It is an unlikely time for such an achievement—given the focus on GST cuts on the ICE market—but the festive season also saw India’s electric two-wheeler market cross a significant milestone: The electric scooter segment (250W+) crossed the 100,000-unit mark in monthly domestic wholesales, starting in September 2025. It has remained at or above that level in every subsequent month except December, which saw a seasonal dip to 86,754 units. January 2026 has seen a bounceback, recording 1,06,298 units and reaffirming the new baseline.

The trajectory over the ten-month period deserves attention. The first month of the financial year, April 2025, opened at 68,439 units. June, the start of the monsoons, saw a dip to 57,199 — the year’s low point. From there, volumes climbed steadily: 61,157 in July, 73,498 in August, and then the step-change to 1,01,852 in September. The October, November, and January figures have all remained in the 1,06,000–1,14,000 range, with only December breaking the pattern.

iQube: The Growth Engine

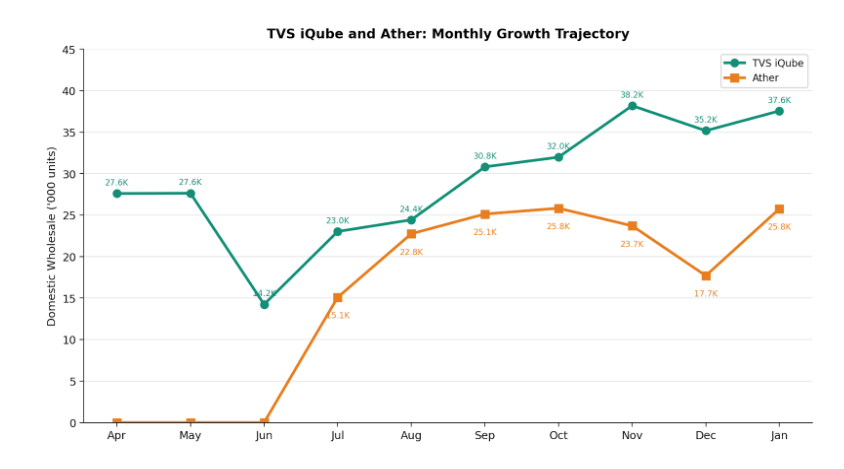

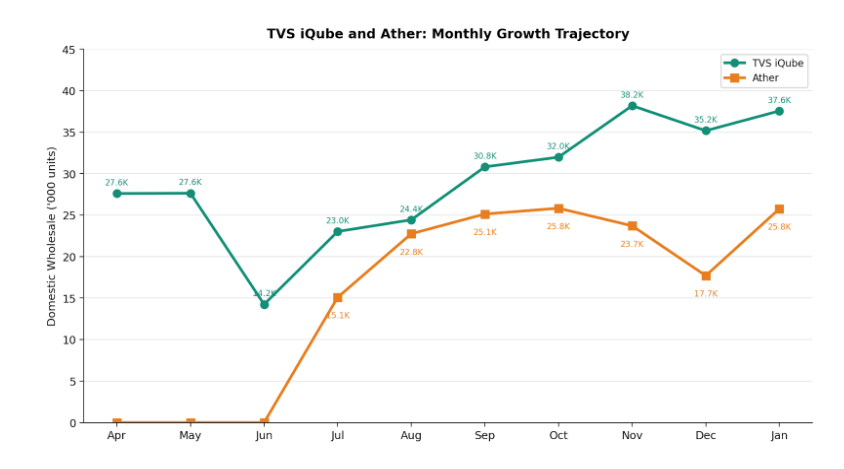

Among the individual brands, TVS Motor’s iQube has shown the most pronounced growth trajectory. The scooter opened the year at 27,604 units in April, dipped sharply to 14,244 in June (suggesting a model-year transition or inventory management), and then embarked on a steady climb: 23,029 in July, 24,434 in August, 30,820 in September. From October onwards, it has operated in the 31,000–38,000 range, reaching a high of 38,191 in November and 37,560 in January.

This represents more than a doubling of TVS iQube’s wholesale run-rate within the financial year. The consistency of volumes in the 32,000–38,000 range from October through January suggests that TVS has achieved a stable production and demand cadence at this level, rather than relying on periodic spikes.

Ather: Finding a Footage

Ather: Finding a Footage

Ather Energy, which began reporting in SIAM data from July 2025, has maintained a relatively stable monthly run-rate. After opening at 15,096 units in July, volumes rose to 22,757 in August and then settled in the 23,000–26,000 range from September through January (with a December dip to 17,701). Ather’s January figure of 25,765 suggests the brand has found its current operating level, though the company’s growth trajectory appears more measured than TVS’s.

Bajaj Chetak and Hero Vida: The Volume Players

The January 2026 data for Bajaj shows cumulative domestic sales of 2,40,254 units for the April–January period. This works out to an average of approximately 24,000 units per month, making Chetak a significant contributor to overall segment volume. The January-specific figure of 28,216 suggests recent momentum.

Hero MotoCorp’s Vida is scaling as well. Cumulative data suggests it has reached approximately 14,000 units per month in recent months, adding meaningful volume from a near-zero base a year ago. This broadening of the competitive field — four or five brands now contributing significant volumes rather than one or two — is itself a sign of segment maturation.

Products and Infrastructure, Not Policy

Unlike the sub-4m passenger vehicle trends, the electric scooter segment’s growth is not linked to the GST change. Electric two-wheelers operate under a different tax framework and were not part of the September 2025 rate revision. The growth is better understood as the result of three converging factors.

First, the product range has improved materially. The current generation of electric scooters from TVS, Ather, and Bajaj offers genuine performance parity with 110cc–125cc petrol scooters in daily urban use, a threshold that earlier models often fell short of. Second, charging infrastructure, particularly home and workplace charging, has expanded. Third, running cost economics continue to favour electric over petrol, and consumer awareness of this advantage has broadened.

The segment’s challenge now is whether the 100,000-unit floor can translate into 150,000 or 200,000 within the next year. The December dip to 86,754 suggests the segment is still subject to seasonal effects, which in turn implies that the buyer base remains somewhat concentrated in urban markets with seasonal variation in two-wheeler demand. Expanding beyond this base will require continued investment in product range, financing, and the public charging network.