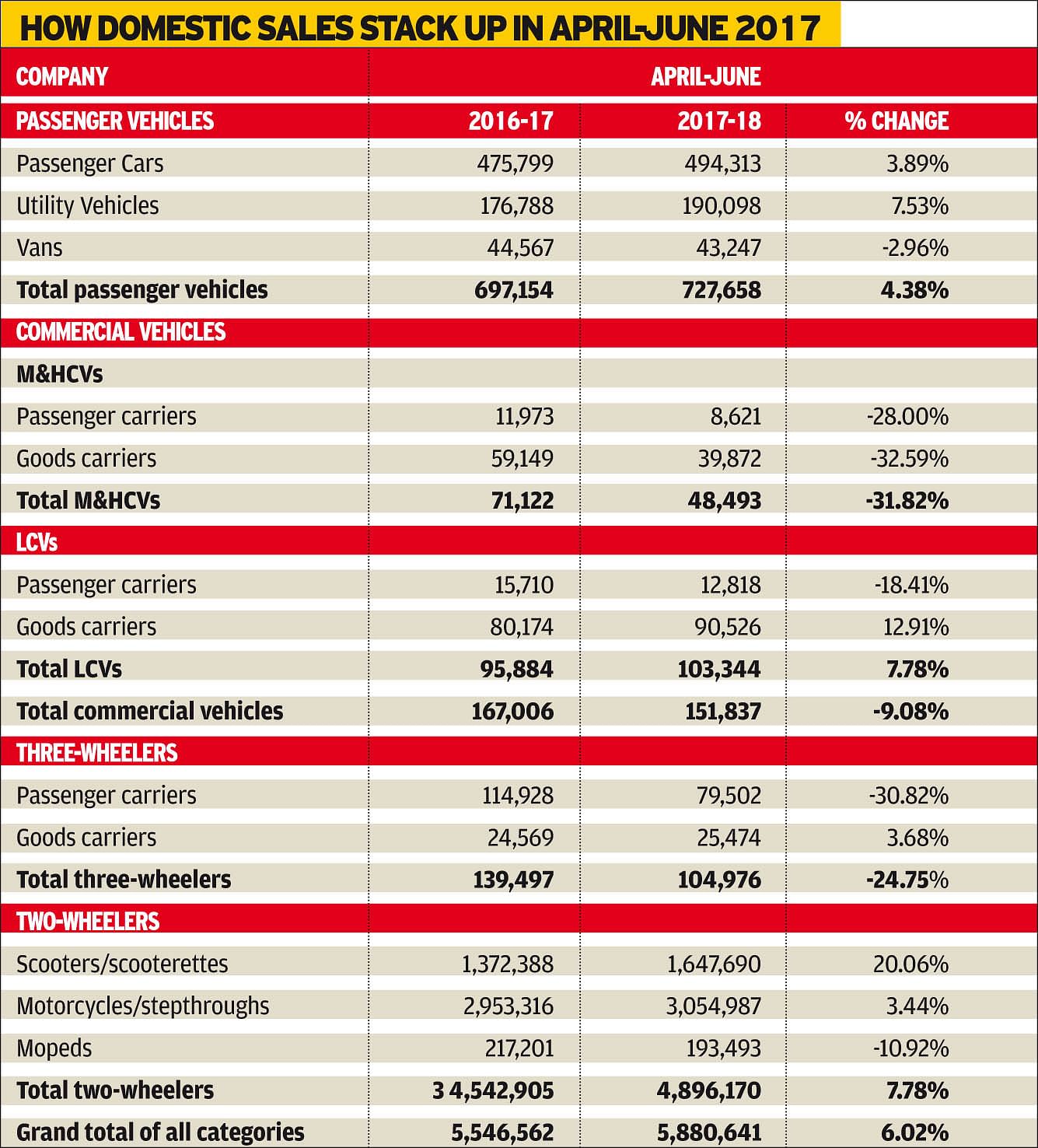

Domestic sales in first quarter FY2018

For the first quarter of FY2017-18 ended June, overall industry numbers at 5,880,641 units mark a YoY growth of 6.02 percent. PV sales grew by 4.38 percent (Cars: 494,313 / +3.89%; UVs: 190,098 / +20.79%; Vans: 43,247 / -2.96%)

The CV sector declined by 9.08 percent in April-June 2017 as compared to the same period last year. Sales of medium and heavy commercial vehicles (M&HCVs) dropped sharply by 31.82 percent, while LCV numbers grew by 7.78 percent in April-June 2017 YoY.

Three-wheeler sales declined by 24.75 percent; while passenger carrier sales registered a de-growth of 30.82 percent, goods carrier sales grew by 3.68 percent in April-June 2017.

Two-wheeler sales were up 7.78 percent in April-June 2017 over April-June 2016. Scooter and motorcycle numbers grew by 20.06 percent and 3.44 percent respectively, while mopeds declined by 10.92 percent.

FADA asks GST Council for a review

With the GST Council's decision of not refunding the entire tax paid on entities billed before July 1, the Federation of Automobile Dealers Association (FADA) has asked the Council for a review on the matter. According to John K Paul, president, FADA, "The automotive industry has been singled out by the government with this kind of an approach. There is only a provision of merely 60 percent credit of the excise duty paid, and that too on stocks billed in the last one year. The situation is even more adverse from the spare parts perspective as companies have to maintain stocks for up to seven years for even defunct cars. So, there is a huge inventory of such parts as well and there will be substantial losses there."

"Transitional losses are going to be huge and as of now, it is the dealers, who are going to bear the brunt of it. While GST overall is the best thing to have happened to the industry, with the current issues, it is seeming as not being trader-friendly", he added.

Vishnu Mathur, director general, SIAM, says: "While there is an anti-profiteering provision in the GST law, there should very well be an anti-loss policy as well. Why be this unfair and cause transitional losses, which would be huge in this case."

Nevertheless, the Indian automotive sector, as a whole, is very much upbeat about GST and considers it as being a reformative step indeed, bringing in seamless, more transparent procedures, quicker logistics, as well as lower costs.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

10 Jul 2017

10 Jul 2017

9010 Views

9010 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi