Chip-hit Maruti Suzuki and Hyundai drag sales down in November, Tata shines

With Maruti sales down 19% and Hyundai by 23%, overall car sales take a hit

When the top two players in the passenger vehicle market, which together command a near-61 percent market share, record poor sales it is imperative that overall industry numbers will be impacted. Therefore, it comes as no surprise that November 2021 PV sales are in the red.

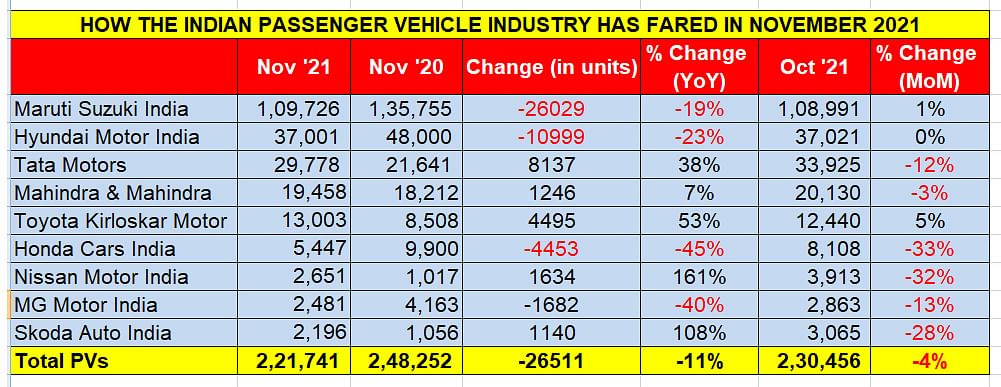

A quick analysis of nine carmakers which released their official sales numbers for November 2021 reveals that total sales at 221,741 units are down a sizeable 11% year on year (November 2020: 248,252) and there is also a month-on-month sales decline of 4% (October 2021: 230,456).

Maruti Suzuki India: 109,726 units / -19%

Maruti Suzuki India has reported domestic market sales of 109,726 PVs in November 2021, down 19% don year-ago sales of 135,775 units. Despite having a strong order book of an estimated 200,000 units, the continuing shortage of electronic components as a result of the semiconductor crisis is hampering better sales for the PV market leader.

Other than the utility vehicle segment, Maruti Suzuki sales have taken a hit. UV sales last month were 24,574 units, up 4.2% YoY (November 202: 23,753). The entry level Alto and S-Presso combine sold 17,473 units, which marks a sharp decline of 22% (November 2020: 22,339).

Poor sales of the usually high-selling seven models comprising the Wagon R, Baleno, Swift, Celerio, Dzire, Ignis and Tour S added to the overall decline. At 57,019 units, their sales last month were down 25.6% YoY (November 2020: 76,630). The Eeco van too is feeling the heat: the 9,571 units sold last month are down 14.4% YoY.

Hyundai Motor India: 37,001 units / -23%

Hyundai Motor India sold a total of 37,001 units last month, which constitutes a marked 23% YoY sales decline (November 2020: 48,000). Month-on-month growth is flat, considering 37,021 units were sold in October 2021.

Tata Motors: 29,778 units / 38%

Tata Motors is on a roll. The company has notched the best growth among the nine carmakers here. With 29,778 Tata PVs being bought last month, the YoY growth is a robust 38% (November 2020: 21,641). The total comprised 28,047 IC-engine cars and 1,751 electric vehicles. While the ICE cars notched 32% YoY growth (November 2020: 21,228), the surge in demand for Tata EVs is reflected in the 324% YoY increase in EVs (November 2020: 413), albeit on a low base. However, when comparing November sales to October 2021’s 33,925, there is a 12% month-on-month sales decline.

Mahindra & Mahindra: 19,458 units / 7%

At fourth place in the pecking order, Mahindra & Mahindra has 19,458 units to its credit and posted 7% YoY growth (November 2020: 18,212). Its utility vehicles accounted for 19,384 units and clocked 8% growth (November 2020: 17,971). Overall PV growth would have been better if not for the poor sales of cars and vans – just 74 units and down 69% on year-ago sales of 241 units.

Veejay Nakra, Chief Executive Officer, Automotive Division, M&M, said: “Our growth in SUVs continues with an 8% increase in November. The demand remains strong across our product portfolio of SUVs, pickups, and small commercial vehicles. Momentum in exports continues with a 90% growth. The issues around semiconductor-related parts continue to remain a challenge for the industry. We are monitoring the situation closely and taking appropriate steps.”

Toyota Kirloskar Motor: 13,003 units / 53%

Among the few strong performances came from Toyota Kirloskar Motor with 13,003 units, registering 53% growth (November 2020: 8,508) and 5% MoM growth (October 2021: 12,440). Commenting on the numbers,

V Wiseline Sigamani, Associate General Manager(AGM), Sales and Strategic Marketing, TKM said, “Demand from the market continues to be strong which is duly reflected in our booking orders and we are trying our best to cater to these orders. Spike in both demand and orders can be attributed to the popularity our products enjoy amongst our customers and has been further aided by the recent product refreshments, including the launch of the new Legender 4x4 and the Innova Crysta limited edition. Both the Fortuner and the Innova Crysta continue to lead their respective segments.”

Growth outlook continues to be grim

Given that Maruti Suzuki, the bellwether of the Indian PV industry, has confirmed that its production in December 2021 will be 15-20% below regular levels (similar to November), expect December numbers from the market leader to be similar territory. Which is a pity because it is understood that the company has a sizeable backlog of orders (estimated at over 150,000) but the vexing issue of shortage of electronic components as a result of the semiconductor crisis remains a bugbear.

In a usual year’s December, car buyers prefer to shift their purchase decision to January of the new year to avail of a new model year but given the massive on-ground supply-demand mismatch, consumers just might hasten to buy what they get.

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

02 Dec 2021

02 Dec 2021

9157 Views

9157 Views

Ajit Dalvi

Ajit Dalvi