Auto component industry’s FY24 turnover grows 9.8% to Rs. 6.14 lakh crore

Revenue improved on the back of steady vehicles production in the country, a robust aftermarket and growth in exports.

India’s auto component industry clocked Rs 6.14 lakh crore ($74.1 billion) in turnover during FY24, representing a growth of 9.8% on a year-on-year basis, according to the Automotive Component Manufacturers Association of India (ACMA).

Revenue improved on the back of steady vehicles production in the country, a robust aftermarket and growth in exports. The production of two-wheelers was up 10%, with 350cc-500cc and 500cc segments growing 33% and 55%, respectively, while passenger vehicle production increased 7%, with utility vehicles (UVs) now at 56% of total production (up from 49%).

“It is pertinent to note that apart from an increase in vehicle production, higher value addition from the component sector has led to growth in the auto components sector. On the trade front, while overall merchandise exports from India witnessed degrowth in FY24, auto components' exports have grown despite geopolitical challenges and increases in logistics costs. That apart, growth in imports has been comparatively lesser, leading to a trade surplus, indicating a thrust by the industry on front of localisation,” Shradha Suri Marwah, President, ACMA and CMD, Subros said.

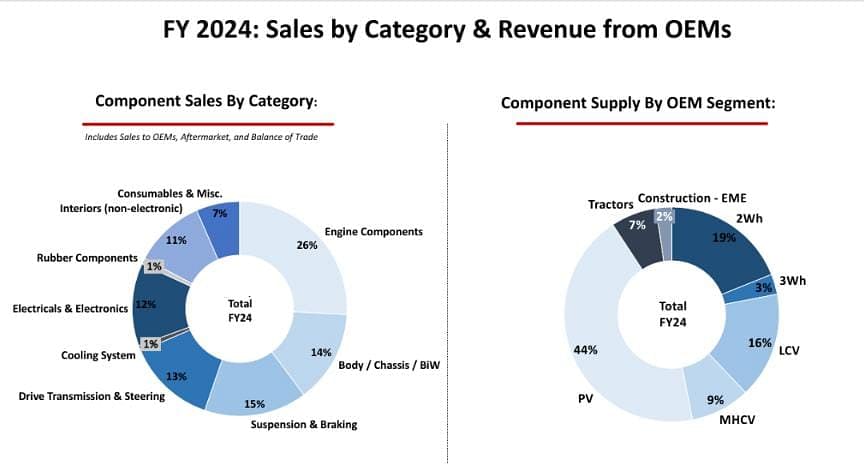

Vinnie Mehta, Director General, ACMA, noted that component supply to OEMs in the domestic market grew 8.9% on yea,r to Rs. 5.18 lakh crore, with the component supply for electric vehicles accounted for 6% of the total industry turnover.

“Exports grew by 5.5% to USD 21.2 billion while imports grew by 3% to USD 20.9 billion, thus resulting in a trade surplus of USD 300 million. The Aftermarket, estimated at Rs. 93,886 crore also witnessed growth of 10%,” he said.

Increased movement of vehicles and a surge in demand for used vehicles led to buoyancy in the aftermarket across all segments. “The aftermarket, with an increase in e-commerce, is witnessing enhanced penetration, especially in the hinterland, and a gradual evolution into the organised sector,” ACMA said in its review.

Going forward, it adds, the tailwinds for the industry include factors like high estimated GDP growth for FY25, domestic vehicle demand, emphasis on infrastructure development, stable international demand/exports, focus on clean and new technology and new entrants in the mobility space. However, the industry also faces headwinds including geo-political challenges, increasing freight costs and high GST rates on auto components.

"Steady growth in the vehicle industry has resulted in the sector reaching pre-pandemic levels of performance in FY24 in most segments. However, the first quarter of FY25 witnessed somewhat slower offtake in vehicle sales, especially in PVs and CVs, given the high base, due to inclement weather conditions and elections. With strong macro-economic indicators, conducive government policies and a growth of over 7% projected for the Indian GDP, we are hopeful that the auto components industry will continue to perform well in FY25," Marwah said.

RELATED ARTICLES

Weekly News Wrap: India-US Trade Deal, Mahindra’s Rs 15,000 Crore Bet, Honda’s Europe Export Plan, Automechanika 2026

From a preferential quota for auto parts into the US to Mahindra’s biggest integrated plant in Nagpur, the week reset th...

Jaguar Registrations Collapse 99% as Land Rover Shows Growth in UK Market

Jaguar registered just six vehicles in January as brand restructuring takes effect, while sister brand Land Rover posted...

TVS Motor Launches Two New Models in Egyptian Market

The Indian two-wheeler manufacturer introduces the Ronin Top motorcycle and Ntorq Race Edition scooter through its distr...

25 Jul 2024

25 Jul 2024

4564 Views

4564 Views

Autocar Professional Bureau

Autocar Professional Bureau

Angitha Suresh

Angitha Suresh